Better Buy: Brookfield Renewable Partners vs. Enterprise Products Partners

Brookfield Renewable Partners (NYSE: BEP) has a yield of 6.4%. Enterprise Products Partners (NYSE: EPD) offers a yield of 5.9%. While the easy answer for an income investor may seem to be the higher yield limited partnership, that misses some important facts here. Before making the call on which of this pair is a better buy, you should pit these two against each other on some key facts and metrics.

1. What they do

Enterprise and Brookfield have vastly different purposes. Enterprise is one of the largest midstream players in North America, owning the pipes, storage, processing facilities, and ports that help get oil and natural gas from where they are pulled from the ground to where they finally get used in various different forms. Brookfield, as its name implies, owns, buys, and builds renewable power assets like hydroelectric dams and solar and wind farms. It is one of the larger players in the space, with a globally diversified portfolio that's growing off of a huge foundation of reliable hydro plants (around 75% of its capacity). Hydroelectric is one of the oldest and most reliable sources of renewable power known to man.

Image source: Getty Images

There is no winner on this particular factor, but it is probably the first most important issue to consider. If you want to go green, then Brookfield is the only real option here. If you just want to own a good high-yield partnership, then both are pretty well matched.

2. Who runs the show

Brookfield Renewable Partners is part of the Brookfield Asset Management (NYSE: BAM) family of companies. Brookfield Asset Management is a Canadian entity that has an over-100-year history of owning and operating infrastructure assets. It is a well respected company.

That said, it also runs a number of other partnerships, acting as the general partner for each, and makes investments with its own money and the money of others. Brookfield Asset Management gets paid for doing all of this, so it is incentivized to continue increasing the assets under its care. Although historically that hasn't been an issue for the partnerships it operates, it could set up a conflict of interest with unitholders if asset growth starts to become more important than asset quality.

Some time ago Enterprise bought its general partner, a move often referred to as an internalization transaction. Not to sound simplistic, but this means that Enterprise runs Enterprise. There is no outside entity that might have a conflicting goal. If you prefer simpler business structures, then Enterprise is the better option. That said, since there has yet to be an issue with conflict of interest at Brookfield, this is largely a wash -- unless this type of thing really bothers you.

3. Distribution history

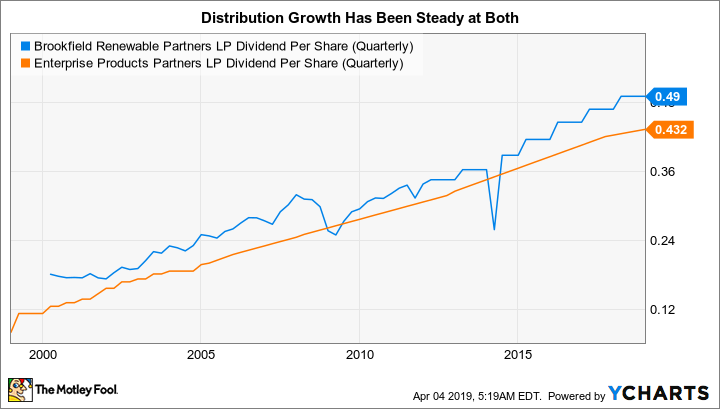

Enterprise has increased its distribution every year for 22 consecutive years. Within that streak is a run of 58 consecutive quarters of increases. That's an incredibly impressive showing that speaks to a conservatively run partnership that puts great weight on returning value to unitholders via distributions. The trailing 10-year distribution growth rate is around 5%, above the historical rate of inflation growth, thus, ensuring that the buying power of distributions has grown over time.

That said, Enterprise has pulled back on distribution growth recently, dropping growth into the low single digits so it can rejigger its business a little. The goal is to self fund more of its growth spending to limit the number of units it has to issue over time. This transition should be over shortly, with distribution growth picking back up to historical levels. Although this is a short-term negative, it is making Enterprise a more desirable entity over the long term.

BEP Dividend Per Share (Quarterly) data by YCharts

Brookfield has increased its distribution annually for a decade. Over that span the annualized growth rate was a little under 5%. Far from falling short of Enterprise on this one, Brookfield has basically upped the payout every year of its existence at roughly the same annualized rate. It's hard to fault it for not being around as long as Enterprise.

That said, Brookfield Renewable has a specific goal of increasing distributions 5% to 9% annually; Enterprise doesn't have a specific goal. This is, again, largely a wash.

4. Growth prospects

Brookfield Renewable Partners is at the forefront of a global shift away from carbon-based fuels, replacing those dirty energy sources with clean, renewable power. This will be a decades-long process, providing the partnership with ample room to keep growing. Right now its growth is being driven by contractual price hikes from existing assets (1% to 2% annual growth), investment in current assets (2% to 4%), and the acquisition and construction of new assets (3% to 5%). All in all it believes it can sustainably grow funds from operations in the 6% to 11% range, more than enough to support its distribution growth target.

Enterprise operates in the world that Brookfield Renewable is looking to replace. However, Enterprise's market is the United States, which is in the midst of an oil and natural gas boom. There simply isn't enough infrastructure to handle all of the oil and gas being produced, which provides the partnership with a nice runway for growth. It currently has $5.1 billion of growth projects under construction that should keep it busy through 2020. However, it continues to expect production to increase in its core markets well beyond that point, which should result in continued opportunity for investment.

Although Brookfield is likely latched to the trend with a longer growth path, Enterprise's growth appears set to last for many years into the future. This is largely a wash again.

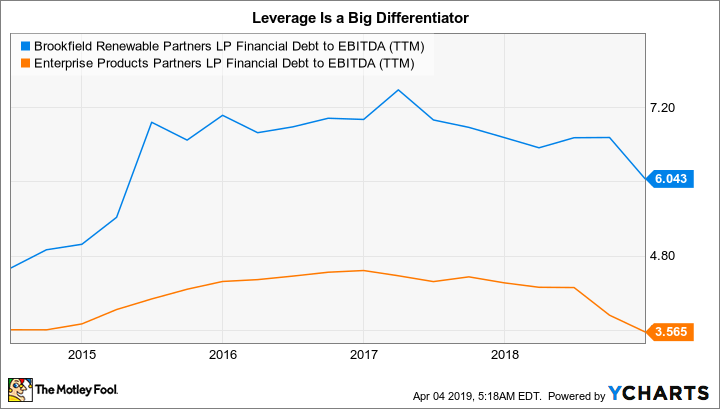

5. Finally a notable difference: Leverage

The last item up basically relates to each partnership's use of its balance sheet. Enterprise Products is among the most conservatively financed midstream partnerships, and has long prided itself on its fiscal discipline. This shows up in many ways, but one key metric is the partnership's low debt-to-EBITDA ratio of just 3.6. Brookfield Renewable, on the other hand, has historically made greater use of leverage, operating with a debt to EBITDA ratio of roughly 6.

BEP Financial Debt to EBITDA (TTM) data by YCharts

If you are a conservative investor, Enterprise wins this one hands down. To some extent the difference in who controls each entity has a hand in the leverage each employs. Brookfield Asset Management's incentive is to grow Brookfield Renewable Partners' asset base, and using leverage is one way to make that happen more quickly. Stepping back, Brookfield's leverage isn't out of line with some of the larger utilities, but its business is very different from that of a traditional regulated utility. The uncertainty of building non-regulated electricity assets and investing in foreign countries could easily be seen as a reason to use less leverage.

Who wins?

The truth is that investors probably wouldn't go wrong with either of these high-yield partnerships. Still, there are some nuances that may matter to you. For example, if you are trying to go green, then Brookfield Renewable is the easy choice. However, if you favor conservative investments, then Enterprise's low leverage and total control over its own destiny would likely make it the better option. It's a tough call, but since most would probably do just fine taking the cautious approach, Enterprise gets the final nod.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Brookfield Asset Management. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance