Bear of the Day: RH (RH)

RH RH is a curator of design, taste, and style in the luxury lifestyle market. The company offers collections through its retail galleries, source books, and online through multiple different websites.

Over the last 60 days, analysts have taken an overwhelmingly bearish stance on the stock, pushing it into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Share Performance & Quarterly Results

RH shares have struggled to gain traction over the last year, down more than 30% and underperforming relative to the Zacks Consumer Staples sector by a fair margin.

Image Source: Zacks Investment Research

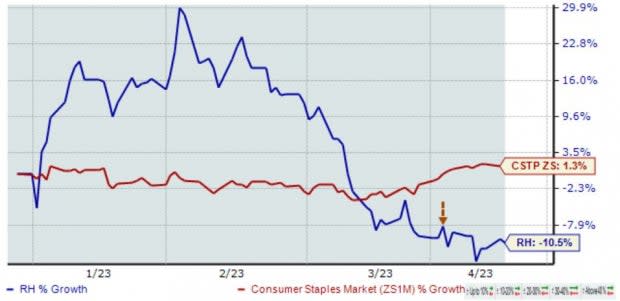

And year-to-date, RH shares are down more than 10%, indicating sellers have been in control and again underperforming relative to the Zacks Consumer Staples sector.

RH posted somewhat weak results in its latest release, falling short of the Zacks Consensus EPS Estimate by roughly 14% and reporting revenue modestly under expectations.

As illustrated by the arrow in the chart below, the market wasn’t impressed with the results, with shares moving downward post-earnings.

Image Source: Zacks Investment Research

RH’s next quarterly release is scheduled for June 1st; the Zacks Consensus EPS Estimate of $2.32 indicates a 70% decline in earnings year-over-year. Further, our consensus revenue estimate stands at $726.2 million, 24% lower than the year-ago figure.

Image Source: Zacks Investment Research

Valuation

Currently, RH shares trade at a 19.1X forward earnings multiple, above the 17.2X five-year median and nearly in line with the Zacks sector average.

Image Source: Zacks Investment Research

Further, the company’s forward price-to-sales presently works out to be 1.7X, in line with the five-year median and well below the Zacks sector average.

Image Source: Zacks Investment Research

RH carries a Style Score of “D” for Value.

Bottom Line

Weak quarterly results and negative earnings estimate revisions from analysts paint a challenging picture for the company in the near term.

RH RH is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook over the last several months.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RH (RH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance