Beyond Meat earnings beat expectations, boosts guidance

Beyond Meat (BYND) reported its first profit as a public company and beat on both the top and bottom lines during its third quarter. The company also raised its guidance for the full year.

Here were the numbers for Beyond Meat’s third quarter, compared to estimates compiled by Bloomberg:

Revenue: $92 million vs. $82.24 million expected

Adj. earnings per share: 6 cents vs. 4 cents expected

Adj. EBITDA: $11 million vs. $6.77 million expected

The alternative-protein maker boosted its full-year revenue guidance and expects between $265 million to $275 million. Wall Street was expecting $262 million for the full year. The company also sees full-year adjusted EBITDA of $20 million, better than estimates for $14.3 million.

“We are very pleased with our third quarter results which reflect continued momentum across our business and mark an important milestone as we achieved our first ever quarter of net income,” CEO Ethan Brown said in a statement. “We remain focused on expanding our distribution footprint, both domestically and abroad, building our brand, introducing new innovative products into the marketplace, and bolstering our infrastructure and internal capabilities to fuel our future growth.”

Gross margins for Beyond also rose during the third quarter to 35.6% from 33.8% in the second quarter. Analysts were anticipating 33.3%.

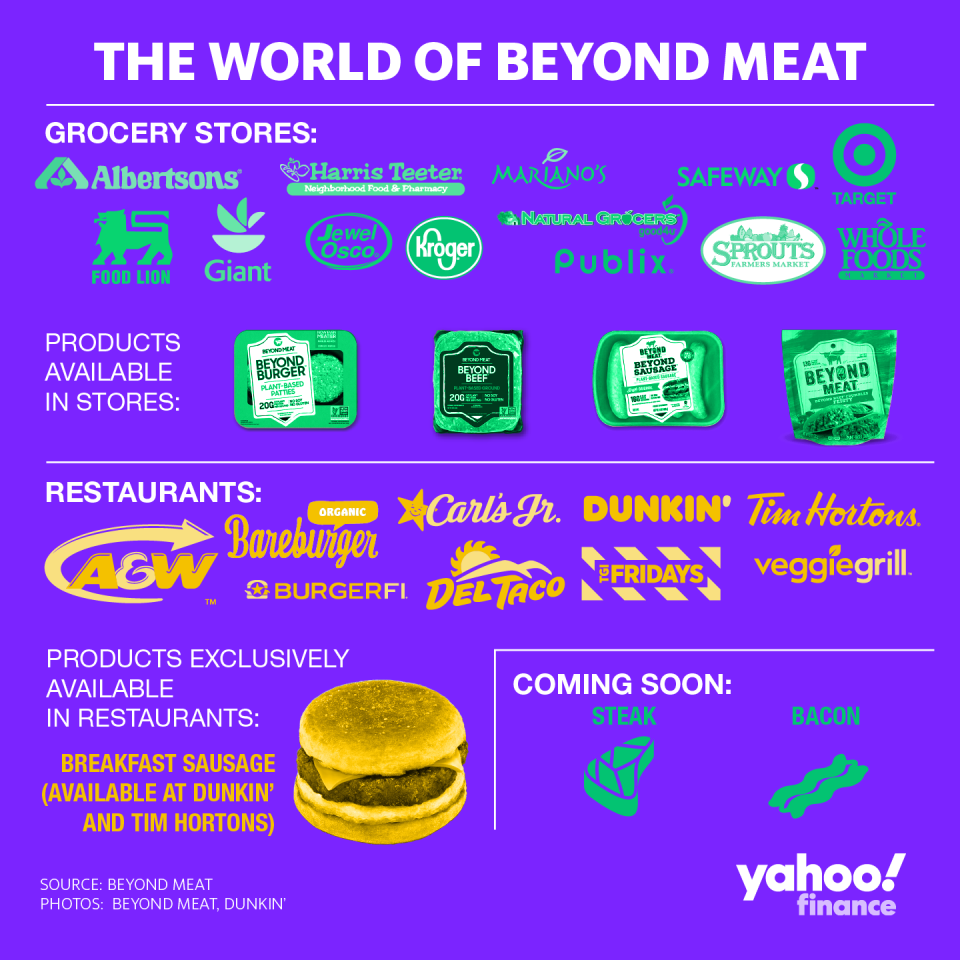

Beyond Meat’s third-quarter revenue more than tripled from last year, as partnerships with major restaurants ramped up during the quarter. McDonald’s Canada announced late last month that it would be testing burgers featuring Beyond Meat patties at 28 stores. Many have speculated that the partnership between McDonald’s and Beyond could expand into the U.S. following a successful test period in Canada. “We feel very optimistic with the long-term relationship with McDonald's,” Brown said on the earnings conference call. “I have every expectation that this test will result in more work with McDonald's.”

Monday, Beyond announced a new partnership with Denny’s to launch the Denny’s Beyond Burger. The burgers will be sold in 180 Denny’s stores in the Los Angeles area. After a successful test period in New York City, Dunkin’ (DNKN) announced last week that it would be rolling out the Beyond Meat breakfast sandwich to all 9,000 U.S. stores. The company’s initial plan was to launch nationwide in early 2020, but due to better-than-expected demand and reception, Dunkin’ accelerated the rollout plan.

Shortly after announcing second-quarter results in July, Beyond Meat announced a secondary offering, which allowed shareholders to cash out ahead of the typical lock-up period expiration date. Brown was one of the Beyond insiders that took profits. Tuesday, remaining insiders will be able to sell shares as the official lock-up expires. Many are expecting Tuesday to be an extremely volatile trading session for Beyond stock.

Aside from the potential volatility expected to hit the stock, Beyond shares have been on a tear since hitting the public market in early May. After pricing at $25 per share, the stock surged over 800% from its IPO price $234.90 per share before falling from those highs. Beyond stock has fallen 55% from its July highs, but the company’s public debut is still the best-performing IPO of 2019.

Even as Beyond Meat investors have reaped the benefits of the recent plant-based meat craze. Concerns of intense competition in the space continue to grow. At the end of September, Nestle-owned Sweet Earth launched its Awesome Burger, and Kellogg’s (K) entered the race with its Incogmeato brand and will officially launch early next year. One of Beyond Meat’s biggest competitors, Impossible Foods, hit grocery stores nationwide during the third quarter.

In addition to increased competition, management noted that one of the main focuses for the company is being able to price its products below traditional meat. According to Beyond Meat’s management, the net selling price per pound in Q3 fell to $5.74 from $6.06 last year. CFO Mark Nelson noted that a significant decline in cost of goods sold per pound drove margin expansion during the last quarter.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

Read the latest stocks and stock market news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance