Better Buy: Newmont or Barrick Gold Stock?

Written by Kay Ng at The Motley Fool Canada

Gold stocks have generally been weak this year due to a stronger U.S. dollar that has weighed on gold prices. As a result, large-cap gold stocks Newmont (TSX:NGT) and Barrick Gold (TSX:ABX) have declined this year. Year to date, Newmont stock has corrected about 21%, while Barrick Gold stock has dropped roughly 11%. Let’s explore which may be a better buy today.

Past performance may be indicative of future performance

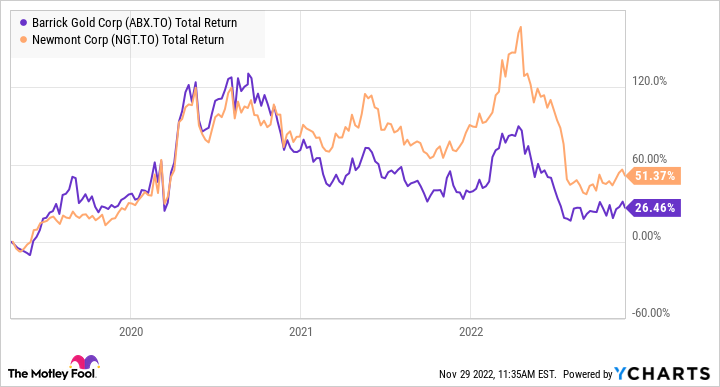

As you can see in the total return chart, gold stocks tend to move in tandem with each other. So, the one that has delivered greater returns may be a better buy. Newmont stock has delivered greater total returns over a multi-year period.

ABX Total Return Level data by YCharts

When based on only price appreciation in the period, Newmont stock’s climb of about 41% also doubled that of Barrick Gold’s 20%.

Financial position

Newmont’s retained earnings are positive, which is always a good sign. As Investopedia explains, “Retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments… retained earnings decrease when a company either loses money or pays dividends and increase when new profits are created.” Specifically, the gold stock’s retained earnings were US$2.8 billion at the end of the third quarter (Q3).

Its debt-to-equity ratio is 84%, which is not that different from 82% in the “normalized” year of 2019.

In contrast, Barrick Gold has accumulated a deficit of almost US$6.3 billion. In other words, its retained earnings are in negative territory. However, the company’s capital structure has improved. The debt-to-equity ratio is 59%, down from 68% in 2019. The gold miner also earns an S&P credit rating of BBB+, which should instill confidence in investors.

Recent results

In Q3, Newmont realized an average gold price of US$1,691 per ounce, down 4.9%, while its all-in sustaining costs (AISC) for its gold operations increased by roughly 13% to US$1,271 per ounce. Accordingly, its adjusted EBITDA, a cash flow proxy, declined about 35% to US$850 million. Q3 cash flow from operations fell 59% to US$466 million, resulting in year-to-date free cash flow generation of US$703 million.

In Q3, Barrick Gold’s AISC for its gold operations was US$1,269 per ounce, up 23% year over year. Adjusted EBITDA declined about 31% to US$1,150 million. Its Q3 net cash provided by operating activities fell 28% to US$758 million, resulting in year-to-date free cash flow generation of US$528 million.

The Foolish investor takeaway

Both companies have witnessed a drop in profits lately due to inflationary pressures resulting in higher costs of operation and lower gold prices. It would be smart to limit your portfolio exposure to this sector.

That said, between the two, Barrick Gold stock appears to be a better value. The consensus analyst 12-month price target is US$53.60 for Newmont, which represents 18% near-term upside potential. At US$45.37 per share, its dividend yields 4.8% for additional returns. Barrick’s price target is US$20.40, which implies a 29% near-term upside is possible. At US$15.80 per share, its dividend yields 3.5%.

The post Better Buy: Newmont or Barrick Gold Stock? appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Barrick Gold?

Before you consider Barrick Gold, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in November 2022 ... and Barrick Gold wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 15 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 11/4/22

More reading

4 TSX Dividend Stocks Offering Big Income in a Bearish Market

Just Released: The 5 Best Stocks to Buy in November 2022 [PREMIUM PICKS]

The 3 Best Dividend Stocks to Buy in November 2022 [PREMIUM PICKS]

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2022

Yahoo Finance

Yahoo Finance