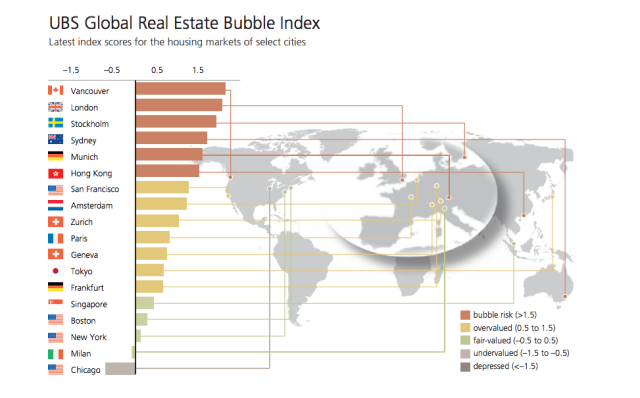

The biggest real estate bubble isn’t in London, San Francisco, or New York

That’s not to say that housing in London, San Francisco, and New York isn’t extremely expensive, gouged by foreign demand and sparse on space for new buildings. But it could be worse—it could be Vancouver.

According to UBS’s so-called Global Real Estate Bubble index, the number of cities at risk of being in a bubble has tripled in the past year and topping the list in 2016 is the Canadian city. Londoners shouldn’t breathe a sigh of relief just yet—the British capital still ranked second.

Stockholm, Sydney, Munich and Hong Kong are also at risk of a sharp correction in house prices. In the past five years, house prices in these cities have increased by almost 50% on average, according to the UBS report published this week (pdf). Last year, just London and Hong Kong were deemed to be at risk of a being in a bubble.

Vancouver’s housing market has been significantly overvalued for almost a decade but now it’s in “overdrive,” the UBS report said. The weak Canadian dollar has increased demand from foreign buyers while central bank stimulus has kept interest rates low and pushed up the number of mortgages. The government has even imposed an extra 15% property tax on foreign buyers to try and cool demand. “The risk of a substantial price correction appears very elevated,” the report said.

San Francisco’s property market is heading towards the risk of a bubble. Despite income growth in the area also being above the national average; the house price increases are still significantly higher.

New York, however, is fairly priced. For four years, the house prices have grown slower than the national average.

But this is probably very little consolation for the people that live there. As the report says, “the city remains one of the most expensive and unaffordable cities in the world” where rents are 50% higher than a decade ago. New Yorkers, you still have permission to complain about house prices.

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz:

Yahoo Finance

Yahoo Finance