BLACKROCK: Investors Taking On More Risk Should Build Some Ballast Into Their Portfolios

Reuters

FA Insights is a daily newsletter from Business Insider that delivers the top news and commentary for financial advisors.

Investors Are Taking On Increasing Risk But Should Rebalance (BlackRock Blog)

Recent Fed data shows that investors have moved into riskier investments after the financial crisis. Americans now hold 34.9% of their financial assets in riskier investments (stocks, corporate bonds, and mutual funds), slightly below the highest in Q1 2000, when investors had 38.4% exposure to riskier investments, writes BlackRock's Russ Koesterich. " I still think that an improving global economy and growing corporate incomes will support risky assets over the balance of 2014."

That being said, he thinks investors should "consider some strategies to build some ballast into their portfolios, such as rebalancing with a tilt toward value." They should rebalance their portfolios and think about taking on some of the previous years' losers.

"As for where the value is, I still believe stocks offer better value than bonds, even after a five-year bull market. Within stocks, the shift toward value from growth supports my preference for large cap and mega cap names over small cap stocks, as well as my preference for international equities and less expensive sectors of the equity market, such as energy and technology."

Brokerages Are Trying Out New Pay Models To Attract Millennials (Investment News)

As the financial advisor industry sees a generational shift its also trying out new pay models to attract Millennials, writes Mason Braswell at Investment News. Some are trying out models that focus on salary over commissions. "I grew up in the industry when commission was the only way you did it," Devin DeStefano at Wells Fargo, said at an industry conference. "We are going to try something different and pair salary with commission over time."

Howard Marks' Brilliant Observation On What It Takes To Be A Great Investor (Bloomberg TV)

Oak Tree Capital's Howard Marks told Bloomberg TV's Stephanie Ruhle and Erik Schatzker what it takes to be a great investor. "Well, I think that -- the big question is how much of your time, effort, and capital will you -- and self-esteem will you risk in the effort of trying to be right? And how much will you spend trying to avoid being wrong?" Marks said. "They are two different things. And in order to be -- have a shot at being really right, you got to have a shot at being really wrong." Marks also said that "almost everything in investing is symmetrical. And it’s the symmetry that people are leery of. It’s not -- they’re not, as you point out, Erik, they're not afraid to make money, they’re not afraid to be great. They’re afraid to have a big mistake on their hands."

Advisors Should Direct Asset Allocation Based On Fed Cycles (The Wall Street Journal)

"Sector performance patterns are closely correlated to the Federal Reserve's monetary policy cycle," writes Steve Krawick, president of West Chester Capital Advisors in a new WSJ column. We are currently in the fourth phase in which the Fed is exercising accommodative policy with low interest rates. "Historically, in this environment, consumer discretionary stocks and financials have outperformed S&P benchmarks and their peer sectors," Krawick writes. "So, during this cycle, we have our clients overweight in that sector and underweight in others like industrials, materials, and technologies, which tend to underperform under current conditions." But the Fed will soon transition to the first phase, when the Funds rate rises, and when industrials, materials, and technologies that are underperforming will come out on top.

"Using Fed policy cycles to direct allocation isn't rocket science and it's not revolutionary. But when advisers are able to anticipate sector performance, we can effectively and strategically reduce clients' risk exposure and hopefully provide them with fewer sleepless nights."

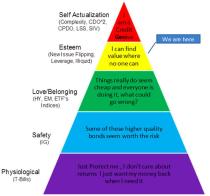

Maslow’s Hierarchy Of Credit Bubbles (Brean Capital)

Peter Tchir, head of macro strategy at Brean Capital, recent wrote that there isn't a credit bubble and now recommends "going long Credit – with IG CDS as the favorite way, followed by AAA CLO or off the run high yield and leveraged loans."

"There will still be trading opportunities to get short credit, I just don’t think that now is the time, and although I think we are not in a bubble, the easy money has been made and we are closer to the top than the bottom of the cycle."

Brean Capital

More From Business Insider

Yahoo Finance

Yahoo Finance