Beware a $12 Trillion Pension Revolt Against Low Rates

(Bloomberg Opinion) -- The Federal Reserve’s towering $7 trillion balance sheet looks small in comparison to the U.S. defined-benefit pension industry. With more than $12 trillion of retirement assets across corporate America and state and local governments, these liability-driven investors have enough firepower to move financial markets if they so choose.

Their next potential target just might be the world’s biggest bond market.

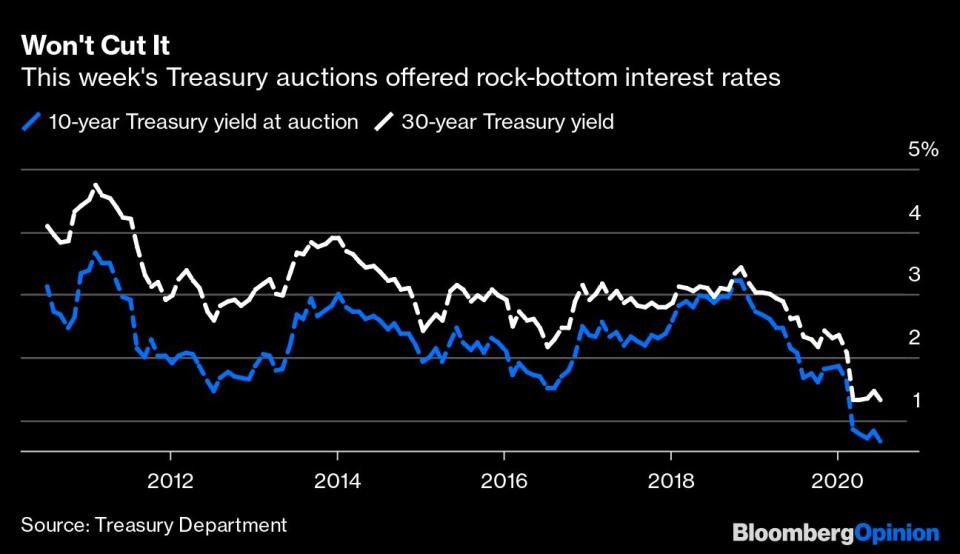

By now, it’s no secret that long-term U.S. Treasury yields are pinned near record lows. Before the coronavirus crisis, 10-year yields never fell below 1.32%, while the 30-year bond bottomed out last year around 1.9%. For almost four months, the 10-year note has traded between 0.54% and 0.95%, while 30-year Treasuries haven’t come close to climbing back to their previous low. All the while, inflation expectations are creeping higher, leaving real inflation-adjusted rates about as negative as they have ever been.

For defined-benefit pension managers who are expected to deliver annual returns in the high single digits, this won’t cut it. Bank of America Corp. strategists Ralph Axel and Olivia Lima wrote recently that pension funds and other liability-focused investors such as insurance companies probably won’t buy into the Treasury market until yields rise by “at least” 50 basis points, if not 75 to 100 basis points. In other words, the 10-year rate would have to double and the 30-year would have to breach 2% again.

Their thesis stems from a correlation analysis of moves in 10-year yields and the change in Treasury holdings reported in the Fed’s quarterly flow of funds data. When adjusted for the sharp increase in bond prices in the first three months of 2020, Axel and Lima found that both private defined-benefit pension funds and the general accounts of insurance companies reduced their Treasury holdings in the first quarter.

Judging by the sharp decline in Treasury Strips — an acronym for Separate Trading of Registered Interest and Principal of Securities — they probably steered clear in the past three months as well. The amount of the ultra-long duration debt outstanding has fallen for four consecutive months, a first since 2012, around the same time real yields hit record lows.

Now, even if pensions weren’t buyers of Treasuries in recent months, benchmark yields remained suppressed for the entire second quarter. Credit the Fed’s bond-buying efforts for that: At one point in March, the Fed was buying $75 billion of Treasuries each day. It has since committed to purchasing about $80 billion a month, which, while still a large sum, is nonetheless a pullback and comes as the Treasury Department is widely expected to continue ramping up the size of its auctions to finance the government’s fiscal relief measures.

Put together, it would suggest the potential for some fireworks at the long end of the yield curve. Here’s how Bank of America concludes 10-year yields will be back at 1% by the end of the year:

The question is who will step up to buy in the second half when we expect coupon supply to be significantly higher than Fed purchases. This leaves a gap in Treasury supply vs. Fed demand that will need to be absorbed by other investors and increases the potential for higher long-end rates, i.e., a bear steepening of the rates curve, unless demand picks up for long duration Treasuries, or the macro outlook deteriorates. Because pension and insurance companies are the main buyers in the long end, this leads to the question of whether LDI demand will be strong enough to keep yields stable as coupon bond supply ramps up for the next several months.

The forecast is all the more striking given Bank of America’s history in analyzing defined-benefit pensions. In July 2016, when Treasury yields set record lows, I interviewed Shyam Rajan, then the bank’s head of U.S. rates strategy and now its head of U.S. Treasury trading. With the benchmark 10-year yield at about 1.4%, he reckoned retirement funds might throw in the towel. “As a pension fund, you’ve got to be scared that rates could actually go lower,” he said at the time.

Obviously, rates eventually fell below that level but not before gradually climbing through late 2018, when the 10-year yield topped 3% for the first time in seven years. With yields much higher, managers could simply aim to buy enough long-dated bonds to align principal and interest payments with payouts to retirees in a process known as immunization. Now, the funds are known more for risky gambits in alternative strategies — and for being chronically underfunded.

As Bank of America’s strategists put it, purchasing Treasuries now only serves to “lock in such large funding gaps and also lock in low rates of return on the bonds.” The latest auction of 10-year notes this week offered a yield of 0.653%, the lowest on record, while a sale of 30-year bonds priced to yield just 1.33%. That’s not going to move the needle for state pension funds that widely assume an annual return of 7% to 8%.

Yet even with almost $1 trillion in Treasuries owned among insurance companies and defined-benefit pensions, it’s unclear how much they can steer long-term rates. Thursday’s $19 billion long-bond auction was nothing short of spectacular, with nonprimary dealer buyers taking the second-largest share ever. Some strategists speculated that foreign investors swooped in with hedging costs low relative to recent history.

“It seems that investors used this auction as a liquidity opportunity to put on flatteners,” noted Thomas Simons at Jefferies LLC. “There’s no reason to believe the move will subside any time soon as there is clearly a lot of momentum behind it.” For those wagering on a steeper yield curve, this recent jolt just creates a better entry point.

For some sense of pensions’ influence, in September 2018, Citigroup Inc. estimated the funds alone reduced the spread between five- and 30-year Treasuries by as much as 32 basis points over 12 months. Even if they could exert similar influence in the opposite direction this time, in a market that has since grown by $4 trillion, that would still fall far short of Bank of America’s threshold.

The biggest wild card, as usual, is the Fed itself. Just how far would policy makers allow the U.S. yield curve to steepen before intervening with something like Operation Twist? Judging by their rebuke of negative-rate policy, it seems as if they realize the strains that near-zero yields place on banks, insurers and pensions. So it would stand to reason that they’d be fine with the yield curve from five to 30 years at least steepening by an additional 40 to 50 basis points to align with its 10-year average of roughly 150 basis points and put the long bond right around its 2% inflation target. On the other hand, all it would take is a worsening economic outlook or a sharp drop in the price of risk assets for the central bank to swoop in with another dose of easing.

It’s because of the central bank’s heavy hand in the $19.2 trillion Treasury market that I’ve argued typical supply-demand dynamics don’t carry much weight. While I still believe that’s the case, the lack of enthusiastic buying from anyone but the Fed might be enough to tip the scales. As in 2016, pensions have ample reason to fear that rates will move even lower. But at these levels, they’re left with virtually no choice but to revolt and hope for better days ahead.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News. He is also a CFA charterholder.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Yahoo Finance

Yahoo Finance