The BioSyent (CVE:RX) Share Price Is Down 34% So Some Shareholders Are Getting Worried

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by BioSyent Inc. (CVE:RX) shareholders over the last year, as the share price declined 34%. That falls noticeably short of the market return of around -0.7%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 21% in three years. The falls have accelerated recently, with the share price down 22% in the last three months.

View our latest analysis for BioSyent

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the BioSyent share price fell, it actually saw its earnings per share (EPS) improve by 1.8%. It could be that the share price was previously over-hyped. It seems quite likely that the market was expecting higher growth from the stock. But looking to other metrics might better explain the share price change.

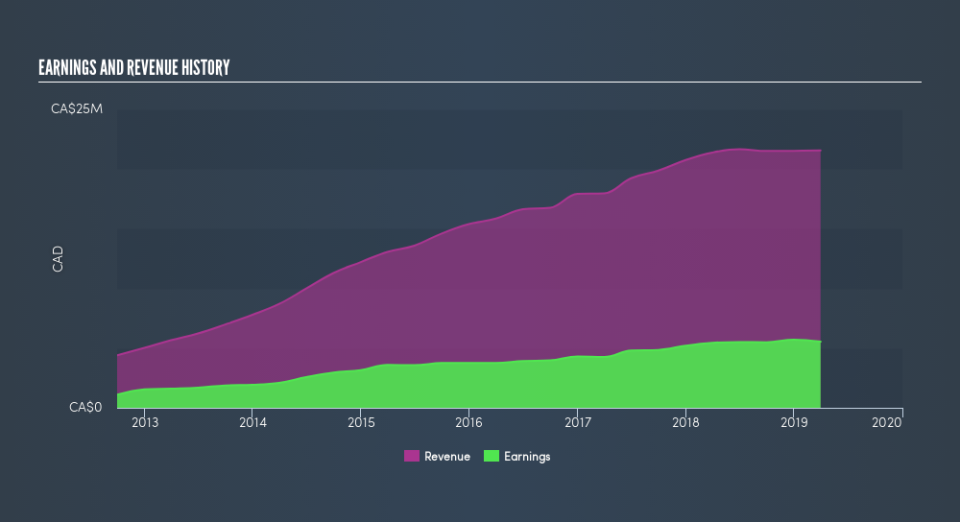

Revenue was pretty flat on last year, which isn't too bad. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that BioSyent shareholders are down 34% for the year. Unfortunately, that's worse than the broader market decline of 0.7%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7.2% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you would like to research BioSyent in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like BioSyent better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance