Better Buy: Square vs. Visa

Square (NYSE: SQ) and Visa (NYSE: V) are linked because they're both big players in the debit and credit card payment process. But with different roles, they present different opportunities for investors.

On a simple level, Square is the new upstart that's trying to innovate in the mobile point-of-sale space, while Visa is the stalwart that controls a huge share of the digital payment infrastructure. And that difference may determine which stock is a better buy long-term.

Image source: Square.

Comparing the numbers

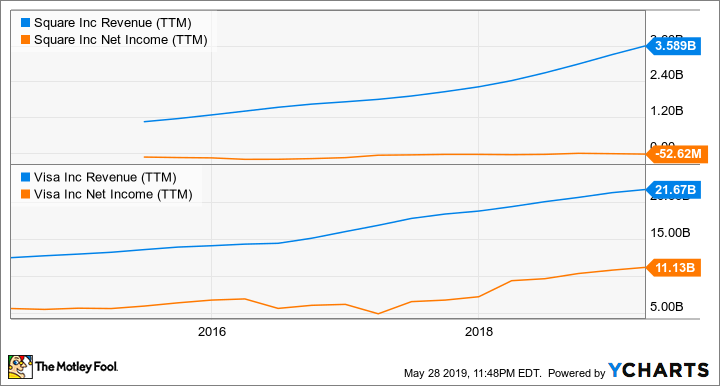

There's no question Square has Visa's growth numbers beat. Square has grown revenue 135% in the last three years, dwarfing the (still impressive) 51% growth at Visa.

SQ Revenue data by YCharts. TTM = trailing 12 months.

The big difference you can see above is that Square isn't yet profitable and Visa is printing money. Square's bottom line is improving, but at the end of the day, it's a company investing in expanding its business, while Visa is letting decades of investment pay off.

Risk falls squarely on Square

From a risk standpoint, these companies couldn't be more different. Visa owns the payment network that digital transactions run on, taking a small cut of each transaction. When new innovations like Square or Apple Pay arrive, they leverage Visa's network to operate. It's extremely hard to disrupt such a network.

Square, on the other hand, is the point-of-sale device, and those companies come and go. Companies adapt their point-of-sale devices as new capabilities are added, like chip readers or new functionality from the underlying software. Square has stayed ahead of many competitors by offering services people want, but it's still not as big a moat for the business as Visa has.

To mitigate its risks, Square has built out services like payroll, inventory, marketing, employee management, and other services that make it easy to run a small business. It's even offering capital, like a bank, by leveraging the data it knows about businesses. The goal is to expand the moat of the business, but it's still not as durable as Visa.

Where's the value?

It's tough to argue that either Square or Visa is a value stock. Visa trades at 35 times earnings, and Square isn't yet profitable. A better metric to look at might be price to sales, which you can see below.

SQ PS Ratio (TTM) data by YCharts.

Based on price to sales, Square is the better value by a long shot, but that value should be taken with a grain of salt. Square will likely never reach Visa's operating margin of 63%, which is on par with the best tech companies in the world. Square has more costs for each transaction plus sales and product development costs to stay a step ahead of competitors. Considering how far ahead Visa is in generating a strong margin, it deserves a higher price-to-sales ratio.

The bottom line

I like Square's business a lot and have given it an outperform call on my CAPS page. But Visa's business has an incredible moat that seems to get wider even as innovative payment solutions are added to the market. And with profits growing rapidly, this is a stock I think investors could own for decades to come.

More From The Motley Fool

Travis Hoium owns shares of Apple, Square, and Visa. The Motley Fool owns shares of and recommends Apple, Square, and Visa. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance