Best Income Stocks to Buy for February 1st

Here are three stocks with buy rank and strong income characteristics for investors to consider today, February s1st:

S&T Bancorp STBA: This bank holding company which is engaged in general banking business, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.7% over the last 60 days.

S&T Bancorp, Inc. Price and Consensus

S&T Bancorp, Inc. price-consensus-chart | S&T Bancorp, Inc. Quote

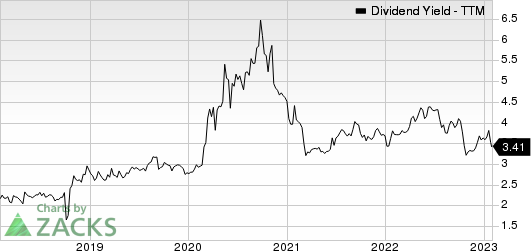

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 3.41%, compared with the industry average of 2.62%.

S&T Bancorp, Inc. Dividend Yield (TTM)

S&T Bancorp, Inc. dividend-yield-ttm | S&T Bancorp, Inc. Quote

Siemens SIEGY: This company which is the world's largest supplier of products, systems, solutions and services for industrial automation and building technology, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 1.4% over the last 60 days.

Siemens AG Price and Consensus

Siemens AG price-consensus-chart | Siemens AG Quote

This Zacks Rank #1 company has a dividend yield of 2.14%, compared with the industry average of 0.00%.

Siemens AG Dividend Yield (TTM)

Siemens AG dividend-yield-ttm | Siemens AG Quote

Global Water Resources GWRS: This water resource management company that owns and operates regulated water, wastewater and recycled water utilities, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 9.5% over the last 60 days.

Global Water Resources, Inc. Price and Consensus

Global Water Resources, Inc. price-consensus-chart | Global Water Resources, Inc. Quote

This Zacks Rank #1 company has a dividend yield of 2.09%, compared with the industry average of 1.80%.

Global Water Resources, Inc. Dividend Yield (TTM)

Global Water Resources, Inc. dividend-yield-ttm | Global Water Resources, Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

S&T Bancorp, Inc. (STBA) : Free Stock Analysis Report

Siemens AG (SIEGY) : Free Stock Analysis Report

Global Water Resources, Inc. (GWRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance