Blackstone (BX) to Post Q3 Earnings: What's in the Offing?

Blackstone BX is scheduled to report third-quarter 2018 results on Oct 18, before the opening bell. Its revenues and earnings are projected to grow on a year-over-year basis.

In the last reported quarter, the company’s economic net income surpassed the Zacks Consensus Estimate. Growth in assets under management (AUM) and rise in revenues were partially offset by higher expenses.

Moreover, Blackstone boasts an impressive earnings surprise history. Its earnings have surpassed estimates in each of the trailing four quarters with an average positive surprise of 22.9%.

However, activities of the company in the third quarter failed to win analysts’ confidence. As a result, its Zacks Consensus Estimate for earnings of 73 cents has moved 2.7% lower over the past 30 days. Nonetheless, the figure reflects a year-over-year improvement of 5.8%.

In fact, the consensus estimate for sales of $1.82 billion reflects rise of 4.5% from the year-ago quarter.

Factors to Influence Q3 Results

Driven by net inflows, the company’s fee-earning AUM and total AUM have been witnessing consistent growth since the past few years. Notably, with an improvement in the overall economic scenario, Blackstone’s fund-raising ability is likely to continue aiding the uptrend in its fee-earning AUM and total AUM in the to-be-reported quarter.

The Zacks Consensus Estimate for fee-earning AUM for the third quarter is $337 billion, which reflects an improvement of 17.8% year over year. Also, the consensus estimate for total AUM of $452 billion depicts 16.8% growth from the prior-year quarter end.

Given the growth in assets, the company’s performance fee is expected to be positively impacted. Estimates for performance fees (segment revenues) of $933 million indicate an increase of 4.2% on a year-over-year basis.

Additionally, net management and advisory fees (segment revenues) are projected to be $735 million, up 6.2% from the year-ago quarter.

However, because of rise in compensation and benefit costs, the company’s overall expenses remained elevated in the past few years. Moreover, as its well-performing funds require more headcount, expenses are likely to increase further during the quarter.

Here is what our quantitative model predicts:

We cannot conclusively predict whether Blackstone will beat the Zacks Consensus Estimate this time. This is because it doesn’t have the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Blackstone is -1.07%.

Zacks Rank: Blackstone currently has a Zacks Rank of 2 (Buy), which increases the predictive powerof ESP. But we need to have a positive Earnings ESP to be sure of the positive surprise.

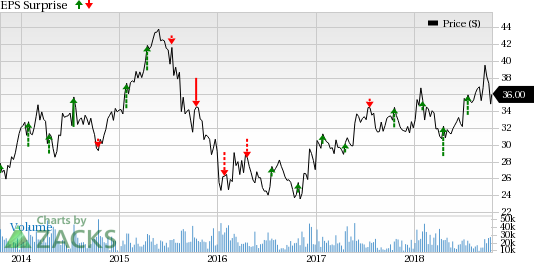

The Blackstone Group L.P. Price and EPS Surprise

The Blackstone Group L.P. Price and EPS Surprise | The Blackstone Group L.P. Quote

Stocks That Warrant a Look

Here are some stocks that you may want to consider, as according to our model, these have the right combination of elements to post an earnings beat this quarter.

M&T Bank Corporation MTB is slated to release results on Oct 18. The company has an Earnings ESP of +0.35% and carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

People's United Financial, Inc. PBCT has an Earnings ESP of +0.30% and holds a Zacks Rank of 2. It is slated to report quarterly numbers on Oct 18.

Ameris Bancorp ABCB has an Earnings ESP of +1.11% and has a Zacks Rank #3. It is scheduled to report results on Oct 19.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

Ameris Bancorp (ABCB) : Free Stock Analysis Report

The Blackstone Group L.P. (BX) : Free Stock Analysis Report

People's United Financial, Inc. (PBCT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance