Baytex Energy (TSX:BTE) Stock: A Preview to Strong Earnings for the Sector

Baytex Energy (TSX:BTE)(NTSE:BTE) stock is not rallying today. The price of oil is down, and investors remain skeptical. Yet Baytex just reported a fantastic earnings result and a very bullish five-year outlook. I think it’s a preview to a strong earnings reporting season for oil and gas stocks in general. So, investors may want to get ready for strength in this sector.

Let’s look into this.

Baytex Energy stock has languished, but things are looking good at the company

Baytex Energy reported a solid first-quarter result this morning. Key metrics are booming, and this is strengthening the case to invest in Baytex Energy stock. For example, production increased 12% sequentially. More importantly, cash flow increased over 90%, and the company was free cash flow positive again.

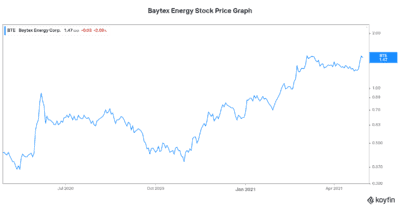

As we can see from this graph, Baytex Energy stock has been soaring in 2021. The price of oil has also been soaring and is now at almost $65. This is clearly impacting the fortunes of Baytex and all oil and gas companies. Baytex is now actively reducing its debt balance. What effects will a soaring oil and gas commodity price environment have on other Canadian energy stocks?

Suncor Energy stock: Up 24% so far in 2021

This bullish environment for oil and gas stocks is benefitting Suncor Energy (TSX:SU)(NYSE:SU) stock. Up 24% so far in 2021, Suncor will be releasing its first-quarter result on May 3. Market expectations are calling for EPS of $0.32. This is a dramatic improvement relative to last year, which came in at a loss of $0.20.

Suncor continues to trade at cyclical lows. It’s been battered along with the rest of the sector. But it has the advantage of a diversified business model. The refining side complements the exploration and production side of the business. In the end, Suncor should be less volatile. So, its stock price rise in 2021 hasn’t been as steep as Baytex Energy stock’s. But that’s to be expected, because Suncor has a lower risk profile.

This is setting Suncor up for continued good days ahead. On its Q4 call, Suncor management laid out their targets. Oil was trading closer to $55 at that time. They were targeting incremental cash flow of $1 billion by 2023 and $2 billion of incremental cash flows by 2025. Suncor breaks even at $35 oil. Oil is currently at $65. This translates into massive cash flows for 2021 and beyond assuming oil prices hold firm. Like Baytex Energy, Suncor’s cash flows will be massive if this oil price environment continues.

Baytex Energy stock is up more than 100% in 2021, but Canadian Natural Resources stock is also rallying

This environment is also benefitting Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) stock. Up 22% so far in 2021, CNQ stock is another top-quality energy stock. Canadian Natural Resources is Canada’s best-in-class oil and gas stock. Its long-life, low-decline assets are gems. They mean there are comparatively low capital expenditures and a high degree of predictability. Its asset base is resilient, diversified, and flexible.

Because of this, the company churns out massive amounts of cash flow, even in hard times. This makes Canadian Natural stock more resilient than Baytex Energy stock. But back to cash flow — 2020 cash flow came in at $4.7 billion. Free cash flow came in at a healthy $2.1 billion. Canadian Natural Resources stock still has a generous dividend yield of 5%. Expectations for the upcoming first-quarter release is for EPS of $0.84 versus a loss of $0.25 last year. This is obviously a huge improvement.

Motley Fool: The bottom line

Energy companies are having a moment here. Oil is at $65, and profitability and cash flows are rising in the sector. Baytex Energy stock isn’t rallying today, but its results were impressive. I expect that the other, larger energy stocks will rally after they post Q1 earnings next week.

The post Baytex Energy (TSX:BTE) Stock: A Preview to Strong Earnings for the Sector appeared first on The Motley Fool Canada.

Speaking of energy stocks...

Should you invest $1,000 in Suncor Energy right now?

Before you consider Suncor Energy, you may want to hear this.

Motley Fool Canadian Chief Investment Advisor, Iain Butler, and his Stock Advisor Canada team just revealed what they believe are the 10 best stocks for investors to buy right now... and Suncor Energy wasn't one of them.

The online investing service they've run since 2013, Motley Fool Stock Advisor Canada, has beaten the stock market by over 3X. And right now, they think there are 10 stocks that are better buys.

More reading

Fool contributor Karen Thomas owns shares of Canadian Natural Resources and CDN NATURAL RES.

5 Years From Now, You’ll Probably Wish You’d Grabbed These Stocks…Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. You aren’t on the list to receive our newest stock picks — but it’s not too late. 2021

Yahoo Finance

Yahoo Finance