Avis Budget (CAR) Q4 Earnings Beat Estimates, '18 View Solid

Avis Budget Group, Inc. CAR reported solid fourth-quarter 2017 results with adjusted earnings of $38 million or 45 cents per share compared with $13 million or 15 cents per share in the prior-year quarter. Adjusted earnings comfortably beat the Zacks Consensus Estimate of 19 cents.

GAAP earnings for the quarter were $220 million or $2.65 per share against a loss of $31 million or 35 cents per share in the year-ago quarter. The improvement was primarily driven by global sales growth, positive pricing in the Americas, cost-cutting measures and one-time U.S. tax reform benefit. GAAP earnings for full-year 2017 amounted to $361 million or $4.25 per share compared with $163 million or $1.75 per share for the prior-year.

Revenues for the reported quarter were $2,019 million compared with $1,879 million in the year-ago quarter. The year-over-year increase was largely attributable to pricing and utilization improvement in the Americas, strong volume growth and stringent cost-cutting initiatives. The company’s revenues barely exceeded the Zacks Consensus Estimate of $2,018 million. Total revenues for full-year 2017 increased 2% year-over-year to $8,848 million from $8,659 million for the prior-year.

For the quarter, adjusted earnings before interest, tax, depreciation and amortization (EBITDA) were $140 million compared with $121 million in the year-ago quarter.

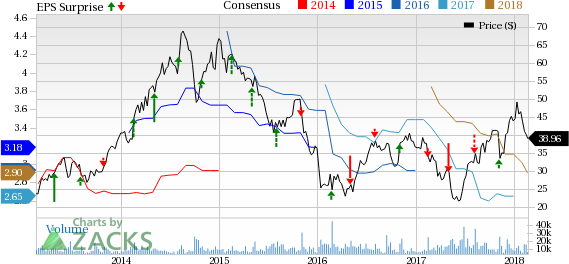

Avis Budget Group, Inc. Price, Consensus and EPS Surprise

Avis Budget Group, Inc. Price, Consensus and EPS Surprise | Avis Budget Group, Inc. Quote

Segmental Performance

Americas reported revenues of $1,382 million compared with $1,343 million in the prior-year quarter, primarily due to 3% increase in volume and a more than 2% rise in local currency time and mileage revenues per day, partially offset by 2% lower ancillary revenues per day.

The International segment’s revenues for the reported quarter increased 19% year over year to $637 million due to 15% increase in rental days including 8% benefit from the acquisition of FranceCars.

Financials

Avis Budget had cash and cash equivalents of $611 million as of Dec 31, 2017 compared with $490 million in the prior-year. Net cash inflow from operating activities amounted to $2,648 million at the year-end 2017.

The company’s long-term debt increased to $3,599 million at the end of the year from $3,523 million in the prior year.

For full-year 2017, the company reported adjusted free cash flow of $354 million.

Avis Budget repurchased approximately 1.9 million shares worth $73 million during the fourth quarter, bringing the full-year tally to 6.1 million shares for $200 million.

2018 Guidance

For full-year 2018, Avis Budget forecasts revenues of $9,200 million to $9,450 million, excluding the impact from future changes in currency exchange rates. The company expects adjusted EBITDA of $740 million to $820 million.

For the year, adjusted earnings is expected to be $240 million to $310 million. The company expects adjusted free cash flow between $325 million to $375 million.

Zacks Rank & Key Picks

Avis Budget has a Zacks Rank #5 (Strong Sell). A few better-ranked stocks in the same industry are:

Healthcare Services Group, Inc. HCSG, SGS SA SGSOY and Xerox Corporation XRX each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Healthcare Services has an expected long-term earnings growth rate of 11%.

SGS has an expected long-term earnings growth rate of 6%.

Xerox surpassed estimates thrice in the trailing four quarters with an average beat of 5.2%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Healthcare Services Group, Inc. (HCSG) : Free Stock Analysis Report

SGS SA (SGSOY) : Free Stock Analysis Report

Xerox Corporation (XRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance