Bank of Canada holds interest rate, lowers growth forecast

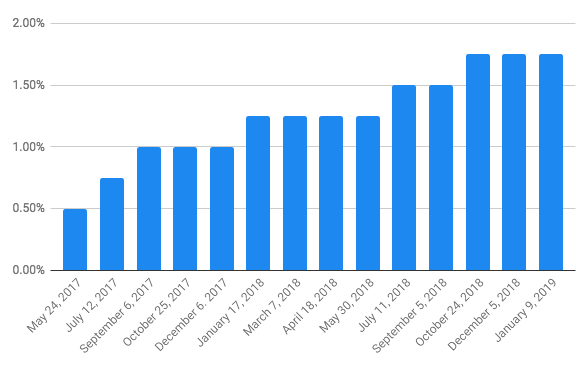

There were no surprises from the Bank of Canada. For the second month in a row, it announced the economy isn’t ready for an interest rate hike. The benchmark rate stays at 1.75 per cent.

The Bank of Canada now expects real GDP will grow by 1.7 per cent in 2019. That’s lower than the 1.9 per cent projected in its October outlook. It also sees increasing signs that the US-China trade conflict is weighing on global demand and commodity prices.

The Bank of Canada expects mandatory production cuts will take a toll on Canada’s oil sector. But it says the rest of the economy is performing well.

“The Bank of Canada has taken itself out of the rate hike game, and its message today suggests that it isn’t quite as sure about when it will come off the sidelines and hike again,” says CIBC chief economist Avery Shenfeld, in a research note.

The bank last raised interest rates at its October meeting, for the third hike in 2018. That was before the stomach-churning stock market drops, plunging oil prices, and elevated fears of a global economic slowdown.

It was also before U.S. Federal Reserve Chair Jerome Powell signaled a willingness to pump the brakes on rate hikes if the economy hit the skids.

Markets saw no additional hikes ahead of the announcement. Back in November 2018, traders expected three.

Bank of Canada Governor Stephen Poloz has said future hikes will be data dependent. That includes the fallout from falling oil prices, sluggish wage growth, and global trade tensions.

Last month, Poloz called the current level of interest rates “appropriate for the time being.”

The Bank of Canada reiterated the need to rise over time to a neutral range, which it estimates is between 2.5 and 3.5 per cent.

“If we’re right that even the Bank’s new lower economic growth forecasts will prove too optimistic, then there is little prospect of further rate hikes,” says Capital Economics’ Stephen Brown, in a research note.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance