Best Growth Stocks to Buy for June 17th

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, June 17th:

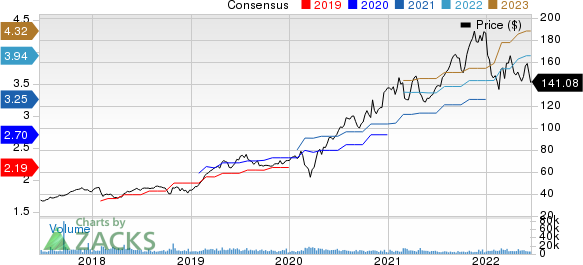

Cadence Design Systems CDNS: This company which offers products and tools that help customers to design electronic products, it carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.6% over the last 60 days.

Cadence Design Systems, Inc. Price and Consensus

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

Cadence Design Systemshas a PEG ratio of 2.11 compared with 8.65 for the industry. The company possesses a Growth Score of A.

Cadence Design Systems, Inc. PEG Ratio (TTM)

Cadence Design Systems, Inc. peg-ratio-ttm | Cadence Design Systems, Inc. Quote

Core & Main CNM: This company which offers products and services that are used in the maintenance, repair, replacement and construction of water and fire protection infrastructure, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 10.7% over the last 60 days.

Core & Main, Inc. Price and Consensus

Core & Main, Inc. price-consensus-chart | Core & Main, Inc. Quote

Core & Mainhas a PEG ratio of 1.12 compared with 1.31 for the industry. The company possesses a Growth Score of A.

Core & Main, Inc. PEG Ratio (TTM)

Core & Main, Inc. peg-ratio-ttm | Core & Main, Inc. Quote

Southwest Airlines LUV: This passenger airline company that provides scheduled air transportation in the United States and 'ten near-international' markets,carries a Zacks Rank #1(strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 122.5% over the last 60 days.

Southwest Airlines Co. Price and Consensus

Southwest Airlines Co. price-consensus-chart | Southwest Airlines Co. Quote

Southwest Airlines has a PEG ratio of 2.18 compared with 5.78 for the industry. The company possesses a Growth Score of B.

Southwest Airlines Co. PEG Ratio (TTM)

Southwest Airlines Co. peg-ratio-ttm | Southwest Airlines Co. Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance