BJ's Wholesale (BJ) Q1 Earnings Coming Up: What's in Store?

BJ's Wholesale Club Holdings, Inc. BJ is likely to register an increase in the top line when it reports first-quarter fiscal 2023 results on May 23 before market open. The Zacks Consensus Estimate for revenues is pegged at $4,812 million, indicating growth of 7% from the prior-year reported figure.

The bottom line of this operator of membership warehouse clubs is expected to have declined year over year. The Zacks Consensus Estimate for first-quarter earnings per share has been stable at 84 cents over the past 30 days and suggests a decline of 3.5% from the year-ago period.

BJ's Wholesale has a trailing four-quarter earnings surprise of 19.6%, on average. In the last reported quarter, this Westborough-based company’s bottom line surpassed the Zacks Consensus Estimate by a margin of 12.4%.

Factors to Consider

BJ's Wholesale’s focus on simplifying assortments, boosting marketing and merchandising capabilities, expanding into high-demand categories and building an own-brand portfolio is commendable. The company remains committed to enhancing omnichannel capabilities and providing value for customers. These endeavors have been contributing to growth in membership signups and renewals.

BJ's Wholesale’s better pricing, private-label offerings, merchandise initiatives and digital solutions are likely to have favorably impacted the to-be-reported quarter’s top line. We expect total comparable club sales to have increased 4.2%. Excluding gasoline sales, we expect comparable club sales to have improved 6%.

However, margins remain an area to watch. Higher freight costs, investments in inflationary categories and any markdowns in general merchandise inventory might have hurt merchandise margins.

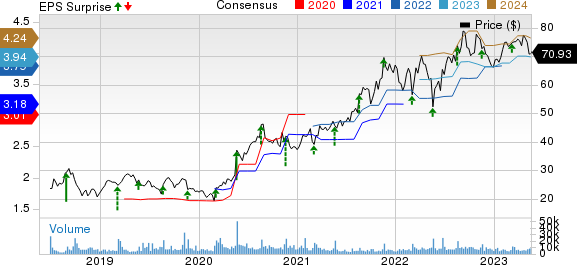

BJ's Wholesale Club Holdings, Inc. Price, Consensus and EPS Surprise

BJ's Wholesale Club Holdings, Inc. price-consensus-eps-surprise-chart | BJ's Wholesale Club Holdings, Inc. Quote

What the Zacks Model Unveils

Our proven model predicts an earnings beat for BJ's Wholesale this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

BJ's Wholesale has an Earnings ESP of +5.26% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With the Favorable Combination

Here are some other companies you may want to consider as our model shows that these also have the right combination of elements to post an earnings beat:

American Eagle Outfitters AEO currently has an Earnings ESP of +9.81% and a Zacks Rank #3. The company is likely to register a bottom-line increase when it reports first-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for the quarterly earnings per share of 17 cents suggests an increase of 6.3% from the year-ago quarter.

American Eagle Outfitters’ top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $1.06 billion, which indicates a marginal increase of 0.9% from the figure reported in the prior-year quarter. American Eagle Outfitters has a trailing four-quarter earnings surprise of 0.9%, on average.

Ulta Beauty ULTA currently has an Earnings ESP of +0.66% and a Zacks Rank of #3. The company is likely to register an increase in the bottom line when it reports first-quarter fiscal 2023 results. The Zacks Consensus Estimate for the quarterly earnings per share of $6.81 suggests an increase of 8.1% from the year-ago quarter.

Ulta Beauty’s top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.62 billion, which suggests an increase of 11.5% from the figure reported in the prior-year quarter. ULTA delivered an earnings beat of 26.2%, on average, in the trailing four quarters.

DICK'S Sporting Goods DKS currently has an Earnings ESP of +2.15% and a Zacks Rank #3. The company is expected to register an increase in the bottom line when it reports first-quarter 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of $3.21 suggests an increase of 12.6% from the year-ago quarter.

DICK'S Sporting Goods’ top line is anticipated to have risen year over year. The consensus mark for revenues is pegged at $2.83 billion, indicating an increase of 4.7% from the figure reported in the year-ago quarter. DKS has a trailing four-quarter earnings surprise of 10%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance