The Best Cities to Invest in Real Estate on a Budget

These days everyone wants to be the next big-time real estate mogul. And why not? It entails a lifetime of partying with the Hollywood elite, flying on personal jets emblazoned with your name, putting out inspirational, ghost-written best-sellers, or maybe even getting yourself on a presidential ticket. It doesn’t sound half-bad, right?

It’s no wonder the idea of flipping—buying low, fixing up, and selling high—has become a bit of a national obsession over the past decade or two. It’s led to a dozen or so fun, fantasy-tinged reality shows (yay!). It also helped accelerate the housing crash back in those wacky days of low- or no-cost credit (boo!). But it comes with challenges. For us ordinary Americans—the other 99%—particularly those living in the country’s most expensive cities, buying just one home, or trading up to a larger one, is daunting enough. After all, prices are continuing to rise and inventories are continuing to drop.

So what’s an aspiring real estate investor or wannabe landlord to do?

For more and more people, the answer is to head straight out of town. Increasingly, those on a budget are looking beyond their pricey hometown cities to purchase investment properties in other, lower-cost metros where prices and rents are steadily going up.

The timing is right to invest in real estate: Median prices on existing (and not newly built) homes are expected to increase 6% this year, according to realtor.com®. That makes housing a stronger bet than other investment opportunities such as the stock market, which has been delivering anemic or wildly uneven returns.

Plenty of investors do not “want to stomach the volatility of the [stock] markets … and like having a tangible investment that they can see, touch, and feel,” says Jason Stock, an investment adviser with CalChoice Financial. His firm helps investors add single-family homes to their retirement portfolios, he says.

And here’s the thing: Even when times get tough, or the country falls into a recession, rental properties still do relatively well.

“Rents will go down a little bit—but people still need places to live,” says Steven Hovland, director of research at HomeUnion, an Irvine, CA–based company that helps everyday investors find, buy, and manage their properties for a fee.

Where should budget-minded investors turn?

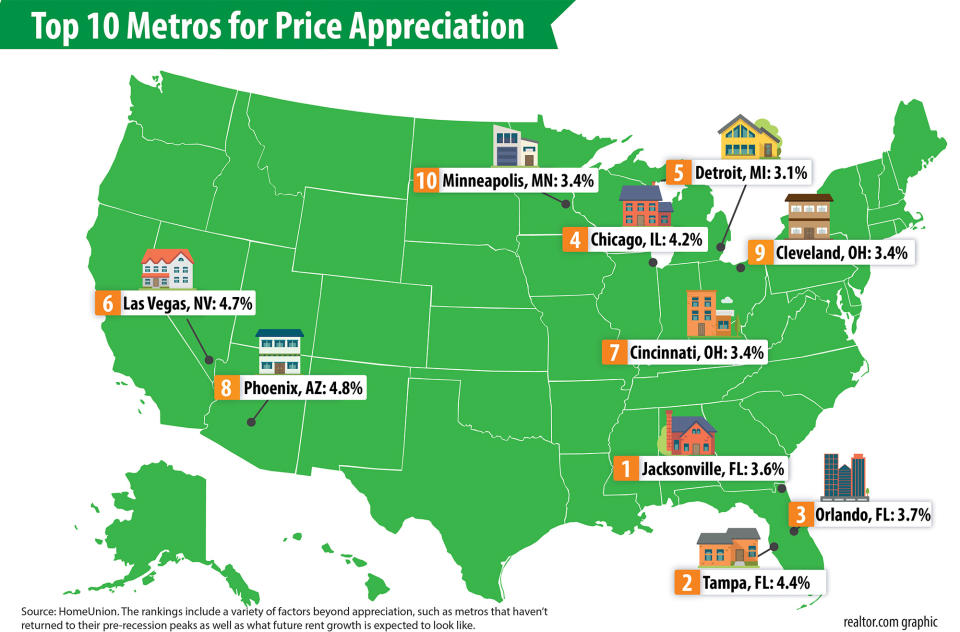

HomeUnion crunched the numbers for realtor.com to help us find out. We looked at metrics for both flippers and landlords. We sought out the top 10 metropolitan markets for the best first-year home price appreciation for investors who plan to sell their properties. Then we separately found the top 10 metros where buyers can get the biggest first-year rental returns as landlords.

For both lists, HomeUnion looked only at standalone single-family homes in the still reasonably affordable price range of $232,500 and under. The figure represents the median price of existing residences in April, according to the National Association of Realtors®.

So once you smash that piggy bank to bits, exactly where should you invest your hard-earned cash?

First up, let’s look where investors can expect home prices to rise, ensuring a profitable sale of their property.

To come up with the list, HomeUnion:

Factored in metros where prices haven’t returned to their prerecession peaks.

Compared prices from the first quarter of 2015 to the first quarter of 2016.

Forecast future rent growth by looking at local economies, employment numbers, and previous rent hikes and drops. Because we’re making the assumption that you’ll rent out the place before you buckle down and sell it.

The rankings included a variety of factors, which is why some cities with lower appreciation rates may appear higher on the list.

So let’s take a closer look at our top 10 list, shall we?

Jacksonville, FL, at 3.6%

Tampa, FL, at 4.4%

Orlando, FL, at 3.7%

Chicago, IL, at 4.2%

Detroit, MI, at 3.1%

Las Vegas, NV, at 4.7%

Cincinnati, OH, at 3.4%

Phoenix, AZ, at 4.8%

Cleveland, OH, at 3.4%

Minneapolis, MN, at 3.4%

Florida is hotter than hot in the real estate investment game, snagging the top 3 spots for a simple reason: It appeals to aging baby boomers with cash who are moving into the state, Hovland says. And, in case you’ve managed to forget during all of the recent millennial mania, there are an awful lot of baby boomers out there.

“You had a lot of retirees in the Northeast holding on to their homes, because they lost a lot of equity” after the housing crash, Hovland says. “But now they are able to sell them.” And apparently, many of them are moving to the Sunshine State.

The Florida metros are also seeing more companies and centers expand or develop new facilities in their areas, bringing more jobs and workers looking for places to live.

The faded automotive manufacturing mecca of Detroit also turns out to be a great investment, according to the analysis. The city has been experiencing a resurgence of sorts as hip restaurants, shops, and entrepreneurs are flocking to the area. Yes, we know—you’ve heard this for a while. It’s really happening now.

So now let’s check out the best spots for first-year rental returns:

To figure out where nascent landlords can make the best ROI, HomeUnion:

Analyzed annual rent growth.

Looked at local economies, employment numbers, and previous rent hikes and drops.

HomeUnion looked only at all-cash sales for its calculations. While closing costs are not included, maintenance costs and other fees are part of the profits.

Those focused on getting a healthy flow of rental income from the get-go might want to cut this list out and put it on the wall:

Cleveland, OH, at 11.1%

Columbia, SC, at 9.7 %

Birmingham, AL, at 8.5%

Pittsburgh, PA, at 8.4%

Milwaukee, WI, at 8.4%

Cincinnati, OH, at 8.2%

Memphis, TN, at 8%

Greenville, SC, at 8%

Tampa, FL, at 8%

Philadelphia, PA, at 8%

Cleveland is delivering the best returns because the Midwestern city’s growing health care and manufacturing industries are expected to continue boosting both demand and prices for local homes, Hovland says.

The median rent for a two-bedroom apartment in Cleveland was $910 a month in July, according to ApartmentList. It was $880 in Columbia and $890 in Birmingham.

Columbia is a smart investment as the state capital is both a military hub, with more than 50,000 active-duty soldiers at Fort Jackson, and home of the University of South Carolina and its nearly 34,000 students.

Meanwhile, Birmingham’s biotech firms are booming, driving housing demand.

And Tampa, unlike Jacksonville and Orlando, earned a spot on both lists because it still has a lot of foreclosed homes and short sales—which are ripe for investment property pickers, Hovland says.

Should you get into the investment game?

“We are becoming more like a renter nation,”says Jon Ortner, vice president of business development with Renters Warehouse. The firm manages 15,000 homes in the country for investors, including 5,500 single-family homes in Minnesota, where the firm is based.

A young family that started renting a Minnesota house from Ortner’s firm six years ago is indicative of a growing trend, he says. They put their goal of homeownership on the back burner when they realized they could live in a good school district and have more disposable income without taking on a mortgage.

They are hardly alone.

The number of renters is up—rising by nearly 9 million families and individuals from 2005 to mid-2015, according to a study by Harvard University’s Joint Center for Housing Studies. A whopping 37% of Americans are now renters.

And the idea of living in a rental while owning an investment property somewhere cheaper seems to have special appeal to millennials, says Gary Beasley, CEO of Roofstock, an online marketplace for leased single-family rentals with property managers.

“Younger people like the exposure to real estate, but also like the fact that they are not tied down to primary residences and mortgages that limit their mobility,” he says.

One of his clients, a Google engineer in his early 30s who lives in the San Francisco Bay Area, could have used $129,000 in savings to buy a rental property in Orlando that would yield 6% in income. But instead, he bought five houses in Florida and Atlanta to diversify his investments. He expects to pocket 7.5%, or about $2,800 a month, in pure profit as a result.

Second-home owners can also reduce their tax load while growing equity in their property, says Diana Hill, director of real estate investing for financial education company Online Trading Academy.

But landlords must be mindful of treating their property like a business, says Brian Davis, co-founder and blogger at Spark Rental, an educational resource for landlords and property managers.

A tenant screening should include a full credit report, criminal background check, eviction history report, employment and income verification, and prior landlord verification

“Where mom-and-pop rental investors run into trouble is insufficient tenant screening and incomplete cash flow calculations,” he says.

The post The Best Cities to Invest in Real Estate on a Budget appeared first on Real Estate News and Advice - realtor.com.

Related Articles

Yahoo Finance

Yahoo Finance