Better Buy: Tellurian vs. Cheniere

Over the past couple of decades, Cheniere Energy (NYSEMKT: LNG) has made, lost, and remade investors a lot of money -- the stock has gained an incredible 2,240%, though it's still down from the all-time high reached back in 2014.

Cheniere's story is one of a management team willing to take a massive gamble that paid off, as its liquefied natural gas (LNG) facilities now generate billions of dollars in positive -- and predictable -- cash flows each year under long-term contracts with exporters.

Tellurian (NASDAQ: TELL), on the other hand, is at the very beginning of its journey, yet it's under the same management team that built Cheniere -- chiefly the founder of both companies, Charif Souki, but also a handful of other executives who led Cheniere from start-up to cash cow.

Can Souki and his team do it again? Or is it possible they even do it one better? With some slight differences in the business model, Tellurian has a lot to offer. But as a start-up, there remain significant risks investors must consider before making a choice. Keep reading to learn the investment case -- and risks -- for both companies.

Image source: Getty Images.

How Cheniere became the world's biggest LNG pure play (and a massive investing success)

If you go back around 20 years, just about everyone in the energy industry was convinced the U.S. was running out of natural gas. The industry knew about the substantial gas deposits found deep in shale rock all over North America, but the equipment and techniques to cost-effectively extract it simply didn't exist.

Souki founded Cheniere to capitalize on that reality, with plans to develop LNG import terminals to bring natural gas into the country as domestic production fell. Well, a funny thing happened: Producers and drilling companies kept working at ways to unlock all that gas, and developed what we now call fracking -- hydraulic fracturing -- and combined it with horizontal drilling.

The combination of more-powerful drilling and pumping systems with these new techniques has paid off in spades; it's estimated that North American natural gas reserves are sufficient to last another century.

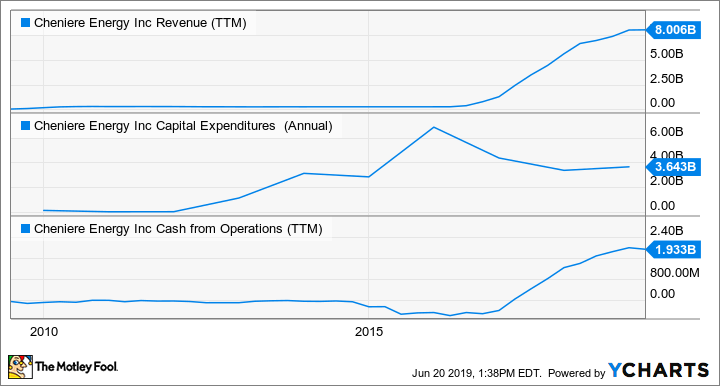

Fortunately for Cheniere and its investors, Souki and his team completely reversed course, and transformed Cheniere into the biggest pure-play LNG producer and exporter in the world. But it spent much of that time generating essentially zero revenue while spending billions to build its liquefaction and export terminals:

LNG Revenue (TTM) data by YCharts.

The big takeaway? Investors spent many years riding out Cheniere's build-out, investing almost exclusively in its potential to deliver the cash flows that management promised investors would come.

And come they have, to the tune of nearly $2 billion in operating cash flow over the past 12 months. Moreover, the company expects to reach nearly $3 billion in distributable cash flows by 2023, based on a combination of signed agreements with new customers and ongoing expansion.

So even after the massive 2,300% in gains that investors have enjoyed over the past decade, Cheniere likely isn't done rewarding them just yet.

Doing it one better with Tellurian?

Despite having guided the company through an amazing turnaround, Souki was essentially forced out of Cheniere in late 2015 by activist investors. He didn't spend much time trying to figure out his next step, founding Tellurian in February 2016 along with Martin Houston, former COO of BG Group (a leader in LNG) prior to its acquisition by Shell.

By late 2016, Tellurian had entered into an agreement to merge with Magellan Petroleum, taking that company's assets as a starting point to build a new LNG business from little more than the ground up.

Of course, that means the same thing for Tellurian investors that Cheniere shareholders endured for the better part of a decade: essentially zero operating results, and making an investment based entirely on the company's potential to build a cash-cow business.

And since closing the merger with Magellan and going public as Tellurian on Feb. 10, 2017, Mr. Market hasn't been patient, or kind:

Tellurian has been one of the most-volatile energy stocks, and has lost 42% of its value. Moreover, it hasn't even broken ground on its LNG export facility, which will be called Driftwood LNG.

However, it has received approval from the Federal Energy Regulatory Commission (FERC) to build Driftwood, and more recently, export authorization from the Department of Energy.

These are significant steps forward. Tellurian will make its final investment decision (FID) in the coming months to move forward with construction of Driftwood, which is a foregone conclusion at this point, and should begin raising capital to fund construction later this year.

The company doesn't expect it will produce or export any LNG until 2023, and that's if everything goes according to plan, which is not guaranteed. Moreover, it's not just an LNG facility: A huge part of Tellurian's plan is its Permian Global Access Pipeline (PGAP), which it expects to complete at the same time as Driftwood, to give it access to 2 billion cubic feet per year of low-cost natural gas.

That's a lot to coordinate and get right at the same time.

But if there's one thing Tellurian has going for it, it's the management team. In addition to Souki and Houston, Tellurian is stocked with Cheniere executives who guided that company through this same phase, including Meg Gentle, who is now Tellurian's CEO (Souki and Houston are chairman and vice-chairman respectively), and four other top executives.

Without getting too bogged down in the details, Tellurian looks incredibly appealing because it has experienced leaders who've done this before, and management projects the facilities they plan to build will generate $8 per share in cash flows when completed.

Tellurian stock trades for around $8 per share today. If it reaches that target, and trades for a similar valuation to Cheniere -- around 9 times cash from operations recently -- it's worth $72 per share.

If it happens, that would turn a $10,000 investment into $90,000 in about five years.

Risk for upside, or predictability? You decide!

Global demand for LNG is set to remain very strong over the next decade and longer, between global population growth increasing demand for cheap energy, and the shift away from coal in many countries further increasing gas demand.

And the difference between Cheniere and Tellurian at this point is, Cheniere is established, with a track record of delivering LNG to its partners -- something lenders and equity investors both value when it comes to turning over more capital to fund continued growth. It also now has positive cash flows it can use to fund expansion, so it's not reliant solely on capital markets.

Tellurian, however, is completely reliant on the "generosity of others" at this stage. It plans to use a combination of stock sales, equity stakes by partner energy companies, and debt to fund Driftwood and PGAP. It certainly has leadership with a pedigree, and it plans to do it one better with a slightly different strategy to fund construction and access cheap natural gas supplies. But execution risk is far greater for Tellurian than for Cheniere.

Based on that, it's up to you to decide whether you're willing and able to take on the risk that Tellurian fails and investors get wiped out -- potentially for reasons it cannot control that make access to capital impossible -- or if you're better off reducing that downside risk with Cheniere, even though it means the potential upside is much smaller.

More From The Motley Fool

Jason Hall owns shares of Tellurian Inc. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance