Better Buy: Skyworks Solutions vs. Qualcomm

If you're looking to invest in a chip company that's exposed to the imminent transition to 5G wireless, then two companies have surely popped up on your radar: Skyworks Solutions (NASDAQ: SWKS) and Qualcomm (NASDAQ: QCOM).

Skyworks is a pure-play wireless chip company that mainly sells chips into the smartphone market. In its most recent quarter, 73% of its revenue came from sales of wireless chips into smartphones while the remaining 27% were sold into what the company terms the "broad market."

Image source: Qualcomm.

Qualcomm, on the other hand, isn't just a chip company, even though it generates most of its revenue from chip sales into products like smartphones and, increasingly, other areas like automotive and the Internet of Things: It's also a wireless patent company. In fact, the bulk of the company's operating income comes from its wireless patent licensing business (although that proportion has come down substantially as its chip business's profitability has improved and major smartphone vendors refuse to pay Qualcomm royalties.)

So the question you might have is this: Which of these two stocks is the better way to gain exposure to the wireless market?

A tale of two different risk profiles

Qualcomm is facing a number of serious problems. There are fears that the company's ongoing trial with the FTC could lead to an unfavorable outcome that could devastate the company's wireless technology licensing business. The overall smartphone market continues to be sluggish and competition in the market for low-end smartphone applications processors is fierce, which affects its chip business.

However, I believe that the stock at its current price -- the shares trade at less than 12 times analysts' fiscal 2020 earnings per share (EPS) projections -- does embed a nontrivial degree of pessimism. If the stars were to align for Qualcomm (with, arguably, the most critical factor being a positive resolution of the FTC lawsuit), then the stock could rise both quickly and significantly from current levels.

That, however, is far from a guarantee.

Skyworks, on the other hand, is a more straightforward story. It's a chip company that has significant smartphone exposure (and, in particular, it's highly exposed to Apple, which some analysts estimate makes up 35%-40% of Skyworks' total revenue), but it's also set to benefit from the same secular shift to 5G wireless that Qualcomm is through the sale of more sophisticated chips.

The stock is also fairly cheap, trading at about 12 times analysts' fiscal 2019 EPS projections and 10.9 times their fiscal 2020 EPS expectations. And, unlike with Qualcomm, there aren't any imminent threats to Skyworks' business model.

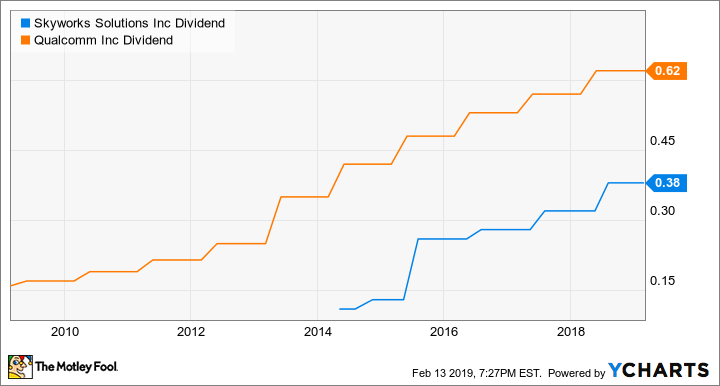

It's also worth noting that from the perspective of an income investor, Qualcomm probably looks like a much better bet, given its hefty 4.8% dividend yield relative to Skyworks' significantly lower 1.82% dividend yield. Now, if Qualcomm makes it through the current storm that it's facing, then its dividend should not only be sustainable but set to continue on a solid growth path. If it doesn't, then not only could the stock price fall apart, but the dividend could be at significant risk of a cut (or, even more pessimistically, an outright suspension).

SWKS Dividend data by YCharts.

Investor takeaway

The way I see it is this: Qualcomm might have significantly more near-term upside potential than Skyworks simply by virtue of the fact that the former's share price is being depressed by some pretty substantial fears. At the same time, if things don't go right for Qualcomm and its lucrative wireless technology licensing business simply falls apart, the downside risk looks pretty severe, too.

So, at a high level, I think it ultimately comes down to your risk tolerance. If much higher risk and potentially larger rewards are more appealing to you, then Qualcomm might be worth a closer look. If your appetite for risk is significantly lower and you're willing to accept potentially lower returns, then Skyworks might be the stock worth examining more thoroughly.

More From The Motley Fool

Ashraf Eassa owns shares of Qualcomm. The Motley Fool owns shares of and recommends AAPL and Skyworks Solutions. The Motley Fool owns shares of Qualcomm and has the following options: long January 2020 $150 calls on AAPL and short January 2020 $155 calls on AAPL. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance