Ball Corp's New Aluminum Cups an Alternative to Plastic Ones

Ball Corporation BLL recently rolled out the first-ever infinitely recyclable aluminum cups in the United States, in response to consumers’ demand for sustainable packaging. The latest product aims to replace plastic cups with aluminum cups.

Ball Corporation has developed the aluminum cup as an alternative to plastic cups, over the past several years. These aluminum cups are used at home as well as indoor and outdoor venues across the United States. Through 2020, the company’s latest innovation will produce a limited supply of aluminum cups for entertainment venues and major concessionaires.

Ball Corporation’s latest launch backs consumers’ rising demand for sustainable beverage packaging options. Further, the new solution positions the company well to expand its product line over the next several years.

In September, Ball Corporation will unveil its aluminum cups along with additional products at major entertainment and sports venues across the United States. Per Ball Corporation’s research, 78% of consumers expect beverage brands to start using environmentally-friendly containers, over the next five years.

In fact, in addition to sustainability and recycling strengths, these cups are durable, sturdy, and can be customized with logos and graphics. Currently available in a 20-ounce size, the aluminum cups will likely be available in other sizes as well in the near future, based on market demand.

Ball Corporation anticipates to ramp up production in its Westminster, CO, innovation facility by the end of 2020.

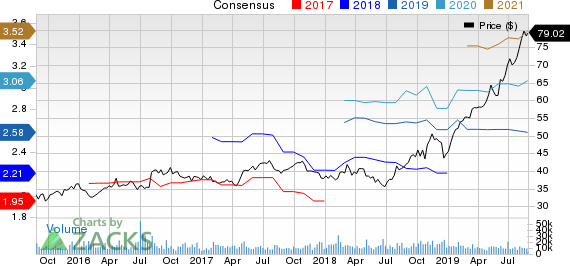

Ball Corporation's shares have surged 90.5% over the past year compared with the industry’s growth of 60.8%.

Overall global beverage can demand continues to grow as customers are now preferring cans over glass and plastic. Ball Corporation remains poised to capitalize on this demand by investing in capacity and products.

Ball Corporation’s Segments Poised for Growth in 2019

The company expects to achieve EBITDA of $2 billion and free cash flow of more than $1 billion in the current year, backed by continued strong demand for aluminum packaging and robust aerospace backlog. The Beverage Packaging, North and Central America segment will gain from volume growth and net fixed cost savings in the remaining half of the year.

The Beverage Packaging, South America segment is poised well for improved results, with robust industry beverage can demand in South America, particularly in Brazil. The Beverage Packaging, Europe segment will also gain on customers’ growing preference for cans and increased production in new lines in the company’s existing facilities. Further, the company is poised to benefit from solid backlog in its aerospace segment.

Ball Corporation Price and Consensus

Ball Corporation price-consensus-chart | Ball Corporation Quote

Zacks Rank & Key Picks

Ball Corporation carries a Zacks Rank #3 (Hold), at present.

A few better-ranked stocks in the Industrial Products sector are Zebra Technologies Corporation ZBRA, Avery Dennison Corporation AVY and Tetra Tech, Inc. TTEK. While Zebra Technologies presently sports a Zacks Rank #1 (Strong Buy), Avery Dennison and Tetra Tech carry a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zebra Technologies has a projected earnings growth rate of 16.71% for the current year. The stock has gained 25% in a year.

Avery Dennison has an estimated earnings growth rate of 8.42% for 2019. The company’s shares have gained 8.3% in the past year.

Tetra Tech has an expected earnings growth rate of 15.97% for the ongoing year. The stock has appreciated 48% over the past year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ball Corporation (BLL) : Free Stock Analysis Report

Zebra Technologies Corporation (ZBRA) : Free Stock Analysis Report

Avery Dennison Corporation (AVY) : Free Stock Analysis Report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance