Betting on Bitcoin is Wall Street's most crowded trade right now

Wall Street loves Bitcoin (BTC).

The cryptocurrency, up over 300% this year alone, is also maybe too loved by investors, according to Bank of America Merrill Lynch’s latest monthly survey of fund managers.

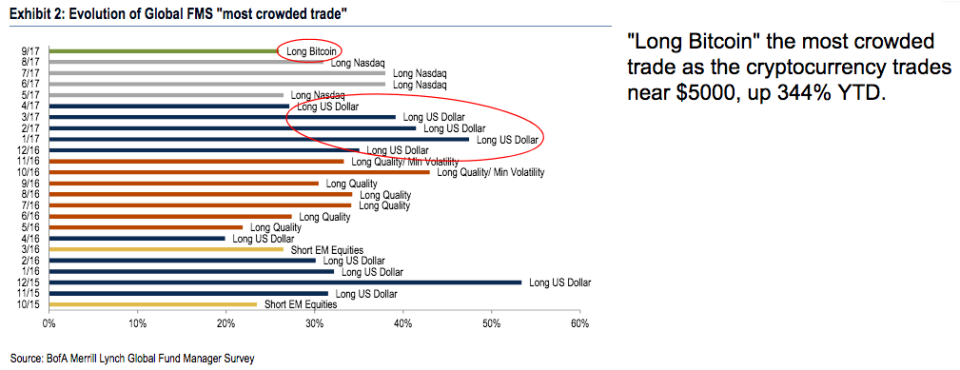

In September, a survey of 181 managers revealed that being long Bitcoin — that is, betting that its price would rise — is most crowded trade right now. Most simply, this means managers see bets on Bitcoin as disproportionately favored by investors right now.

On Tuesday morning, Bitcoin was trading just above $4,300. At the start of the year, Bitcoin was trading closer to $900. We’d also note that on Monday, our daily Yahoo Finance Twitter poll indicated that 20% of respondents would put $10,000 in Bitcoin right now if they had this much money to invest for the next decade; 53% of respondents said an S&P 500 index fund.

As Yahoo Finance’s Dan Roberts has chronicled, the hype around Bitcoin, however, isn’t just about the digital currency’s price but the blockchain technology that backs up Bitcoin. A blockchain is a distributed, immutable ledger for recording data or executing smart contracts — effectively a set of characters unique to a transaction executed on the blockchain. And so the enthusiasm around Bitcoin is largely an enthusiasm around our transactions moving to execution via blockchain rather than, say, through existing financial institutions.

Bitcoin took over from being long the tech-heavy Nasdaq as the most crowded trade in September, with the tech play dominating investor sentiment throughout the summer.

During the first part of 2017, the FAAMG stocks — Facebook (FB), Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL) — accounted for about a third of the market’s advance.

For the first few months of 2017, going long the U.S. dollar was seen as the most crowded trade. This has unwound in recent months, with the dollar last week hitting its lowest level in over two years. Though as Bloomberg’s Luke Kawa wrote Monday, this change in the dollar’s value relative to other major currencies is a function of stronger global economic growth.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance