Ball Corp Shares Up 61% in a Year: What's Driving the Rally?

Shares of Ball Corporation BLL have outperformed the industry in the past year, aided by continued strong demand for aluminum packaging, solid backlog in the aerospace segment, new products and focus on cost-cutting actions. The stock has surged 60.8% over the past year, outperforming the industry’s growth of 41.2%.

The company has a market cap of $24.1 billion. For the last three months, its average volume of shares traded has been approximately 2.19M. The company has an expected long-term earnings per share growth rate of 5.50%.

Let’s delve deeper and analyze the reasons behind the company’s impressive price performance and find out if there is room for further appreciation:

Strong Outlook: Ball Corporation expects to achieve EBITDA of $2 billion and free cash flow of more than $1 billion in 2019. This is backed by continued solid demand for aluminum packaging and a robust aerospace backlog. The Aerospace business is poised to witness revenue growth of nearly 25% this year. With contracted backlog levels and won-not-booked backlog of $4.8 billion at the end of the second quarter, the future looks bright for aerospace for the next three to five years.

The company anticipates earnings per share to be up 10-15% in 2019 and beyond. Additionally, overall global beverage can demand continues to grow as customers are now preferring cans over glass and plastic.

Healthy Growth Projections

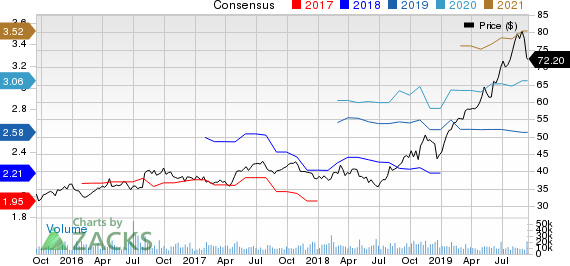

The Zacks Consensus Estimate for Ball Corporation’s 2019 earnings per share is currently pegged at $2.58, indicating year-over-year growth of 17.5%. The same for 2020 is pinned at $3.06, calling for a year-over-year rise of 18.5%.

Driving Factors

Ball Corporation’s North and Central American segment is likely to benefit from fixed cost savings, volume growth, improved aluminum can-sheet quality and reduce start-up costs in 2019 and beyond. The South America segment is strongly positioned for improved results in the current year as industry beverage-can demand in South America, particularly in Brazil, is solid. Beer customers are shifting from glass packaging to aluminum cans, and overall consumption of alcohol and non-alcoholic products are on the rise.

Furthermore, the Europe segment will benefit from customers’ growing preference for cans and increased production in new lines in the company’s existing facilities.

The company continues to execute its strategies of achieving better value for standard products and higher growth for specialty products. Ball Corporation’s focus on pursuing cost-out programs, completing growth-capital projects and commercializing on the inherent sustainability attributes of metal packaging will bear fruit in the days ahead.

Ball Corporation Price and Consensus

Ball Corporation price-consensus-chart | Ball Corporation Quote

Zacks Rank & Stocks to Consider

Ball currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Albany International Corporation AIN, AGCO Corporation AGCO and UFP Technologies, Inc. UFPT. While Albany International sports a Zacks Rank #1, AGCO Corp and UFP Technologies carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Albany International has an estimated earnings growth rate of 33.85% for 2019. The company’s shares have rallied 40.1%, year to date.

AGCO Corp has a projected earnings growth rate of 31.11% for the current year. The stock has gained 38.1% so far this year.

UFP Technologies has an expected earnings growth rate of 8.10% for the ongoing year. The stock has appreciated 11.1% over the past year.

5 Stocks Set to Double

Zacks experts released their picks to gain +100% or more in 2020. One is a famous cutting-edge food company that is “hiding in plain sight.” Swamped with competitors and ignored by Wall Street, its stock price floundered. Now, suddenly, it acquired a company that gives it an advantage none of its peers have.

Today, see all 5 stocks with extreme growth potential >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ball Corporation (BLL) : Free Stock Analysis Report

UFP Technologies, Inc. (UFPT) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Albany International Corporation (AIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance