Believe It or Not, Medical Marijuana Sales Could Fall -- Here's What It Means for Investors

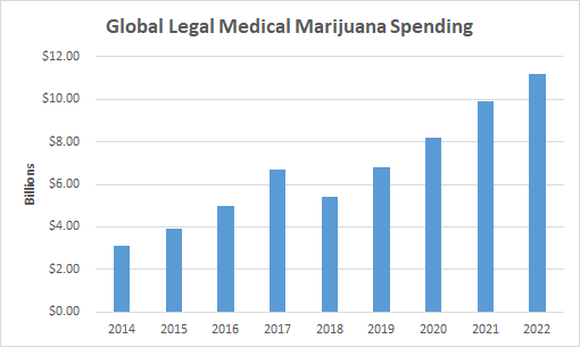

If you think medical marijuana sales have been soaring, you're right. In 2014, global medical marijuana spending totaled $3.1 billion, according to Arcview Market Research and BDS Analytics. By 2017, that figure had more than doubled to $6.7 billion.

Rapid growth for the medical marijuana industry makes sense. In the U.S., states are following each other in legalizing medical cannabis like dominoes falling one after another. With Oklahoma's recent vote to legalize medical marijuana, 30 U.S. states now have laws that broadly allow legal use of weed for medical purposes. Germany, the most heavily populated country in the European Union, legalized medical cannabis last year.

Based on the continued expansion of countries and states that allow legal medical marijuana, you might think global medical marijuana spending will keep on growing in 2018 like it has in previous years. But it won't -- at least not if projections from Arcview and BDS Analytics are right. Here's what's going on with medical marijuana markets and what it means for investors.

Image source: Getty Images.

The trend isn't a friend -- at least temporarily

Medical marijuana sales naturally increased as legalization efforts succeeded in U.S. states and in other countries. But take a look at this chart.

Data source: Arcview Market Research/BDS Analytics. Chart by author.

Everything was rocking along nicely until this year. Arcview Market Research and BDS Analytics project that global medical marijuana spending will drop by more than 19% year over year in 2018. That might be a shock, especially considering that medical marijuana spending jumped 34% last year.

Following the major dip in 2018, however, medical marijuana sales are expected to increase again. And the growth rate over the next four years should be nearly as impressive as the period between 2014 and 2017.

Behind the decline

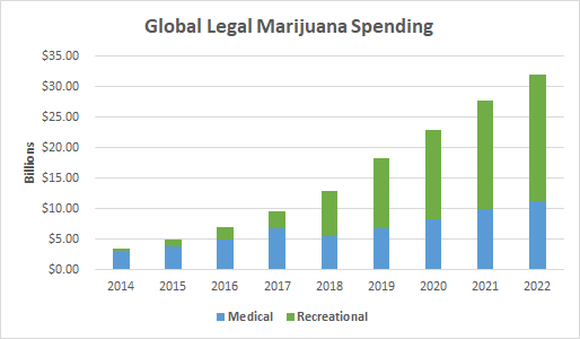

You might be scratching your head about why medical marijuana spending would sink so much in 2018 after several years of rapid growth. Are the analysts at Arcview and BDS Analytics off their rockers? Not at all. The explanation for the temporary decline in global medical marijuana spending can be seen in another chart.

Data source: Arcview Market Research/BDS Analytics. Chart by author.

Note that the growth trajectory for total global spending on marijuana doesn't taper off at all in 2018. That's because spending on recreational marijuana is projected to explode this year.

You can probably guess why recreational marijuana spending is taking off in 2018. California's legal recreational marijuana market opened this year. Most of the sales for medical marijuana in 2017 are expected to switch to recreational marijuana in 2018. It's easier for patients who took medical marijuana in the past to simply buy recreational marijuana instead of obtaining a prescription.

While California is the biggest reason for the decline in global medical marijuana spending this year, it's not the only factor. Canada passed legislation in June to legalize the adult use of recreational marijuana. The recreational market is scheduled to open across the country in October.

Impact on investors

Does the temporary decline of medical marijuana sales affect investors? Not as much as some might expect. Many of the stocks that profited from the sale of medical marijuana are either already making money from the recreational marijuana market or soon will do so.

MedMen Enterprises (NASDAQOTH: MMNFF), for example, has a significant focus on medical marijuana. The company recently acquired Treadwell Nursery to expand into Florida's medical marijuana market. But MedMen also has strong ties to California and is poised to benefit from growth in the state's recreational marijuana market.

All of the major Canadian medical marijuana growers are positioning themselves for the country's adult-use recreational market that opens in a few months. Aurora Cannabis (NASDAQOTH: ACBFF) has probably been the most aggressive at making acquisitions to increase its capacity in anticipation of the recreational market. But Aurora also continues to have its eyes firmly set on the global medical marijuana market -- an opportunity that the company's Chief Corporate Officer Cam Battley said last month that "not everyone has fully appreciated."

However, there has been some impact to investors that's related to the decline in medical marijuana spending. The transition in California from its previous medical marijuana market to the new recreational market has been a bumpy one.

Scotts Miracle-Gro (NYSE: SMG) especially felt this impact as the California market turned out to be weaker than expected, in part because the state and counties imposed taxes that were too high. But Scotts CEO Jim Hagedorn thinks conditions are starting to improve in California.

Probably the best approach for investors is to not view the marijuana market as different segments but instead look at it in its entirety. The rapid growth of recreational marijuana sales in the U.S. and Canada combined with global medical marijuana growth together present significant opportunities for marijuana stocks -- at least for some of them. However, the timing of how quickly these markets expand could also make some marijuana stocks risky bets.

More From The Motley Fool

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance