Better Buy: Enbridge vs. Plains All American Pipeline

With a $75 billion market cap, Canada's Enbridge (NYSE: ENB) is one of the largest midstream companies in North America. That said, Plains All American (NYSE: PAA), weighing in at around $17 billion, is no pipsqueak: It works with some of the energy industry's largest and most respected companies (think ExxonMobil). If you are an income investor looking at the space, both are likely to find their way to your shortlist. Here's some important background before you decide to jump aboard either of these two high-yield stocks, because one has better income credentials than the other.

1. A closer look at Enbridge

Enbridge has a giant market cap relative to peers, but that doesn't fully capture just how big it is. For example, its business spans from northern Canada all the way down to the border with Mexico in lower Texas. It operates 17,000 miles of oil and products pipelines (about 50% of EBITDA) and 26,000 miles of natural gas pipelines (30%), and provides natural gas to 3.7 million utility customers and owns 1.7 gigawatts of renewable power capacity (about 15%). So, it's not only a big pipeline company, but its business also encompasses a huge portion of the much-broader energy space.

Image source: Getty Images

It recently completed a big corporate makeover, buying a number of controlled public entities in an effort to simplify its business structure while selling noncore assets to cover the cost. That transition is largely behind the company, which is now looking largely to the future with 3 billion Canadian dollars' worth of investment projects planned for 2019. It's got another CA$13 billion set for 2020 and beyond. Enbridge believes that these projects will support 10% dividend growth through 2020, with the rate dropping to between 5% and 7% thereafter -- a still-respectable figure.

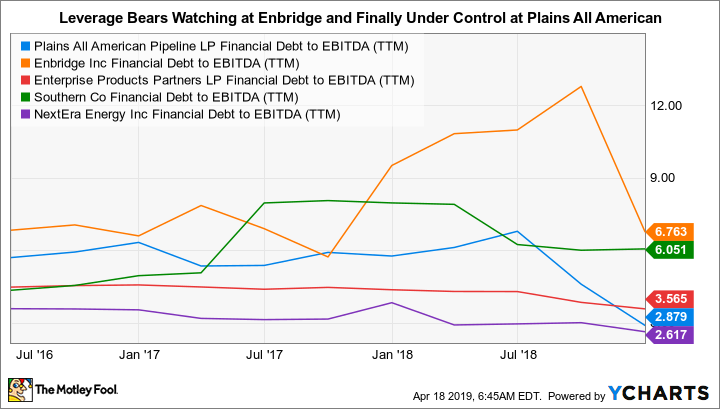

Dividend growth, meanwhile, is a big issue here. Enbridge has a strong 23-year history of annual dividend hikes under its belt. The yield today is a generous 6%. The only problem with Enbridge is that it makes fairly aggressive use of its balance sheet, with debt to EBITDA up in the 6.7 times range. That's high for a pipeline company and for a utility. However, this isn't new: Enbridge has a long history of operating with this much leverage and continuing to reward investors with regular dividend hikes, which is one of the key facts separating it from Plains All American.

2. Getting back on its feet

Plains is focused on the midstream space, with roughly 18,000 miles of crude and natural gas pipelines, storage and terminalling facilities, and other transportation assets (like boats, trucks, and railcars). It's not a small player, with operations spanning from northern Canada down to Texas, just like Enbridge. That said, it isn't quite as diversified, as it doesn't own utility assets, and isn't as large. That's not inherently bad, since smaller investments can have a much bigger impact on the top and bottom lines at a smaller company.

PAA financial debt to EBITDA (TTM) data by YCharts.

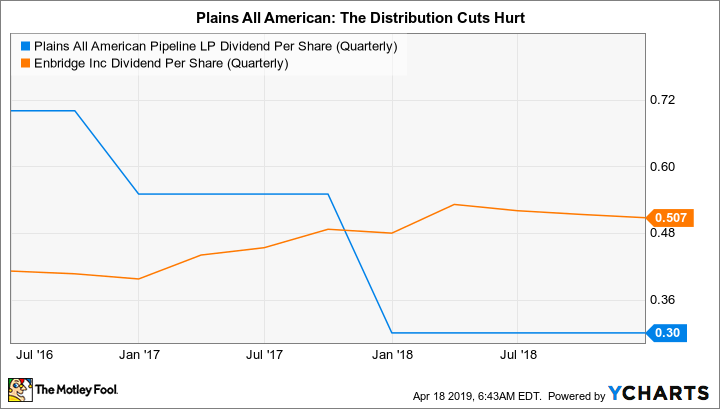

On that score, Plains has $1.1 billion of capital projects planned for 2019. It expects that to lead to adjusted EBITDA growth of around 2% and distributable cash flow growth of around 5%. And while it isn't providing spending plans beyond that point, Plains has additional projects lined up to help it keep expanding in the future. While those 2019 projections may not sound impressive, the limited partnership just hiked its distribution by 20%, year over year. The forward yield is around 6% today. But step back from that giant dividend hike -- it comes with a backstory.

Plains' debt-to-EBITDA ratio rose dramatically between 2013 and 2017, peaking at over six times. It was, unfortunately, having a hard time covering its distribution and paying for its growth plans. Management chose to hit the reset button in 2016 and cut the distribution. That, however, wasn't enough leeway for Plains, which was forced to cut the distribution again in 2017. All in all, the distribution was reduced by nearly 60%. Management has finally reached key deleveraging goals, with debt to EBITDA down to a very low three times or so, and the partnership has started to increase distributions again. But that 20% hike is from a very low base.

PAA dividend per share (quarterly) data by YCharts.

So, in many ways, Plains has a bright future ahead of it as it regains its financial footing. However, for investors who were relying on the distribution, well, they got creamed. And that's not something investors should forget here: Enbridge managed to work through its own big corporate overhaul without cutting its dividend.

A little more work, but worth the effort

Enbridge and Plains are both notable names in the midstream space. Enbridge is bigger and more diversified, but that alone isn't enough to make it a better pick than Plains. Nor is its yield, since the two are currently about on par there. What separates Enbridge out is the fact that it was able to work through a notable transition without a dividend cut. Plains couldn't manage that. While leverage is higher at Enbridge, and should be monitored, Plains All American's now-strong balance sheet and solid prospects should be taken with a grain of salt. On the whole, Enbridge looks like the better option here for investors seeking a consistent income stream.

More From The Motley Fool

Reuben Gregg Brewer owns shares of ExxonMobil. The Motley Fool owns shares of and recommends Enbridge. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance