Banks hope to shake off concerns over a global recession in earnings

The large-cap banks will kick off the first earnings season of 2019 this week, and their biggest challenge will be fending off concerns about a looming recession.

Bank stocks had a tough 2018, mostly because investors have concerns about being exposed to financials if a recession cripples the industry with loan losses. With the post-crisis recovery now in its 10th year, warning signals — such as the Fed easing on its monetary policy and slight deterioration in credit quality — are starting to flash.

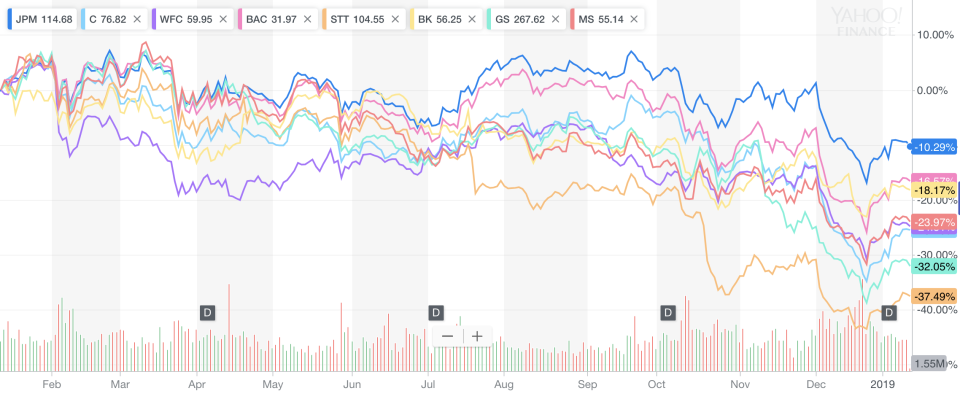

Shares of Morgan Stanley (MS), Wells Fargo (WFC), Citigroup (C), Goldman Sachs (GS), and State Street (STT) have all fallen over 20% over the last year. Although JPMorgan Chase (JPM), Bank of America (BAC), and Bank of New York Mellon (BK) have done better in comparison, they still underperformed the S&P 500 and the Dow Jones Industrial Average.

Worries about a coming recession weren’t calmed by a pre-Christmas surprise statement from the U.S. Treasury, in which Treasury Secretary Steven Mnuchin gave an all-clear sign on liquidity levels at the largest, most systemic financial institutions. Markets sold-off as the public scratched their heads over whether or not there was a liquidity issue in the first place.

Kevin Fromer, the president and CEO of the Financial Services Forum, told Yahoo Finance that liquid assets at the eight largest banks — which comprises the FSF’s membership — have doubled over the last 10 years and are vastly improved compared to pre-crisis levels.

“I think they’re well prepared to serve their customers,” Fromer said. “And I believe they’re doing so every day.”

The risk of a recession will be the major theme of this round of quarterly earnings, which kicks off when Citigroup reports on Monday morning.

Keep your eye on corporates

Morgan Stanley wrote Tuesday that the story for financials in 2019 will begin with the guidance that the large banks provide in their earnings calls this week. Their note said that consumer credit appears healthy as Americans continue to show confidence in spending. But Morgan Stanley raised a warning flag on the corporate sector, writing that while commercial and industrial loan growth has been strong, M&A volume fell sharply at the end of 2018. If merger activity remains tepid, that could hurt the banks with sizable investment banking units (i.e. Morgan Stanley, JPMorgan Chase, and Goldman Sachs).

Corporate lending is also in focus as concerns continue to mount over bank exposure to leveraged loans. Deteriorating conditions in corporate debt are raising questions about whether or not banks could handle the fallout if borrowers start to default on loans leveraged at six or seven times earnings. Although bank exposure has historically been low because banks usually sell the loans to investors, enthusiasm in the market for leveraged loans has cooled off significantly over the last two months. Citi published a note Wednesday citing the risk of banks holding onto leveraged loans they can’t sell, which could be seen in this week’s earnings.

“A risk is the potential negative impact of leveraged loan deals that didn’t clear the market in 4Q, with debt perhaps remaining on the banks’ books which could weigh on 4Q earnings,” Citi wrote.

Citi added that malaise among the bank stocks has largely been a result of macroeconomic readings through financial market indicators such as a flattening yield curve.

But Rafferty Capital Markets’s Dick Bove told Yahoo Finance that 2018 was a good year for banks on paper; the sector showed modest loan growth, higher margins, lower costs, and no concerning uptick in loan losses.

“They did phenomenally bad, and the underlying fundamentals of the companies were not that bad,” Bove said of the dissonance between their share prices and overall performance in 2018.

RBC Capital Markets expects the banks to report another quarter of solid earnings, estimating year-over-year loan growth of 2.4%, a two basis point increase in net interest margin (a measure of interest collected on loans minus interest paid on deposits), lower operating expenses, and strong credit quality.

Credit Suisse writes that now is the time for individual companies to prove that they can hedge against a possible economic slowdown with stronger operating metrics and a competitive attitude.

“All banks are not equal,” Credit Suisse’s Susan Roth Katzke wrote in a note Monday. “Some will fare better than others. Those that fare best will be the profitable market share takers. These are the banks we want to own.”

A version of this story was initially published on January 11, 2019.

—

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

Powell, Clarida insist the Fed will be ‘patient’ with monetary policy

5 game-changing papers from this year’s largest gathering of economists

Wells Fargo economist: It’s time to abandon the yield curve

Fed Chair Powell communicates that monetary policy is not on autopilot

Congress may have accidentally freed nearly all banks from the Volcker Rule

Yahoo Finance

Yahoo Finance