Barrick, Randgold in $18.3B Merger, To Form Gold-Mining Giant

Barrick Gold Corporation ABX announced that it has inked an agreement with Randgold Resources Limited for a recommended share-for-share merger. The merger is expected to close by the first quarter of 2019, which is subject to approval by the companies’ shareholders, regulatory approvals and other customary closing conditions.

Per the terms, each shareholder of Randgold will receive 6.128 New Barrick shares for each Randgold share. Post completion of the merger, shareholders of Barrick Gold will own roughly 66.6% and shareholders of Randgold will own roughly 33.4% of the New Barrick Group, on a fully-diluted basis.

Moreover, shareholders of Randgold will be entitled to receive a dividend of $2 per Randgold share for the financial year 2018, which is subject to the approval of Randgold’s board of directors. Meanwhile, shareholders of Barrick Gold will receive an annualized dividend of up to 14 cents per Barrick share, subject to the discretion of Barrick Gold’s board of directors with respect to the declaration of dividends.

Strategy Behind the Merger

The merger is likely to form an industry-leading gold company with the highest concentration of Tier One Gold Assets (mines with 2017 production of at least 500,000 ounces of gold, total cash cost less than $748 per ounce and mine life of more than 10 years). Higher operating metrics, including lowest total cash cost position as well as highest adjusted EBITDA margin are likely to support sustainable investment in growth and shareholder returns.

The New Barrick Group will have total market capitalization of $18.3 billion, based on the closing prices of Barrick Gold and Randgold as of Sep 21, 2018, which was the last day of business prior to the announcement. Additionally, the New Barrick Group is likely to generate total revenues of roughly $9.7 billion and aggregate adjusted EBITDA of around $4.7 billion, based on the financial results of the companies in 2017.

The New Barrick Group will have the ability to generate strong cash flow to support robust investment and return cash to shareholders. It will also have established partnerships with leading Chinese mining companies along with superior scale and the largest gold reserves among senior gold peers such as Goldcorp Inc., Agnico Eagle Mines Limited and Newmont Mining Corporation NEM.

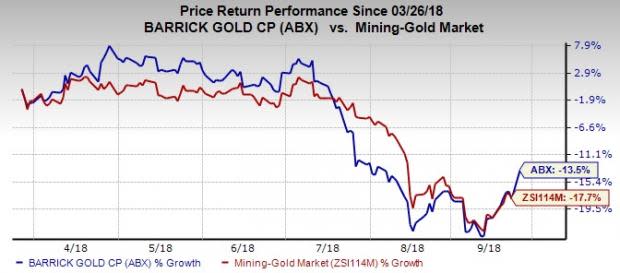

Price Performance

The company’s shares rose 5.4% and closed the day at $11.04, following the announcement. Barrick Gold’s shares have lost 13.5% in the past six months, compared with the industry’s decline of 17.7%.

Zacks Rank & Stocks to Consider

Barrick Gold currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the basic materials space are Trinseo S.A. TSE and Huntsman Corporation HUN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Trinseo has an expected long-term earnings growth rate of 12%. Its shares have gained 11.8% in the past year.

Huntsman has an expected long-term earnings growth rate of 8.5%. Its shares have moved up 4.7% in a year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntsman Corporation (HUN) : Free Stock Analysis Report

Trinseo S.A. (TSE) : Free Stock Analysis Report

Newmont Mining Corporation (NEM) : Free Stock Analysis Report

Barrick Gold Corporation (ABX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance