Better Buy: Wheaton Precious Metals vs. Royal Gold

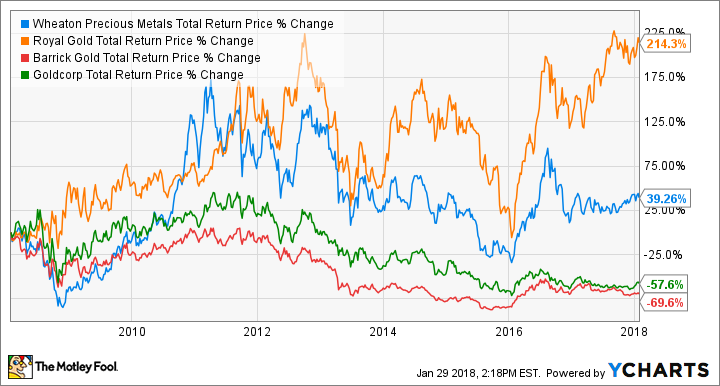

Investors in precious metals may not have had much luck with gold and silver mining stocks in recent years, but owners of streaming stocks have happier stories to tell. Consider Wheaton Precious Metals (NYSE: WPM), also the world's largest precious metals streaming company: The stock gained 50% in the past decade. Or Royal Gold Corp. (NASDAQ: RGLD), which has nearly tripled in 10 years. Comparatively, leading gold mining stocks like Barrick Gold (NYSE: ABX) and Goldcorp (NYSE: GG) have seen their values slashed in half during the period.

I still advocate streaming stocks over their mining counterparts as there are enough reasons to justify why Wheaton Precious and Royal Gold have outperformed pure mining stocks over the years. But to decide which stock between the two is a better buy now, you need to know why Royal Gold has outperformed so far and what the future holds for the two companies. Hint: Do not underestimate Wheaton Precious Metals.

The past: Royal Gold vs. Wheaton

To give you a quick background about the streaming and royalty business, Royal Gold and Wheaton do not extract metals but buy them from mining companies like Barrick and Goldcorp. It works something like this: When miners need funds to support operations or development projects, especially during difficult times when traditional debt sources can become unfeasible, streaming companies like Wheaton and Royal Gold step in and finance the miners up front. In exchange, they secure the right to purchase a certain percentage of the precious metals produced from the miner's mines (per the streaming agreement) at substantially low prices, usually for the life of mine.

Image source: Getty Images.

That means streaming companies can lock in production for long terms without incurring any mining costs. The resulting hefty margins and consistent cash flows have proved rewarding for shareholders.

WPM total return price data by YCharts.

Both Royal Gold and Wheaton count some of the biggest names in the mining industry as streaming partners, but there's a key difference: Royal Gold gets nearly 85% of its revenue from gold. Wheaton, on the other hand, gets about 42% sales from gold and the rest from silver.

This difference in the metal mix has had huge implications on the operational returns for the two companies, largely because gold has historically outperformed silver.

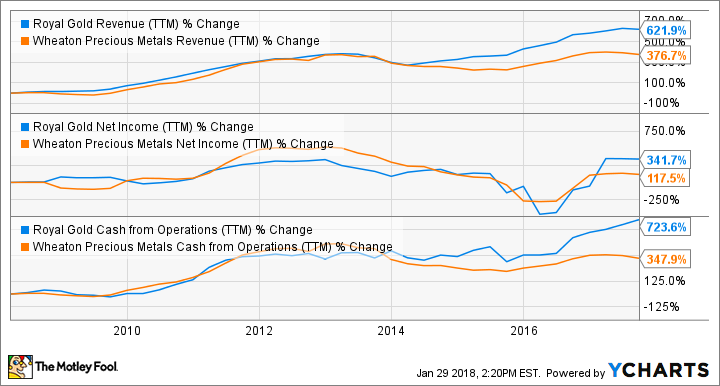

RGLD revenue (TTM) data by YCharts.

Royal Gold's winning streak continued in 2017.

2017: Royal Gold vs. Wheaton

Fiscal 2017 was a record year for Royal Gold as its revenue, net income, and cash from operations hit all-time highs (the company follows a July-June fiscal calendar). What's more, Royal Gold also raised its dividend for the 17th straight year, making it one of the best gold dividend stocks to own. That explains why the stock has gained 25% in the past one year, as of this writing.

Meanwhile, Wheaton shares have barely managed to stay in the green in the past year. That's not to say the company isn't faring well. Not at all. Despite lower production from key mine, Goldcorp's Penasquito, Wheaton still earned 6% higher net income during the nine months ended September. That's because Wheaton's purchase cost (or cost of sales) is incredibly low -- its average cash costs for silver and gold were only $4.43 per ounce and $396 per ounce, respectively, during the third quarter when gold and silver were trading well above $1,200 an ounce and $16 an ounce, respectively, in the spot market.

More importantly, Wheaton continues to generate strong cash flows, so much so that it bumped up its cash-generation payout significantly last year, and will now pay an annual dividend equivalent to 40%, instead of 30%, of its average operating cash flow for the previous four quarters.

In short, Wheaton is doing well too, just not as good as Royal Gold. However, Wheaton's changing product profile could boost its earnings and stock price in coming years.

The future: Royal Gold vs. Wheaton

Wheaton Precious Metals changed its name only recently from the erstwhile Silver Wheaton Corp. The move is in line with the company's aim to reduce exposure to silver. In 2016, Wheaton extended its agreement with mining giant Vale and bagged the right to purchase 75% of the gold produced from Vale's prized Salobo mine for its life. With that, Wheaton is aiming for 45% revenue from gold by 2021.

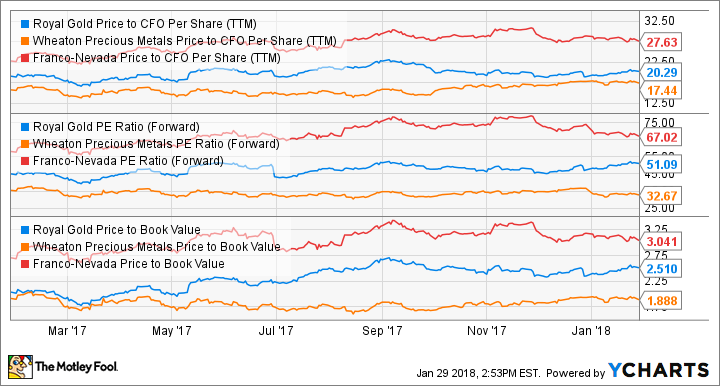

To be fair, I don't expect Wheaton to benefit hugely from greater diversification just yet, but it'll be interesting to watch how the move impacts the company's bottom line and cash flows. Also, Wheaton is now one of the most well-balanced plays in gold and silver. Investors who are willing to take some risks for want of high returns could consider Wheaton right now, especially given how cheap the stock is trading versus its peers Royal Gold and Franco-Nevada Corp.

RGLD price to CFO per share (TTM) data by YCharts.

Royal Gold, for its part, should continue to generate higher profits, cash flows, and steady dividends, making it a better pick over Wheaton for the risk-averse investors.

More From The Motley Fool

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance