The Big Global Growth Rebound Trade of 2020

After months in the making, and a “last mile” that ended up being a race of endurance. It came down to the majesty of a Trump tweet indicating both sides were getting “VERY close to a BIG DEAL with China,” that provided the clearest signpost that a deal was imminent and led to a sharp record-setting rally in equities and a sell-off in Treasuries.

Risk assets have predictably surged, and those investors who were holding on to trade deal premiums were hugely rewarded for their patience as December 15 hedges unwound, and negative equity market bets are getting stopped into trades.

And thanks to the China trade story, no one seemed to care about the U.K. election anymore, except those who are trading pounds. Big mistake as the exit polls are pointing to an 86 Conservative majority and with Lagarde – acknowledging that a combination of structural reform, monetary and fiscal tools need to be available to the ECB, E.U. and U.K. markets could have considerable room to run.

However, for growth assets immediate concerns, the devil will be in the trade deal agreement details and to the extent of the tariff rollbacks, but with one significant trade barrier removed, it looks more and more like the market wants to play “The Big Global Growth Rebound in 2020” trade.

The crucial first signal was from the Feds that gave the all-clear to hedge funds and real money to start putting on USD downside exposure without worrying about a Fed response to Friday’s stonking jobs report.

With a tame inflation environment guaranteed to keep U.S. rates in check and as the persistent global slowdown appears to be decreasing, it’s providing a great set up to extend “risk-on” horizons. Indeed, with high-frequency indicators from PMIs suggesting the data is bottoming, we could be entering a global economic sweet spot.

If this plays out, we should expect a much lower USD, especially against Asia and Euro, which were the two regions most devastated by the manufacturing recession due to the protracted trade war. So, absent the tail risk from trade, the scope for catch-up in F.X. spot returns in more export- and equity-sensitive currencies like KRW, TWD, and MYR.

Stronger commodities and higher oil prices would also be a function of reduced risk from trade.

Oil markets

Oil is up after the U.S. reaches a trade deal with China. But the complex nature of the Oil market seldom, if ever, elicits a pure binary reaction to what should be a favorable outcome for prices.

While benefiting from the Trade deal, traders remain focused that the market is likely to remain oversupplied in 2020 H1(according to the IEA) just when the effect of the current U.S. tariffs is expected to leak into the U.S. economy.

So, while the current trade deal will most probably limit demand devastation, it might not be enough to counter an oversupplied market in early 2020 hence the possible reason we are not seeing a massive bounce in oil prices now commensurate with the frothy risk-on environment.

But taking out offers might not be a bridge too far as the oil market should flourish in this environment — trade deal aside, which should be hugely bullish. A less hawkish Fed, weaker USD, a growing sense that macro headwinds have diminished, and the emergence of the global growth rebound trade, should all provide the ultimate springboard for oil prices.

Gold markets

Gold is a bit anomalous as I had initially pegged gold lower on a tariff rollback trade deal, but with the tame U.S. inflation environment possibly keeping U.S. yield in check, gold may not necessarily have the blow-off bottom as a result of the trade deal. But in the absence of an absolute dovish Fed, downside risk remains elevated as cross-asset relocation into equities could intensify into the weekend even more so if the global growth rebound trade takes hold.

Currency Markets

The Pound

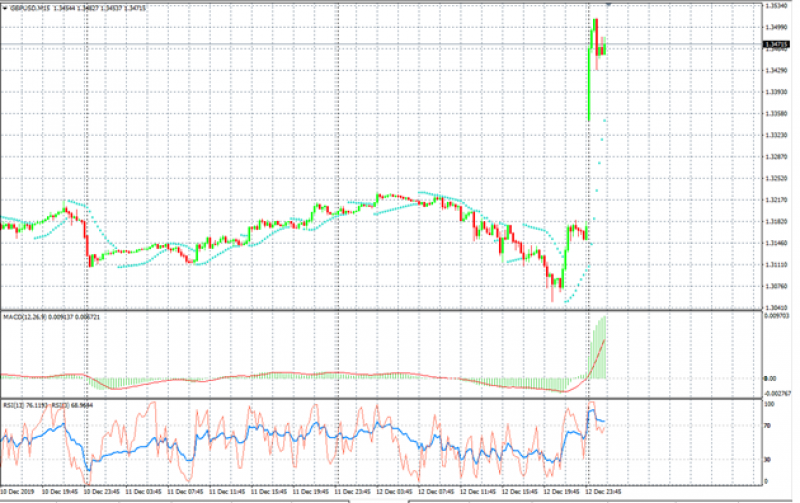

The exit polls show the Conservatives with a decent majority on 368 seats, versus Labour sliding to 191 seats. If proved right, that is a resounding victory for Prime Minister Johnson. Far more emphatic than polls have suggested in recent days. The GBP/USD added an instant 2% on the back of the exit poll, trading up at 1.3500(upper-end of the bullish target)

One-way risk-on bias to F.X. flows since the exit polls, and there was little interest in fading the move until 1.3500, But this could have been a result of the exit poll showing the SNP with 55 seats would be a near clean sweep for the party. It would undoubtedly invigorate Scottish calls for another independence vote.

Australian Dollar

The 200 DMA has been testing, but with the market apparently wanting to play out the tremendous global growth recovery, the Aussie could have legs to run. Sure, the recent run of domestic data, looks dreadful but forward-looking global growth optimism will always trump backward-looking local data any day of the week in currency land.

The Yuan

Phase one deal is a fait acompli, 6.95 targets reached now its time to do it all over again as we enter what could be an even trickier phase 2. Traders won’t be quick to turn a blind eye to the U.S. passage of Hong Kong and Xinjiang Bill’s, which could ultimately be critical for the market’s assessment of the quality of the U.S. and China relationships going forward.

The Ringgit

The Ringgit will revel in the afterglow of the US-Trade deal. Absent the tail risk from trade; there is a significant scope for export and equity flow-sensitive currencies like the Ringgit to perform well, especially with cheap valuations on offer at the KLCI.

This article was written by Stephen Innes, Asia Pacific Market Strategist at AxiTrader

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance