Birchcliff Energy Ltd. Announces Q1 2023 Results, Declaration of Q2 2023 Dividend of $0.20 per Common Share and Discloses Elmworth Land Position

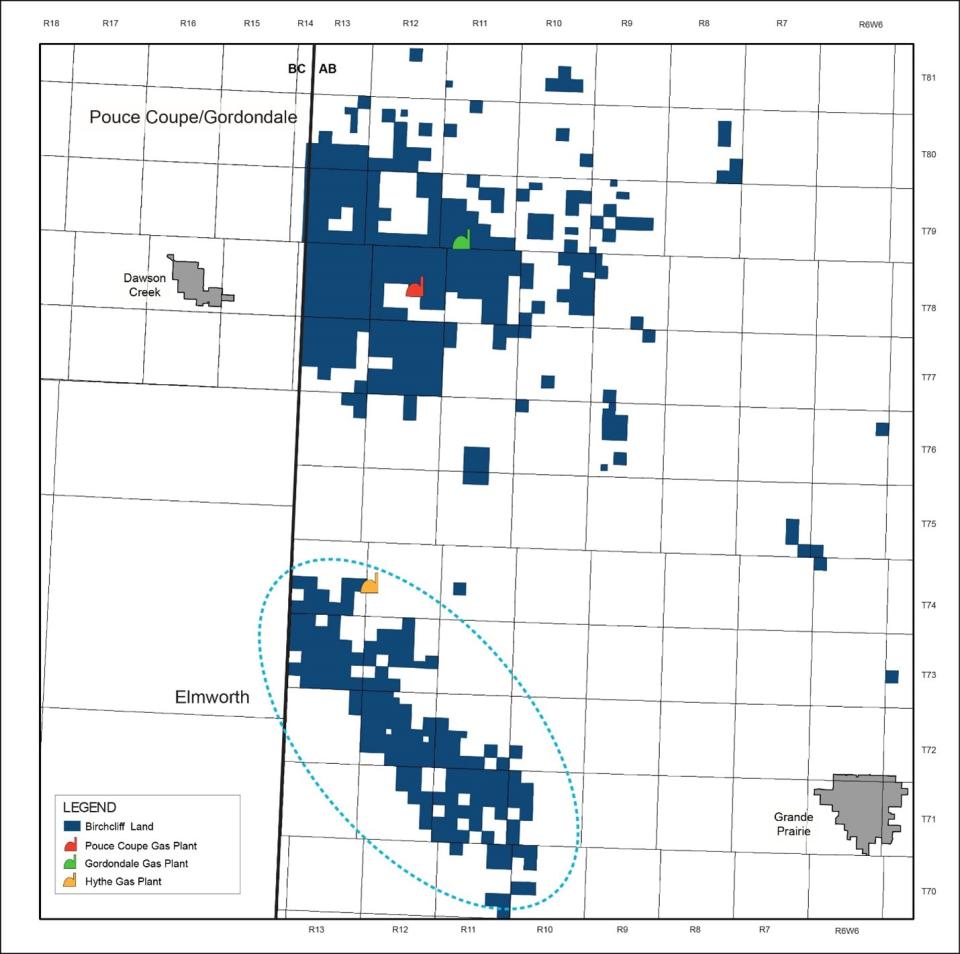

A map outlining the Corporation’s Elmworth area is provided below.

CALGARY, Alberta, May 10, 2023 (GLOBE NEWSWIRE) -- Birchcliff Energy Ltd. (“Birchcliff” or the “Corporation”) (TSX: BIR) is pleased to announce its Q1 2023 financial and operational results and that its board of directors (the “Board”) has declared a quarterly cash dividend of $0.20 per common share for the quarter ending June 30, 2023. Birchcliff is also pleased to disclose the details of its land position on the Montney/Doig Resource Play in Elmworth, Alberta.

“In Q1 2023, we generated adjusted funds flow(1) of $88.7 million, with average production of 74,592 boe/d. In addition, we returned an aggregate of $53.4 million to shareholders in Q1 2023 through our base common share dividend,” commented Jeff Tonken, Chief Executive Officer of Birchcliff. “We are also pleased to disclose our large Montney land position in the Elmworth area of Alberta, which consists of 153 sections of contiguous 100% working interest land located 25 kilometres to the south of our producing properties in Pouce Coupe and Gordondale. This significant land base positions Birchcliff to continue to drive long-term shareholder value, providing us with a large potential future development area that can supply clean natural gas for many years to come.”

Q1 2023 FINANCIAL AND OPERATIONAL HIGHLIGHTS

Achieved quarterly average production of 74,592 boe/d, a 2% decrease from Q1 2022, notwithstanding an unplanned outage on Pembina Pipeline Corporation’s Northern Pipeline system that significantly impacted the Corporation’s NGLs sales volumes in Q1 2023.

Generated quarterly adjusted funds flow of $88.7 million, or $0.33 per basic common share(2), both of which decreased by 52% from Q1 2022. Cash flow from operating activities was $111.3 million, a 28% decrease from Q1 2022.

Reported a quarterly net loss to common shareholders of $42.5 million, or $0.16 per basic common share, as compared to net income to common shareholders of $125.8 million and $0.47 per basic common share in Q1 2022.

Achieved an operating netback(2) of $17.45/boe and adjusted funds flow per boe(2) of $13.22, a 39% and 51% decrease, respectively, from Q1 2022.

Realized an operating expense(3) of $3.95/boe, a 13% increase from Q1 2022.

Total debt(4) at March 31, 2023 was $217.9 million, a 47% decrease from March 31, 2022.

F&D capital expenditures were $115.0 million in Q1 2023.

Returned $53.4 million to common shareholders in Q1 2023 through dividends as compared to $2.7 million in Q1 2022.

Birchcliff’s unaudited interim condensed financial statements for the three months ended March 31, 2023 and related management’s discussion and analysis will be available on its website at www.birchcliffenergy.com and on SEDAR at www.sedar.com.

DECLARATION OF Q2 2023 QUARTERLY DIVIDEND AND SHAREHOLDER RETURNS

As part of its commitment to delivering significant shareholder returns, the Board has declared a quarterly cash dividend of $0.20 per common share for the quarter ending June 30, 2023. The dividend will be payable on June 30, 2023 to shareholders of record at the close of business on June 15, 2023. The ex-dividend date is June 14, 2023. The dividend has been designated as an eligible dividend for the purposes of the Income Tax Act (Canada).

This is the third consecutive quarter in which Birchcliff’s Board has declared a cash dividend of $0.20 per common share.

The Board previously approved an annual base dividend of $0.80 per common share for 2023, which is expected to be declared and paid quarterly at the rate of $0.20 per common share, at the discretion of the Board.

Subsequent to Q1 2023, Birchcliff purchased and cancelled an aggregate of 1,265,268 common shares pursuant to its normal course issuer bid at an average price of $8.10 per common share for an aggregate cost of $10.2 million, before fees.

ELMWORTH – UPDATED LAND POSITION

Over the last number of years, Birchcliff has strategically built a large, contiguous 100% working interest Montney land position in the Elmworth area of Alberta, located 25 kilometres to the south of the Corporation’s producing properties in Pouce Coupe and Gordondale.

As at May 9, 2023, Birchcliff held 153 sections(5) (97,920 acres(5)) of contiguous Montney lands in Elmworth, which are largely undeveloped. Birchcliff expects minimal yearly capital commitments over the next several years to maintain its land position in the area.

This significant, largely undeveloped land base in Elmworth positions the Corporation to continue to drive long-term shareholder value by enhancing its ability for future production growth. The Elmworth asset provides Birchcliff with a large potential future development area which can be responsibly developed over time, leveraging the extensive knowledge that Birchcliff has gained in developing its Pouce Coupe and Gordondale assets. In addition, the Corporation’s lands in Elmworth are located in an area that is well suited to supply clean natural gas to future LNG export facilities in Canada. This significant land position in Elmworth also builds upon Birchcliff’s existing extensive inventory of potential future drilling locations in Pouce Coupe and Gordondale.

To preserve its optionality for future growth in Elmworth, Birchcliff has licenced and is planning to drill 2 (2.0 net) Montney horizontal wells in Elmworth in late Q2 2023, which will continue a number of sections of Montney lands in the area that are set to expire in 2023.

Birchcliff expects that the drilling of these wells will be accomplished within the Corporation’s F&D capital expenditures guidance range of $270 million to $280 million. See “Outlook and Guidance” and “Operational Update”.

Birchcliff is only required to drill the wells in order to continue the lands and accordingly, the wells will not be completed or brought on production in 2023.

By drilling these wells to the planned measured depth, Birchcliff will validate multiple initial term licenses and continue 64 sections of land into their five-year intermediate term.

Birchcliff anticipates that these wells will be completed as it commences the development of its Elmworth area in the future.

Over the last six months, significant Crown land sale activity has occurred in the areas offsetting Birchcliff’s Elmworth land position, which has seen substantially higher prices for the Montney mineral rights as compared to previous years. Since the November 2, 2022 Alberta land sale, approximately $36 million has been spent on 111 sections of prospective Montney lands in the Elmworth area at Alberta Crown land sales(6). There have also been a significant number of sections in Elmworth posted for several upcoming land sales. In addition, several wells have recently been drilled and brought on production in the area, which have had strong production results. The Montney/Doig Resource Play in Elmworth continues to garner attention and capital investment, which solidifies the value of Birchcliff’s contiguous land position in the area.

A map outlining the Corporation’s Elmworth area is provided below.

Includes content supplied by IHS Markit Canada; Copyright © IHS Markit Canada. All rights reserved.

For further information regarding Birchcliff’s Elmworth land position, please see the Corporation’s corporate presentation, a copy of which is available on its website at www.birchcliffenergy.com.

___________________________

(1) Non-GAAP financial measure. See “Non-GAAP and Other Financial Measures”.

(2) Non-GAAP ratio. See “Non-GAAP and Other Financial Measures”.

(3) Supplementary financial measure. See “Non-GAAP and Other Financial Measures”.

(4) Capital management measure. See “Non-GAAP and Other Financial Measures”.

(5) On both a gross and net basis.

(6) Source: https://www.alberta.ca/petroleum-natural-gas-sales.aspx.

ALBERTA WILDFIRE UPDATE

Our first priority is the health and safety of our personnel. At the present time, none of Birchcliff’s operations, which are located northwest of Grande Prairie, Alberta, have been directly impacted by the wildfires in Alberta. We will continue to closely monitor the situation.

Birchcliff’s thoughts are with the people and communities who have been impacted by the wildfires. We would like to thank all emergency responders for their tireless work in responding to the fires and we hope that everyone remains safe.

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

Birchcliff’s annual and special meeting of shareholders is scheduled to take place tomorrow, Thursday, May 11, 2023, at 3:00 p.m. (Mountain Daylight Time) in the McMurray Room at the Calgary Petroleum Club, 319 – 5th Avenue S.W., Calgary, Alberta.

This press release contains forward-looking statements within the meaning of applicable securities laws. For further information regarding the forward-looking statements contained herein, see “Advisories – Forward-Looking Statements”. With respect to the disclosure of Birchcliff’s production contained in this press release, see “Advisories – Production”. In addition, this press release uses various “non-GAAP financial measures”, “non-GAAP ratios”, “supplementary financial measures” and “capital management measures” as such terms are defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure (“NI 52-112”). Non-GAAP financial measures and non-GAAP ratios are not standardized financial measures under GAAP and might not be comparable to similar financial measures disclosed by other issuers. For further information regarding the non-GAAP and other financial measures used in this press release, see “Non-GAAP and Other Financial Measures”.

Q1 2023 UNAUDITED FINANCIAL AND OPERATIONAL SUMMARY | ||||

| Three months ended | Three months ended | ||

OPERATING |

|

| ||

Average production |

|

| ||

Light oil(bbls/d) | 2,088 |

| 2,369 |

|

Condensate(bbls/d) | 5,358 |

| 4,796 |

|

NGLs(bbls/d) | 3,288 |

| 7,976 |

|

Natural gas(Mcf/d) | 383,145 |

| 365,296 |

|

Total(boe/d) | 74,592 |

| 76,024 |

|

Average realized sales price(CDN$)(1)(2) |

|

| ||

Light oil(per bbl) | 105.69 |

| 115.47 |

|

Condensate(per bbl) | 105.88 |

| 121.56 |

|

NGLs(per bbl) | 36.69 |

| 43.56 |

|

Natural gas(per Mcf) | 3.68 |

| 5.40 |

|

Total(per boe) | 31.07 |

| 41.79 |

|

|

|

| ||

NETBACK AND COST($/boe)(2) |

|

| ||

Petroleum and natural gas revenue(1) | 31.08 |

| 41.80 |

|

Royalty expense | (4.37 | ) | (4.41 | ) |

Operating expense | (3.95 | ) | (3.49 | ) |

Transportation and other expense(3) | (5.31 | ) | (5.43 | ) |

Operating netback(3) | 17.45 |

| 28.47 |

|

G&A expense, net | (1.41 | ) | (1.12 | ) |

Interest expense | (0.47 | ) | (0.48 | ) |

Realized loss on financial instruments | (2.36 | ) | (0.03 | ) |

Other cash income | 0.01 |

| 0.01 |

|

Adjusted funds flow(3) | 13.22 |

| 26.85 |

|

Depletion and depreciation expense | (8.26 | ) | (7.47 | ) |

Unrealized gain (loss) on financial instruments | (12.43 | ) | 5.07 |

|

Other expense(4) | (0.56 | ) | (0.08 | ) |

Dividends on preferred shares | - |

| (0.25 | ) |

Deferred income tax recovery (expense) | 1.69 |

| (5.74 | ) |

Net income (loss) to common shareholders | (6.34 | ) | 18.38 |

|

|

|

| ||

FINANCIAL |

|

| ||

Petroleum and natural gas revenue($000s)(1) | 208,647 |

| 285,976 |

|

Cash flow from operating activities($000s) | 111,330 |

| 154,152 |

|

Adjusted funds flow($000s)(5) | 88,737 |

| 183,699 |

|

Per basic common share($)(3) | 0.33 |

| 0.69 |

|

Free funds flow($000s)(5) | (26,302 | ) | 95,417 |

|

Per basic common share($)(3) | (0.10 | ) | 0.36 |

|

Net income (loss) to common shareholders($000s) | (42,548 | ) | 125,792 |

|

Per basic common share($) | (0.16 | ) | 0.47 |

|

End of period basic common shares(000s) | 266,987 |

| 266,810 |

|

Weighted average basic common shares(000s) | 266,447 |

| 265,530 |

|

Dividends on common shares($000s) | 53,392 |

| 2,658 |

|

Dividends on preferred shares($000s) | - |

| 1,717 |

|

F&D capital expenditures($000s)(6) | 115,039 |

| 88,282 |

|

Total capital expenditures($000s)(5) | 115,659 |

| 88,124 |

|

Revolving term credit facilities($000s) | 191,426 |

| 397,752 |

|

Total debt($000s)(7) | 217,927 |

| 408,998 |

|

(1) Excludes the effects of financial instruments but includes the effects of physical delivery contracts.

(2) Average realized sales prices and the component values of netback and costs set forth in the table above are supplementary financial measures unless otherwise indicated. See “Non-GAAP and Other Financial Measures”.

(3) Non-GAAP ratio. See “Non-GAAP and Other Financial Measures”.

(4) Includes non-cash items such as compensation, accretion, amortization of deferred financing fees and other gains.

(5) Non-GAAP financial measure. See “Non-GAAP and Other Financial Measures”.

(6) See “Advisories – F&D Capital Expenditures”.

(7) Capital management measure. See “Non-GAAP and Other Financial Measures”.

OUTLOOK AND GUIDANCE

Updated 2023 Guidance

As a result of the ongoing impact of a force majeure event on Pembina Pipeline Corporation’s (“Pembina”) Northern Pipeline system (the “Pembina Pipeline System”), Birchcliff currently expects that it will be on the low end of its annual average production guidance range of 77,000 to 80,000 boe/d. As previously disclosed in Birchcliff’s press releases dated February 15, 2023 and March 15, 2023, Pembina notified Birchcliff on January 19, 2023 of a force majeure event on the Pembina Pipeline System, which resulted in an unplanned outage impacting a substantial portion of the volumes on the system, including the Corporation’s NGLs sales volumes. The Pembina Pipeline System has been operating under limited NGLs capacity since February 2023, which continues to impact the Corporation’s NGLs sales revenue and volumes. The Corporation has been closely monitoring the situation and diligently working with Pembina to help mitigate the impact of the outage and is optimistic that the outage will be resolved in the near-term.

The Corporation is tightening its 2023 F&D capital expenditures guidance range to $270 million to $280 million (previously $260 million to $280 million) to reflect the drilling of an additional 2 (2.0 net) wells in the Elmworth area, as discussed in further detail under the headings “Elmworth – Updated Land Position” and “Operational Update”.

The Corporation is lowering its 2023 guidance for adjusted funds flow, free funds flow and excess free funds flow to reflect a lower commodity price forecast for 2023. As a result of lower anticipated adjusted funds flow in 2023, Birchcliff now expects to fund its capital program and dividend payments in 2023 through a combination of adjusted funds flow and the Corporation’s extendible revolving term credit facilities (the “Credit Facilities”), which is anticipated to result in higher total debt at year-end 2023 than previously forecast. Birchcliff has significant unutilized credit capacity under its Credit Facilities, which provides it with substantial financial flexibility and additional capital resources. Subsequent to Q1 2023, Birchcliff’s syndicate of lenders confirmed the borrowing base limit under the Credit Facilities at $850.0 million. See “Q1 2023 Financial and Operational Results – Debt and Credit Facilities”.

The following tables set forth Birchcliff’s updated and previous guidance and commodity price assumptions for 2023, as well as its free funds flow sensitivity:

| Updated 2023 guidance and | Previous 2023 guidance and | ||||

Production |

|

| ||||

Annual average production (boe/d) | 77,000 – 80,000 | 77,000 – 80,000 | ||||

% Light oil | 3% |

| 3% | |||

% Condensate | 7% |

| 7% | |||

% NGLs | 8% |

| 9% | |||

% Natural gas | 82% |

| 81% | |||

|

|

| ||||

Average Expenses ($/boe) |

|

| ||||

Royalty(2) | 3.60 – 3.80 | 4.25 – 4.45 | ||||

Operating(2) | 3.60 – 3.80 | 3.55 – 3.75 | ||||

Transportation and other(3) | 5.30 – 5.50 | 5.25 – 5.45 | ||||

|

|

| ||||

Adjusted Funds Flow (millions)(4) | $360 | $475 | ||||

|

|

| ||||

F&D Capital Expenditures (millions) | $270 – $280 | $260 – $280 | ||||

|

|

| ||||

Free Funds Flow (millions)(4) | $80 – $90 | $195 – $215 | ||||

|

|

| ||||

Annual Base Dividend (millions)(5) | $213 | $213 | ||||

|

|

| ||||

Excess Free Funds Flow (millions)(4)(5) | ($123) – ($133) | ($18) – $2 | ||||

|

|

| ||||

Total Debt at Year End (millions)(6) | $280 – $290(7) | $145 – $165 | ||||

|

|

| ||||

Natural Gas Market Exposure |

|

| ||||

AECO exposure as a % of total natural gas production | 15%(8) |

| 17% | |||

Dawn exposure as a % of total natural gas production | 42%(8) |

| 41% | |||

NYMEX HH exposure as a % of total natural gas production | 37%(8) |

| 36% | |||

Alliance exposure as a % of total natural gas production | 6%(8) |

| 6% | |||

|

|

| ||||

Commodity Prices |

|

| ||||

Average WTI price (US$/bbl) | 78.00(9) |

| 78.50 | |||

Average WTI-MSW differential (CDN$/bbl) | 4.20(9) |

| 3.25 | |||

Average AECO price (CDN$/GJ) | 2.45(9) |

| 3.00 | |||

Average Dawn price (US$/MMBtu) | 2.50(9) |

| 3.05 | |||

Average NYMEX HH price (US$/MMBtu) | 2.85(9) |

| 3.50 | |||

Exchange rate (CDN$ to US$1) | 1.35(9) |

| 1.35 | |||

Forward eight months’ free funds flow sensitivity(10) | Estimated change to | |

Change in WTI US$1.00/bbl | $2.7 | |

Change in NYMEX HH US$0.10/MMBtu | $4.8 | |

Change in Dawn US$0.10/MMBtu | $5.4 | |

Change in AECO CDN$0.10/GJ | $2.3 | |

Change in CDN/US exchange rate CDN$0.01 | $3.0 | |

(1) Birchcliff’s updated guidance for its production commodity mix, adjusted funds flow, free funds flow, excess free funds flow, total debt and natural gas market exposure in 2023 is based on an annual average production rate of 77,000 boe/d in 2023, which is the low end of Birchcliff’s annual average production guidance range for 2023. For further information regarding the risks and assumptions relating to the Corporation’s guidance, see “Advisories – Forward-Looking Statements”.

(2) Supplementary financial measure. See “Non-GAAP and Other Financial Measures”.

(3) Non-GAAP ratio. See “Non-GAAP and Other Financial Measures”.

(4) Non-GAAP financial measure. See “Non-GAAP and Other Financial Measures”.

(5) Assumes that an annual base dividend of $0.80 per common share is paid and that there are 266 million common shares outstanding, with no changes to the base dividend rate and no special dividends paid. Other than the dividends declared for the quarters ending March 31, 2023 and June 30, 2023, the declaration of dividends is subject to the approval of the Board and is subject to change.

(6) Capital management measure. See “Non-GAAP and Other Financial Measures”.

(7) The forecast of total debt at December 31, 2023 is expected to be comprised of any amounts outstanding under the Credit Facilities plus accounts payable and accrued liabilities and less cash, accounts receivable and prepaid expenses and deposits at the end of the year.

(8) Birchcliff’s natural gas market exposure for 2023 takes into account its physical and financial basis swap contracts outstanding as at May 1, 2023.

(9) Birchcliff’s updated commodity price and exchange rate assumptions for 2023 are based on anticipated full-year averages, which include settled benchmark commodity prices and the CDN/US exchange rate for the period from January 1, 2023 to April 30, 2023.

(10) Illustrates the expected impact of changes in commodity prices and the CDN/US exchange rate on the Corporation’s updated forecast of free funds flow for 2023, holding all other variables constant. The sensitivity is based on the updated commodity price and exchange rate assumptions set forth in the table above. The calculated impact on free funds flow is only applicable within the limited range of change indicated. Calculations are performed independently and may not be indicative of actual results. Actual results may vary materially when multiple variables change at the same time and/or when the magnitude of the change increases.

Updated Five-Year Outlook(7)

As a result of the changes to its 2023 guidance, Birchcliff is also updating its five-year outlook for 2023 to 2027.

2024

As previously updated in Birchcliff’s press release dated March 15, 2023, the Corporation currently expects that it will keep its production relatively flat year-over-year. 2024 annual average production is currently forecast to be 78,000 boe/d (previously 78,500 boe/d) resulting from forecast 2024 F&D capital expenditures of $255 million.

Assuming the payment of an annual base dividend of $0.80 per common share(8) and that realized commodity prices match the Corporation’s commodity price assumptions, Birchcliff would achieve 2024 excess free funds flow of $67 million (previously $82 million) and total debt at year end 2024 of $230 million (previously $85 million). Birchcliff currently anticipates that excess free funds flow generated in 2024 will be primarily used to reduce indebtedness and that it will be in a position to fund its common share dividend payments and reduce its total debt in 2024 from year-end 2023.

Outlook to 2027

Over the longer-term, Birchcliff remains committed to generating substantial free funds flow and delivering significant returns to shareholders, while achieving disciplined production growth to fully utilize the Corporation’s existing processing and transportation capacity. Birchcliff’s five-year outlook still provides for potential cumulative free funds flow of approximately $1.3 billion by the end of the five-year period. Annual average production in 2027 is still forecast to be 87,000 boe/d, subject to commodity prices.

For further information regarding the Corporation’s updated five-year outlook and the commodity price and other assumptions underlying such outlook, see “Advisories – Forward-Looking Statements” and the Corporation’s corporate presentation, a copy of which is available on its website at www.birchcliffenergy.com.

_________________________________

(7) The five-year outlook presented herein is for illustrative purposes only and should not be relied upon as indicative of future results. The internal projections, expectations and beliefs underlying this outlook are subject to change in light of ongoing results and prevailing economic and industry conditions. Birchcliff’s F&D capital budgets for 2024 to 2027 have not been finalized and are subject to approval by the Board. Accordingly, the levels of F&D capital expenditures for 2024 to 2027 are subject to change, which could have an impact on the Corporation’s forecasted production, adjusted funds flow, free funds flow, excess free funds flow and year end total debt or total surplus over the five-year period. In addition, changes in assumed commodity prices and variances in production forecasts can have an impact on the Corporation’s five-year outlook, which impact could be material. See “Advisories – Forward-Looking Statements”.

(8) Assumes that an annual base dividend of $0.80 per common share is paid and that there are 266 million common shares outstanding, with no changes to the base dividend rate and no special dividends paid. Other than the dividends declared for the quarters ending March 31, 2023 and June 30, 2023, the declaration of dividends is subject to the approval of the Board and is subject to change. The Board has not approved the annual base dividend rate for 2024. See “Advisories – Forward-Looking Statements”.

Q1 2023 FINANCIAL AND OPERATIONAL RESULTS

Production

Birchcliff’s production averaged 74,592 boe/d in Q1 2023, a 2% decrease from Q1 2022. The decrease was primarily due to the outage on the Pembina Pipeline System, which negatively impacted the Corporation’s NGLs sales volumes in Q1 2023, and natural production declines. Birchcliff’s production in Q1 2023 was positively impacted by incremental production volumes from the new Montney/Doig wells brought on production since Q1 2022, including the 5 (5.0 net) wells on its 03-06 pad that were brought on production in December 2022 and early January 2023 and the 6 (6.0 net) wells on its 14-06 pad that were brought on production in February 2023.

Liquids accounted for 14% of Birchcliff’s total production in Q1 2023 as compared to 20% in Q1 2022. Liquids production weighting decreased from Q1 2022 primarily due to a 59% decrease in NGLs sales volumes, which were largely impacted by the outage on the Pembina Pipeline System.

Adjusted Funds Flow and Cash Flow From Operating Activities

Birchcliff’s adjusted funds flow was $88.7 million in Q1 2023, or $0.33 per basic common share, both of which decreased by 52% from Q1 2022. Birchcliff’s cash flow from operating activities was $111.3 million in Q1 2023, a 28% decrease from Q1 2022. The decreases were primarily due to lower petroleum and natural gas revenue, which was largely impacted by a 32% decrease in the average realized natural gas sales price and lower NGLs sales volumes due to the outage on the Pembina Pipeline System. Birchcliff’s adjusted funds flow and cash flow from operating activities were also negatively impacted by a higher realized loss on financial instruments in Q1 2023 as compared to Q1 2022. Birchcliff recorded a realized loss on financial instruments of $15.8 million in Q1 2023 as compared to a negligible realized loss on financial instruments in Q1 2022.

Net Loss to Common Shareholders

Birchcliff reported a net loss to common shareholders of $42.5 million in Q1 2023, or $0.16 per basic common share, as compared to net income to common shareholders of $125.8 million and $0.47 per basic common share in Q1 2022. The change to a net loss position was primarily due to lower adjusted funds flow and an unrealized mark-to-market loss on financial instruments in Q1 2023, which resulted from changes in the fair value of the Corporation’s NYMEX HH/AECO 7A basis swap contracts, partially offset by a deferred income tax recovery in Q1 2023 as compared to a deferred income tax expense in Q1 2022. Birchcliff recorded an unrealized mark-to-market loss on financial instruments of $83.4 million in Q1 2023 as compared to an unrealized mark-to-market gain on financial instruments of $34.7 million in Q1 2022.

Debt and Credit Facilities

Total debt at March 31, 2023 was $217.9 million, a 47% decrease from March 31, 2022. At March 31, 2023, Birchcliff had long-term bank debt under its Credit Facilities of $191.4 million (March 31, 2022: $397.8 million) from available Credit Facilities of $850.0 million (March 31, 2022: $850.0 million), leaving the Corporation with $655.3 million (77%) of unutilized credit capacity after adjusting for outstanding letters of credit and unamortized deferred financing fees.

Subsequent to Q1 2023, Birchcliff’s syndicate of lenders completed its regular semi-annual review of the borrowing base limit under the Credit Facilities. In connection therewith, the lenders confirmed the borrowing base limit at $850.0 million. The Credit Facilities have a maturity date of May 11, 2025 and do not contain any financial maintenance covenants.

Commodity Prices

The Corporation’s average realized sales price in Q1 2023 was $31.07/boe, a 26% decrease from Q1 2022. The decrease was due to lower benchmark commodity prices, which negatively impacted the sales prices Birchcliff received for its production in Q1 2023. Birchcliff is fully exposed to increases and decreases in commodity prices as it has no fixed price commodity hedges in place.

The following table sets forth the average benchmark commodity index prices for the periods indicated:

| Three months ended | |||

| 2023 | 2022 | % Change | |

Light oil – WTI Cushing (US$/bbl) | 76.09 | 94.29 | (19) |

|

Light oil – MSW (Mixed Sweet) (CDN$/bbl) | 99.11 | 115.64 | (14) |

|

Natural gas – NYMEX HH (US$/MMBtu) | 3.42 | 4.95 | (31) |

|

Natural gas – AECO 5A Daily (CDN$/GJ) | 3.05 | 4.49 | (32) |

|

Natural gas – AECO 7A Month Ahead (US$/MMBtu) | 3.21 | 3.61 | (11) |

|

Natural gas – Dawn Day Ahead (US$/MMBtu) | 2.72 | 4.42 | (38) |

|

Natural gas – ATP 5A Day Ahead (CDN$/GJ) | 2.88 | 4.58 | (37) |

|

Natural Gas Market Diversification

Birchcliff’s physical natural gas sales exposure primarily consists of the AECO, Dawn and Alliance markets. In addition, the Corporation has various financial instruments outstanding that provide it with exposure to NYMEX HH pricing. The following table details Birchcliff’s effective sales, production and average realized sales price for natural gas and liquids for Q1 2023, after taking into account the Corporation’s financial instruments:

Three months ended March 31, 2023 | ||||||

| Effective | Percentage | Effective | Percentage of | Percentage of | Effective average |

Market |

|

|

|

|

|

|

AECO(2)(3) | 28,465 | 13 | 89,081 Mcf | 23 | 20 | 3.55/Mcf |

Dawn(4) | 55,292 | 26 | 157,375 Mcf | 41 | 35 | 3.90/Mcf |

NYMEX HH(1)(2)(5) | 47,769 | 23 | 136,689 Mcf | 36 | 31 | 3.88/Mcf |

Total natural gas(1) | 131,526 | 62 | 383,145 Mcf | 100 | 86 | 3.81/Mcf |

Light oil | 19,862 | 9 | 2,088 bbls |

| 3 | 105.69/bbl |

Condensate | 51,062 | 24 | 5,358 bbls |

| 7 | 105.88/bbl |

NGLs | 10,855 | 5 | 3,288 bbls |

| 4 | 36.69/bbl |

Total liquids | 81,779 | 38 | 10,734 bbls |

| 14 | 84.65/bbl |

Total corporate(1) | 213,305 | 100 | 74,592 boe |

| 100 | 31.77/boe |

(1) Effective sales and effective average realized sales price on a total natural gas and total corporate basis and for the AECO and NYMEX HH markets are non-GAAP financial measures and non-GAAP ratios, respectively. See “Non-GAAP and Other Financial Measures”.

(2) AECO sales and production that effectively received NYMEX HH pricing under Birchcliff’s long-term physical NYMEX HH/AECO 7A basis swap contracts have been included as effective sales and production in the NYMEX HH market. Birchcliff sold physical NYMEX HH/AECO 7A basis swap contracts for 5,000 MMBtu/d at an average contract price of NYMEX HH less US$1.205/MMBtu during Q1 2023.

(3) Birchcliff has short-term physical sales agreements with third-party marketers to sell and deliver into the Alliance pipeline system. All of Birchcliff’s short-term physical Alliance sales and production during Q1 2023 received AECO premium pricing and have therefore been included as effective sales and production in the AECO market.

(4) Birchcliff has agreements for the firm service transportation of an aggregate of 175,000 GJ/d of natural gas on TransCanada PipeLines’ Canadian Mainline, whereby natural gas is transported to the Dawn trading hub in Southern Ontario.

(5) NYMEX HH sales and production include financial and physical NYMEX HH/AECO 7A basis swap contracts for an aggregate of 152,500 MMBtu/d at an average contract price of NYMEX HH less US$1.23/MMBtu during Q1 2023.

Birchcliff’s effective average realized sales price for NYMEX HH of CDN$3.88/Mcf (US$2.57/MMBtu) was determined on a gross basis before giving effect to the average NYMEX HH/AECO 7A fixed contract basis differential price of CDN$1.85/Mcf (US$1.23/MMBtu) and includes any realized gains and losses on financial NYMEX HH/AECO 7A basis swap contracts during Q1 2023.

After giving effect to the NYMEX HH/AECO 7A basis contract price and including any realized gains and losses on financial NYMEX HH/AECO 7A basis swap contracts during Q1 2023, Birchcliff’s effective average realized net sales price for NYMEX HH was CDN$2.03/Mcf (US$1.34/MMBtu) in Q1 2023.

The following table sets forth Birchcliff’s sales, production, average realized sales price, transportation costs and natural gas sales netback by natural gas market for the periods indicated, before taking into account the Corporation’s financial instruments:

Three months ended March 31, 2023 | |||||||

Natural | Natural gas | Percentage of | Natural gas production | Percentage of natural gas production | Average realized | Natural gas transportation | Natural gas |

AECO | 66,352 | 52 | 210,309 | 55 | 3.53 | 0.45 | 3.08 |

Dawn | 55,292 | 44 | 157,375 | 41 | 3.90 | 1.54 | 2.36 |

Alliance(5) | 5,178 | 4 | 15,461 | 4 | 3.72 | - | 3.72 |

Total | 126,822 | 100 | 383,145 | 100 | 3.68 | 0.88 | 2.80 |

Three months ended March 31, 2022 | |||||||

Natural | Natural gas | Percentage of | Natural gas production | Percentage of natural gas production | Average realized | Natural gas transportation | Natural gas |

AECO | 72,361 | 41 | 158,501 | 43 | 5.07 | 0.52 | 4.55 |

Dawn | 83,830 | 47 | 161,291 | 44 | 5.77 | 1.57 | 4.20 |

Alliance(5) | 21,419 | 12 | 45,504 | 13 | 5.23 | - | 5.23 |

Total | 177,610 | 100 | 365,296 | 100 | 5.40 | 0.92 | 4.48 |

(1) Excludes the effects of financial instruments but includes the effects of physical delivery contracts.

(2) Supplementary financial measure. See “Non-GAAP and Other Financial Measures”.

(3) Reflects costs to transport natural gas from the field receipt point to the delivery sales trading hub.

(4) Natural gas sales netback denotes the average realized natural gas sales price less natural gas transportation costs.

(5) Birchcliff has short-term physical sales agreements with third-party marketers to sell and deliver into the Alliance pipeline system. Alliance sales are recorded net of transportation tolls.

Capital Activities and Investment

In Q1 2023, Birchcliff drilled 14 (14.0 net) wells and brought 15 (15.0 net) wells on production, with F&D capital expenditures of $115.0 million. The following table sets forth the wells that were drilled and brought on production in the quarter:

| Drilled | On Production | ||

Pouce Coupe |

|

| ||

| 03-06 pad(1) |

| 0 | 1 |

| 14-06 pad(2) |

| 0 | 6 |

| 15-27 pad(3) |

| 3 | 4 |

| 04-23 pad(3) |

| 3 | 4 |

| 04-16 pad |

| 8 | 0 |

|

| TOTAL | 14 | 15 |

(1) The 03-06 pad included 4 wells that were brought on production in December 2022.

(2) The 6 wells on the 14-06 pad were drilled in Q4 2022.

(3) The 15-27 pad and the 04-23 pad each included 1 well that was drilled in Q4 2022.

OPERATIONAL UPDATE

6-Well Pad (14-06)

Birchcliff successfully completed its 6-well 14-06 pad in January 2023, which was brought on production in February 2023. The pad was drilled in late Q4 2022 in 3 different intervals (3 in the Montney D1, 2 in the Montney D2 and 1 in the Montney C) and targeted condensate-rich natural gas. The following table summarizes the aggregate and average production rates for the wells from the pad:

| Wells: IP 30(1) | Wells: IP 60(1) | |

Aggregate production rate (boe/d) | 4,513 | 4,406 | |

| Aggregate natural gas production rate (Mcf/d) | 21,182 | 20,908 |

| Aggregate condensate production rate (bbls/d) | 965 | 903 |

Average per well production rate (boe/d) | 752 | 734 | |

| Average per well natural gas production rate (Mcf/d) | 3,530 | 3,485 |

| Average per well condensate production rate (bbls/d) | 161 | 151 |

Condensate-to-gas ratio (bbls/MMcf) | 46 | 43 | |

(1) Represents the cumulative volumes for each well measured at the wellhead separator for the 30 or 60 days (as applicable) of production immediately after each well was considered stabilized after producing fracture treatment fluid back to surface in an amount such that flow rates of hydrocarbons became reliable. See “Advisories – Initial Production Rates”.

4-Well Pad (15-27) and 4-Well Pad (04-23)

Birchcliff successfully completed its 4-well 15-27 pad and 4-well 04-23 pad at the end of Q1 2023. These wells are producing in-line with the Corporation’s expectations. As the wells on these pads have not yet produced for over 60 days, Birchcliff anticipates providing further details regarding the results of these wells with the release of its Q2 2023 results.

Ongoing Drilling and Completions Operations

The Corporation’s 2023 capital program contemplates the drilling of 25 (25.0 net) wells (previously 23 (23.0 net) wells) and the bringing on production of 32 (32.0 net) wells in 2023. The 25 wells to be drilled in 2023 includes the 2 (2.0 net) wells in Elmworth that will be drilled but not completed or brought on production this year.

The following table sets forth the wells that are part of the Corporation’s full-year 2023 drilling program, including the anticipated timing of the remaining wells to be drilled and brought on production in 2023:

| Total # of wells to be |

| Drilled |

| On production | ||

Pouce Coupe |

|

|

|

|

| ||

|

|

|

|

|

|

| |

| 03-06 pad(1) | Montney D1 Total | 1 |

| 0 |

| 1 |

|

|

|

|

|

|

|

|

| 14-06 pad(2) | Montney D2 | 2 |

| 0 |

| 2 |

|

| Montney D1 | 3 |

| 0 |

| 3 |

|

| Montney C | 1 |

| 0 |

| 1 |

|

| Total | 6 |

| 0 |

| 6 |

|

|

|

|

|

|

|

|

| 15-27 pad(3) | Montney D2 | 1 |

| 1 |

| 1 |

|

| Montney D1 | 2 |

| 1 |

| 2 |

|

| Montney C | 1 |

| 1 |

| 1 |

|

| Total | 4 |

| 3 |

| 4 |

|

|

|

|

|

|

|

|

| 04-23 pad(3) | Montney D2 | 2 |

| 2 |

| 2 |

|

| Montney D1 | 2 |

| 1 |

| 2 |

|

| Total | 4 |

| 3 |

| 4 |

|

|

|

|

|

|

|

|

| 04-16 pad | Basal Doig/Upper Montney | 4 |

| 4 |

| Expected Q2 2023 |

|

| Montney D1 | 4 |

| 4 |

| Expected Q2 2023 |

|

| Total | 8 |

| 8 |

|

|

|

|

|

|

|

|

|

|

| 09-04 pad | Montney D2 | 2 |

| Expected Q3 2023 |

| Expected Q4 2023 |

|

| Montney D1 | 3 |

| Expected Q3 2023 |

| Expected Q4 2023 |

|

| Montney C | 2 |

| Expected Q3 2023 |

| Expected Q4 2023 |

|

| Total | 7 |

|

|

|

|

|

|

|

|

|

| ||

Gordondale |

|

|

|

|

| ||

|

|

|

|

|

|

|

|

| 02-27 pad | Montney D2 | 1 |

| Expected Q3 2023 |

| Expected Q4 2023 |

|

| Montney D1 | 1 |

| Expected Q3 2023 |

| Expected Q4 2023 |

|

| Total | 2 |

|

|

|

|

|

|

|

|

|

|

| |

Elmworth |

|

|

|

|

| ||

|

|

|

|

|

|

| |

| 01-28 pad | Montney | N/A |

| Expected Q2 2023 |

| N/A |

|

|

|

|

|

|

|

|

| 02-08 pad | Montney | N/A |

| Expected Q2 2023 |

| N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| TOTAL | 32 |

|

|

|

|

(1) The 03-06 pad included 4 wells that were brought on production in December 2022.

(2) The 6 wells on the 14-06 pad were drilled in Q4 2022.

(3) The 15-27 pad and the 04-23 pad each included 1 well that was drilled in Q4 2022.

Drilling operations at the Corporation’s 8-well 04-16 pad commenced in Q1 2023 and the pad is currently undergoing completion operations. The pad was drilled in 2 different intervals (4 in each of the Basal Doig/Upper Montney and Montney D1 intervals) and targeted condensate-rich natural gas. The wells are expected to be brought on production in Q2 2023, with production flowing through Birchcliff’s 100% owned and operated natural gas processing plant in Pouce Coupe.

As discussed above, Birchcliff has licenced and is planning to drill 2 (2.0 net) Montney horizontal wells in the Elmworth area in late Q2 2023. Subsequent to the drilling of these wells, the drilling rig is expected to return to the Pouce/Gordondale area where the Corporation plans to drill and complete the remaining wells that are part of the Corporation’s 2023 capital program, consisting of 7 wells in the Pouce Coupe area (09-04 pad) and 2 wells in the Gordondale area (02-27 pad). These 9 wells are expected to be brought on production in Q4 2023, when commodity prices are forecast to be higher.

ABBREVIATIONS

AECO | benchmark price for natural gas determined at the AECO ‘C’ hub in southeast Alberta |

ATP | Alliance Trading Pool |

bbl | barrel |

bbls | barrels |

bbls/d | barrels per day |

boe | barrel of oil equivalent |

boe/d | barrel of oil equivalent per day |

condensate | pentanes plus (C5+) |

F&D | finding and development |

G&A | general and administrative |

GAAP | generally accepted accounting principles for Canadian public companies, which are currently International Financial Reporting Standards as issued by the International Accounting Standards Board |

GJ | gigajoule |

GJ/d | gigajoules per day |

HH | Henry Hub |

IP | initial production |

LNG | liquefied natural gas |

Mcf | thousand cubic feet |

Mcf/d | thousand cubic feet per day |

MMBtu | million British thermal units |

MMBtu/d | million British thermal units per day |

MMcf | million cubic feet |

MSW | price for mixed sweet crude oil at Edmonton, Alberta |

NGLs | natural gas liquids consisting of ethane (C2), propane (C3) and butane (C4) and specifically excluding condensate |

NYMEX | New York Mercantile Exchange |

OPEC | Organization of the Petroleum Exporting Countries |

WTI | West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma, for crude oil of standard grade |

000s | thousands |

$000s | thousands of dollars |

NON-GAAP AND OTHER FINANCIAL MEASURES

This press release uses various “non-GAAP financial measures”, “non-GAAP ratios”, “supplementary financial measures” and “capital management measures” (as such terms are defined in NI 52-112), which are described in further detail below. These measures facilitate management’s comparisons to the Corporation’s historical operating results in assessing its results and strategic and operational decision-making and may be used by financial analysts and others in the oil and natural gas industry to evaluate the Corporation’s performance.

Non-GAAP Financial Measures

NI 52-112 defines a non-GAAP financial measure as a financial measure that: (i) depicts the historical or expected future financial performance, financial position or cash flow of an entity; (ii) with respect to its composition, excludes an amount that is included in, or includes an amount that is excluded from, the composition of the most directly comparable financial measure disclosed in the primary financial statements of the entity; (iii) is not disclosed in the financial statements of the entity; and (iv) is not a ratio, fraction, percentage or similar representation. The non-GAAP financial measures used in this press release are not standardized financial measures under GAAP and might not be comparable to similar measures presented by other companies. Investors are cautioned that non-GAAP financial measures should not be construed as alternatives to or more meaningful than the most directly comparable GAAP financial measures as indicators of Birchcliff’s performance. Set forth below is a description of the non-GAAP financial measures used in this press release.

Adjusted Funds Flow, Free Funds Flow and Excess Free Funds Flow

Birchcliff defines “adjusted funds flow” as cash flow from operating activities before the effects of decommissioning expenditures and changes in non-cash operating working capital. Birchcliff eliminates settlements of decommissioning expenditures from cash flow from operating activities as the amounts can be discretionary and may vary from period to period depending on its capital programs and the maturity of its operating areas. The settlement of decommissioning expenditures is managed with Birchcliff’s capital budgeting process which considers available adjusted funds flow. Changes in non-cash operating working capital are eliminated in the determination of adjusted funds flow as the timing of collection and payment are variable and by excluding them from the calculation, the Corporation believes that it is able to provide a more meaningful measure of its operations and ability to generate cash on a continuing basis. Adjusted funds flow can also be derived from petroleum and natural gas revenue less royalty expense, operating expense, transportation and other expense, net G&A expense, interest expense and any realized losses (plus realized gains) on financial instruments and plus any other cash income and expense sources. Management believes that adjusted funds flow assists management and investors in assessing Birchcliff’s financial performance after deducting all operating and corporate cash costs, as well as its ability to generate the cash necessary to fund sustaining and/or growth capital expenditures, repay debt, settle decommissioning obligations, buy back common shares and pay dividends.

Birchcliff defines “free funds flow” as adjusted funds flow less F&D capital expenditures. Management believes that free funds flow assists management and investors in assessing Birchcliff’s ability to generate shareholder returns through a number of initiatives, including but not limited to, debt repayment, common share buybacks, the payment of dividends and acquisitions.

Birchcliff defines “excess free funds flow” as free funds flow less common share dividends paid. Management believes that excess free funds flow assists management and investors in assessing Birchcliff’s ability to further enhance shareholder returns after the payment of common share dividends, which may include debt repayment, special dividends, increases to the Corporation’s base dividend, common share buybacks, acquisitions and other opportunities that would complement or otherwise improve the Corporation’s business and enhance long-term shareholder value.

The most directly comparable GAAP financial measure to adjusted funds flow, free funds flow and excess free funds flow is cash flow from operating activities. The following table provides a reconciliation of cash flow from operating activities to adjusted funds flow, free funds flow and excess free funds flow for the periods indicated:

| Three months ended | Twelve months ended | ||||

| March 31, | December 31, | ||||

($000s) | 2023 |

| 2022 |

| 2022 |

|

Cash flow from operating activities | 111,330 |

| 154,152 |

| 925,275 |

|

Change in non-cash operating working capital | (22,967 | ) | 28,830 |

| 25,662 |

|

Decommissioning expenditures | 374 |

| 717 |

| 2,746 |

|

Adjusted funds flow | 88,737 |

| 183,699 |

| 953,683 |

|

F&D capital expenditures | (115,039 | ) | (88,282 | ) | (364,621 | ) |

Free funds flow | (26,302 | ) | 95,417 |

| 589,062 |

|

Dividends on common shares | (53,392 | ) | (2,658 | ) | (71,788 | ) |

Excess free funds flow | (79,694 | ) | 92,759 |

| 517,274 |

|

Birchcliff has disclosed in this press release forecasts of adjusted funds flow, free funds flow and excess free funds flow for 2023, excess free funds flow for 2024 and cumulative free funds flow for the period from 2023 to 2027, which are forward-looking non-GAAP financial measures. The equivalent historical non-GAAP financial measures are adjusted funds flow, free funds flow and excess free funds flow for the twelve months ended December 31, 2022. Birchcliff anticipates the forward-looking non-GAAP financial measures for adjusted funds flow, free funds flow and excess free funds flow disclosed herein to be lower than their respective historical amounts primarily due to lower anticipated benchmark oil and natural gas prices which are expected to decrease the average realized sales prices the Corporation receives for its production. The forward-looking non-GAAP financial measure for excess free funds flow disclosed herein is also expected to be lower as a result of a higher targeted annual base common share dividend payment forecast during 2023 and 2024. The commodity price assumptions on which the Corporation’s guidance is based are set forth under the headings “Outlook and Guidance” and “Advisories – Forward-Looking Statements”.

Transportation and Other Expense

Birchcliff defines “transportation and other expense” as transportation expense plus marketing purchases less marketing revenue. Birchcliff may enter into certain marketing purchase and sales arrangements with the objective of reducing any available transportation and/or fractionation fees associated with its take-or-pay commitments. Management believes that transportation and other expense assists management and investors in assessing Birchcliff’s total cost structure related to transportation activities. The most directly comparable GAAP financial measure to transportation and other expense is transportation expense. The following table provides a reconciliation of transportation expense to transportation and other expense for the periods indicated:

| Three months ended | |||

| March 31, | |||

($000s) | 2023 |

| 2022 |

|

Transportation expense | 34,517 |

| 37,837 |

|

Marketing purchases | 10,625 |

| 3,569 |

|

Marketing revenue | (9,438 | ) | (4,234 | ) |

Transportation and other expense | 35,704 |

| 37,172 |

|

Operating Netback

Birchcliff defines “operating netback” as petroleum and natural gas revenue less royalty expense, operating expense and transportation and other expense. Management believes that operating netback assists management and investors in assessing Birchcliff’s operating profits after deducting the cash costs that are directly associated with the sale of its production, which can then be used to pay other corporate cash costs or satisfy other obligations. The following table provides a breakdown of Birchcliff’s operating netback for the periods indicated:

| Three months ended | |||

| March 31, | |||

($000s) | 2023 |

| 2022 |

|

Petroleum and natural gas revenue | 208,647 |

| 285,976 |

|

Royalty expense | (29,308 | ) | (30,158 | ) |

Operating expense | (26,502 | ) | (23,847 | ) |

Transportation and other expense | (35,344 | ) | (37,172 | ) |

Operating netback – Corporate | 117,493 |

| 194,799 |

|

Total Capital Expenditures

Birchcliff defines “total capital expenditures” as exploration and development expenditures less dispositions plus acquisitions (if any) and plus administrative assets. Management believes that total capital expenditures assists management and investors in assessing Birchcliff’s overall capital cost structure associated with its petroleum and natural gas activities. The most directly comparable GAAP financial measure for total capital expenditures is exploration and development expenditures. The following table provides a reconciliation of exploration and development expenditures to total capital expenditures for the periods indicated:

| Three months ended | ||

| March 31, | ||

($000s) | 2023 | 2022 |

|

Exploration and development expenditures(1) | 115,039 | 88,282 |

|

Dispositions | - | (315 | ) |

Administrative assets | 620 | 157 |

|

Total capital expenditures | 115,659 | 88,124 |

|

(1) Disclosed as F&D capital expenditures elsewhere in this press release. See “Advisories – F&D Capital Expenditures”.

Effective Sales – Total Corporate, Total Natural Gas, AECO Market and NYMEX HH Market

Birchcliff defines “effective sales” in the AECO market and NYMEX HH market as the sales amount received from the production of natural gas that is effectively attributed to the AECO and NYMEX HH market pricing, respectively, and does not consider the physical sales delivery point in each case. Effective sales in the NYMEX HH market includes realized gains and losses on financial instruments and excludes the notional fixed basis costs associated with the underlying financial contract in the period. Birchcliff defines “effective total natural gas sales” as the aggregate of the effective sales amount received in each natural gas market. Birchcliff defines “effective total corporate sales” as the aggregate of the effective total natural gas sales and the sales amount received from the production of light oil, condensate and NGLs. Management believes that disclosing effective sales for each natural gas market assists management and investors in assessing Birchcliff’s natural gas diversification and commodity price exposure to each market. The most directly comparable GAAP financial measure for effective total natural gas sales and effective total corporate sales is natural gas sales. The following table provides a reconciliation of natural gas sales to effective total natural gas sales and effective total corporate sales for the periods indicated:

| Three months ended | |||

($000s) | 2023 |

| 2022 |

|

Natural gas sales | 126,821 |

| 177,610 |

|

Realized loss on financial instruments | (15,811 | ) | (199 | ) |

Notional fixed basis costs(1) | 20,156 |

| 22,751 |

|

Effective total natural gas sales | 131,526 |

| 200,162 |

|

Light oil sales | 19,862 |

| 24,624 |

|

Condensate sales | 51,062 |

| 52,466 |

|

NGLs sales | 10,855 |

| 31,265 |

|

Effective total corporate sales | 213,305 |

| 308,517 |

|

(1) Reflects the aggregate notional fixed basis cost associated with Birchcliff’s financial and physical NYMEX HH/AECO 7A basis swaps in the period.

Non-GAAP Ratios

NI 52-112 defines a non-GAAP ratio as a financial measure that: (i) is in the form of a ratio, fraction, percentage or similar representation; (ii) has a non-GAAP financial measure as one or more of its components; and (iii) is not disclosed in the financial statements of the entity. The non-GAAP ratios used in this press release are not standardized financial measures under GAAP and might not be comparable to similar measures presented by other companies. Set forth below is a description of the non-GAAP ratios used in this press release.

Adjusted Funds Flow Per Boe and Adjusted Funds Flow Per Basic Common Share

Birchcliff calculates “adjusted funds flow per boe” as aggregate adjusted funds flow in the period divided by the production (boe) in the period. Management believes that adjusted funds flow per boe assists management and investors in assessing Birchcliff’s financial profitability and sustainability on a cash basis by isolating the impact of production volumes to better analyze its performance against prior periods on a comparable basis.

Birchcliff calculates “adjusted funds flow per basic common share” as aggregate adjusted funds flow in the period divided by the weighted average basic common shares outstanding at the end of the period. Management believes that adjusted funds flow per basic common share assists management and investors in assessing Birchcliff’s financial strength on a per common share basis.

Free Funds Flow Per Basic Common Share

Birchcliff calculates “free funds flow per basic common share” as aggregate free funds flow in the period divided by the weighted average basic common shares outstanding at the end of the period. Management believes that free funds flow per basic common share assists management and investors in assessing Birchcliff’s financial strength and its ability to deliver shareholder returns on a per common share basis.

Transportation and Other Expense Per Boe

Birchcliff calculates “transportation and other expense per boe” as aggregate transportation and other expense in the period divided by the production (boe) in the period. Management believes that transportation and other expense per boe assists management and investors in assessing Birchcliff’s cost structure as it relates to its transportation and marketing activities by isolating the impact of production volumes to better analyze its performance against prior periods on a comparable basis.

Operating Netback Per Boe

Birchcliff calculates “operating netback per boe” as aggregate operating netback in the period divided by the production (boe) in the period. Management believes that operating netback per boe assists management and investors in assessing Birchcliff’s operating profitability and sustainability by isolating the impact of production volumes to better analyze its performance against prior periods on a comparable basis.

Effective Average Realized Sales Price – Total Corporate, Total Natural Gas, AECO Market and NYMEX HH Market

Birchcliff calculates “effective average realized sales price” as effective sales, in each of total corporate, total natural gas, AECO market and NYMEX HH market, as the case may be, divided by the effective production in each of the markets during the period. Management believes that disclosing effective average realized sales price for each natural gas market assists management and investors in comparing Birchcliff’s commodity price realizations in each natural gas market on a per unit basis.

Supplementary Financial Measures

NI 52-112 defines a supplementary financial measure as a financial measure that: (i) is, or is intended to be, disclosed on a periodic basis to depict the historical or expected future financial performance, financial position or cash flow of an entity; (ii) is not disclosed in the financial statements of the entity; (iii) is not a non-GAAP financial measure; and (iv) is not a non-GAAP ratio. The supplementary financial measures used in this press release are either a per unit disclosure of a corresponding GAAP financial measure, or a component of a corresponding GAAP financial measure, presented in the financial statements. Supplementary financial measures that are disclosed on a per unit basis are calculated by dividing the aggregate GAAP financial measure (or component thereof) by the applicable unit for the period. Supplementary financial measures that are disclosed on a component basis of a corresponding GAAP financial measure are a granular representation of a financial statement line item and are determined in accordance with GAAP.

The supplementary financial measures used in this press release include: average realized commodity sales price per bbl, Mcf and boe, as the case may be; petroleum and natural gas revenue per boe; royalty expense per boe; operating expense per boe; G&A expense, net per boe; interest expense per boe; realized gain (loss) on financial instruments per boe; other cash income per boe; depletion and depreciation expense per boe; unrealized gain (loss) on financial instruments per boe; other expense per boe; dividends on preferred shares per boe; natural gas transportation costs per Mcf; and natural gas sales netback per Mcf.

Capital Management Measures

NI 52-112 defines a capital management measure as a financial measure that: (i) is intended to enable an individual to evaluate an entity’s objectives, policies and processes for managing the entity’s capital; (ii) is not a component of a line item disclosed in the primary financial statements of the entity; (iii) is disclosed in the notes to the financial statements of the entity; and (iv) is not disclosed in the primary financial statements of the entity. Set forth below is a description of the capital management measure used in this press release.

Total Debt

Birchcliff calculates “total debt” as the amount outstanding under the Corporation’s Credit Facilities (if any) plus working capital deficit (less working capital surplus) plus the fair value of the current asset portion of financial instruments less the fair value of the current liability portion of financial instruments, less the current liability portion of other liabilities and less capital securities (if any) at the end of the period. Management believes that total debt assists management and investors in assessing Birchcliff’s overall liquidity and financial position at the end of the period. The following table provides a reconciliation of the amount outstanding under the Credit Facilities, as determined in accordance with GAAP, to total debt for the periods indicated:

As at, ($000s) | March 31, | December 31, | March 31, | |||

Revolving term credit facilities | 191,426 |

| 131,981 |

| 397,752 |

|

Working capital deficit (surplus)(1) | 49,365 |

| (7,902 | ) | 46,213 |

|

Fair value of financial instruments – asset(2) | 7,585 |

| 17,729 |

| 4,684 |

|

Fair value of financial instruments – liability(2) | (27,942 | ) | (1,345 | ) | (1,435 | ) |

Other liabilities(2) | (2,507 | ) | (1,914 | ) | - |

|

Capital securities | - |

| - |

| (38,216 | ) |

Total debt(3) | 217,927 |

| 138,549 |

| 408,998 |

|

(1) Current liabilities less current assets.

(2) Reflects the current portion only.

(3) Total debt can also be derived from the amounts outstanding under the Corporation’s Credit Facilities plus accounts payable and accrued liabilities and less cash, accounts receivable and prepaid expenses and deposits at the end of the period.

ADVISORIES

Unaudited Information

All financial and operational information contained in this press release for the three months ended March 31, 2023 and 2022 is unaudited.

Currency

Unless otherwise indicated, all dollar amounts are expressed in Canadian dollars and all references to “$” and “CDN$” are to Canadian dollars and all references to “US$” are to United States dollars.

Boe Conversions

Boe amounts have been calculated by using the conversion ratio of 6 Mcf of natural gas to 1 bbl of oil. Boe amounts may be misleading, particularly if used in isolation. A boe conversion ratio of 6 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value.

MMBtu Pricing Conversions

$1.00 per MMBtu equals $1.00 per Mcf based on a standard heat value Mcf.

Oil and Gas Metrics

This press release contains metrics commonly used in the oil and natural gas industry, including netbacks. These oil and gas metrics do not have any standardized meanings or standard methods of calculation and therefore may not be comparable to similar measures presented by other companies. As such, they should not be used to make comparisons. Management uses these oil and gas metrics for its own performance measurements and to provide investors with measures to compare Birchcliff’s performance over time; however, such measures are not reliable indicators of Birchcliff’s future performance, which may not compare to Birchcliff’s performance in previous periods, and therefore should not be unduly relied upon. For additional information regarding netbacks and how such metric is calculated, see “Non-GAAP and Other Financial Measures”.

Production

With respect to the disclosure of Birchcliff’s production contained in this press release: (i) references to “light oil” mean “light crude oil and medium crude oil” as such term is defined in National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities (“NI 51-101”); (ii) references to “liquids” mean “light crude oil and medium crude oil” and “natural gas liquids” (including condensate) as such terms are defined in NI 51-101; and (iii) references to “natural gas” mean “shale gas”, which also includes an immaterial amount of “conventional natural gas”, as such terms are defined in NI 51-101. In addition, NI 51-101 includes condensate within the product type of natural gas liquids. Birchcliff has disclosed condensate separately from other natural gas liquids as the price of condensate as compared to other natural gas liquids is currently significantly higher and Birchcliff believes presenting the two commodities separately provides a more accurate description of its operations and results therefrom.

Initial Production Rates

Any references in this press release to initial production rates or other short-term production rates are useful in confirming the presence of hydrocarbons; however, such rates are not determinative of the rates at which such wells will continue to produce and decline thereafter and are not indicative of the long-term performance or the ultimate recovery of such wells. In addition, such rates may also include recovered “load oil” or “load water” fluids used in well completion stimulation. Readers are cautioned not to place undue reliance on such rates in calculating the aggregate production for Birchcliff. Such rates are based on field estimates and may be based on limited data available at this time.

With respect to the production rates for the Corporation’s 6-well 14-06 pad disclosed herein, such rates represent the cumulative volumes for each well measured at the wellhead separator for the 30 and 60 days (as applicable) of production immediately after each well was considered stabilized after producing fracture treatment fluid back to surface in an amount such that flow rates of hydrocarbons became reliable, divided by 30 or 60 (as applicable), which were then added together to determine the aggregate production rates for the 6-well pad and then divided by 6 to determine the per well average production rates. The production rates excluded the hours and days when the wells did not produce. To-date, no pressure transient or well-test interpretation has been carried out on any of the wells. The natural gas volumes represent raw natural gas volumes as opposed to sales gas volumes.

F&D Capital Expenditures

Unless otherwise stated, references in this press release to “F&D capital expenditures” denotes exploration and development expenditures as disclosed in the Corporation’s financial statements in accordance with GAAP, and is primarily comprised of capital for land, seismic, workovers, drilling and completions, well equipment and facilities and capitalized G&A costs and excludes any net acquisitions and dispositions, administrative assets and the capitalized portion of cash incentive payments that have not been approved by the Board. Management believes that F&D capital expenditures assists management and investors in assessing Birchcliff’s capital cost outlay associated with its exploration and development activities for the purposes of finding and developing its reserves.

Forward-Looking Statements

Certain statements contained in this press release constitute forward‐looking statements and forward-looking information (collectively referred to as “forward‐looking statements”) within the meaning of applicable Canadian securities laws. The forward-looking statements contained in this press release relate to future events or Birchcliff’s future plans, strategy, operations, performance or financial position and are based on Birchcliff’s current expectations, estimates, projections, beliefs and assumptions. Such forward-looking statements have been made by Birchcliff in light of the information available to it at the time the statements were made and reflect its experience and perception of historical trends. All statements and information other than historical fact may be forward‐looking statements. Such forward‐looking statements are often, but not always, identified by the use of words such as “seek”, “plan”, “focus”, “future”, “outlook”, “position”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “forecast”, “guidance”, “potential”, “proposed”, “predict”, “budget”, “continue”, “targeting”, “may”, “will”, “could”, “might”, “should”, “would”, “on track”, “maintain”, “deliver” and other similar words and expressions.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward‐looking statements. Accordingly, readers are cautioned not to place undue reliance on such forward-looking statements. Although Birchcliff believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct and Birchcliff makes no representation that actual results achieved will be the same in whole or in part as those set out in the forward-looking statements.

In particular, this press release contains forward‐looking statements relating to:

Birchcliff’s plans and other aspects of its anticipated future financial performance, results, operations, focus, objectives, strategies, opportunities, priorities and goals, including its commitment to delivering significant shareholder returns;

Birchcliff’s plans for the Elmworth area, including: that the Corporation’s significant land base positions Birchcliff to continue to drive long-term shareholder value, providing it with a large potential future development area that can supply clean natural gas for many years to come; that Birchcliff expects minimal yearly capital commitments over the next several years to maintain its land position in the area; that this significant, largely undeveloped land base in Elmworth positions the Corporation to continue to drive long-term shareholder value by enhancing its ability for future production growth; that the Elmworth asset provides Birchcliff with a large potential future development area which can be responsibly developed over time, leveraging the extensive knowledge that Birchcliff has gained in developing its Pouce Coupe and Gordondale assets; that the Corporation’s lands in Elmworth are located in an area that is well suited to supply clean natural gas to future LNG export facilities in Canada; that this significant land position in Elmworth also builds upon Birchcliff’s existing extensive inventory of potential future drilling locations in Pouce Coupe and Gordondale; that to preserve its optionality for future growth in Elmworth, Birchcliff has licenced and is planning to drill 2 (2.0 net) Montney horizontal wells in Elmworth in late Q2 2023, which will continue a number of sections of Montney lands in the area that are set to expire in 2023; that Birchcliff expects that the drilling of these wells will be accomplished within the Corporation’s F&D capital expenditures guidance range of $270 million to $280 million; that these wells will not be completed or brought on production in 2023; that by drilling these wells to the planned measured depth, Birchcliff will validate multiple initial term licenses and continue 64 sections of land into their five-year intermediate term; that Birchcliff anticipates that these wells will be completed as it commences the development of its Elmworth area in the future; and that the Montney/Doig Resource Play in Elmworth continues to garner attention and capital investment, which solidifies the value of Birchcliff’s contiguous land position in the area;

statements with respect to dividends, including that the annual base dividend of $0.80 per common share for 2023 is expected to be declared and paid quarterly at the rate of $0.20 per common share, at the discretion of the Board;

the information set forth under the heading “Outlook and Guidance” as it relates to Birchcliff’s outlook and guidance, including: that as a result of the ongoing impact of the force majeure event on the Pembina Pipeline System, Birchcliff currently expects that it will be on the low end of its annual average production guidance range of 77,000 to 80,000 boe/d; that the outage on the Pembina Pipeline System will be resolved in the near-term; that as a result of lower anticipated adjusted funds flow in 2023, Birchcliff now expects to fund its capital program and dividend payments in 2023 through a combination of adjusted funds flow and the Corporation’s Credit Facilities, which is anticipated to result in higher total debt at year-end 2023 than previously forecast; that the significant unutilized credit capacity under its Credit Facilities provides the Corporation with substantial financial flexibility and additional capital resources; forecasts of annual average production, production commodity mix, average expenses, adjusted funds flow, F&D capital expenditures, free funds flow, annual base common share dividend, excess free funds flow, total debt at year end and natural gas market exposure in 2023; the expected impact of changes in commodity prices and the CDN/US exchange rate on Birchcliff’s forecast of free funds flow in 2023; that the forecast of total debt at December 31, 2023 is expected to be comprised of any amounts outstanding under the Credit Facilities plus accounts payable and accrued liabilities and less cash, accounts receivable and prepaid expenses and deposits at the end of the year; that the Corporation currently expects that it will keep its production in 2024 relatively flat year-over-year; that 2024 annual average production is currently forecast to be 78,000 boe/d resulting from forecast 2024 F&D capital expenditures of $255 million; that assuming the payment of an annual base dividend of $0.80 per common share and that realized commodity prices match the Corporation’s commodity price assumptions, Birchcliff would achieve 2024 excess free funds flow of $67 million and total debt at year end 2024 of $230 million; that Birchcliff currently anticipates that excess free funds flow generated in 2024 will be primarily used to reduce indebtedness and that it will be in a position to fund its common share dividend payments and reduce its total debt in 2024 from year-end 2023; that over the longer-term, Birchcliff remains committed to generating substantial free funds flow and delivering significant returns to shareholders, while achieving disciplined production growth to fully utilize the Corporation’s existing processing and transportation capacity; that Birchcliff’s five-year outlook still provides for potential cumulative free funds flow of approximately $1.3 billion by the end of the five-year period; and that annual average production in 2027 is still forecast to be 87,000 boe/d, subject to commodity prices;

statements under the heading “Operational Update” and elsewhere in this press release regarding Birchcliff’s 2023 capital program and its exploration, production and development activities and the timing thereof, including: estimates of F&D capital expenditures; the anticipated number, types and timing of wells to be drilled and brought on production; that Birchcliff anticipates providing further details regarding the results of its 15-27 and 04-23 pads with the release of its Q2 2023 results; that the wells from the 04-16 pad are expected to be brought on production in Q2 2023, with production flowing through Birchcliff’s 100% owned and operated natural gas processing plant in Pouce Coupe; that subsequent to the drilling of the 2 wells in Elmworth, the drilling rig is expected to return to the Pouce/Gordondale area where the Corporation plans to drill and complete the remaining wells that are part of the Corporation’s 2023 capital program, consisting of 7 wells in the Pouce Coupe area (09-04 pad) and 2 wells in the Gordondale area (02-27 pad); and that these 9 wells are expected to be brought on production in Q4 2023, when commodity prices are forecast to be higher;

the performance and other characteristics of Birchcliff’s oil and natural gas properties and expected results from its assets (including statements regarding the potential or prospectivity of Birchcliff’s properties); and

that Birchcliff anticipates the forward-looking non-GAAP financial measures for adjusted funds flow, free funds flow and excess free funds flow disclosed herein to be lower than their respective historical amounts primarily due to lower anticipated benchmark oil and natural gas prices which are expected to decrease the average realized sales prices the Corporation receives for its production; and that the forward-looking non-GAAP financial measure for excess free funds flow disclosed herein is expected to be lower as a result of a higher targeted annual base common share dividend payment forecast during 2023 and 2024.