Aviat (AVNW) Boosts Multi-Band Solution With MB-XD Enhancement

Aviat Networks, Inc. AVNW recently announced the addition of a significant enhancement to its WTM 4800 Multi-Band product line. Dubbed MB-XD, the latest improvement will enable superior multi-band solutions to support 5G with augmented rural broadband networks on the back of extended radio links over longer distances.

With an experience of more than seven decades, Aviat Networks has been a global provider of microwave networking solutions. The entity offers public and private operators with communications networks to cater to the accretive demand for IP-centric, multi-gigabit data services.

With avant-garde technology, Aviat simplifies the entire lifecycle of designing, deploying, and maintaining wireless transport networks with greater performance and reliability. The WTM 4800 is touted as the industry’s simplest multi-band solution.

It considerably minimizes the total cost of ownership (TCO) compared to alternative solutions that are dependent on two, three, and four separate multi-band radio boxes. It is a unique radio platform that has been specifically designed to support E-Band and Multi-Band 5G transport applications.

The WTM 4800 is available in three different product options — 10 Gbps E-Band (Single channel 80 GHz radio), 20 Gbps E-Band (Dual channel 80 GHz radio), and 10 Gbps Multi-band (single channel 80 GHz plus a single or 11-23 GHz dual-channel microwave radio).

The recent incorporation of MB-XD capability in Aviat’s WTM 4800 Multi-Band product line will facilitate operators to reduce their TCO by up to 90% per link compared to other fiber alternatives. Further, it will support ultra-long-distance applications while extending the reach of 10 Gbps links over distances up to 20 km.

It will also help in significantly reducing recurring spectrum fees. These robust characteristics of the MB-XD enhancement are likely to enable operators to deliver state-of-the-art network services at higher capacities and bolster Aviat’s global footprint by expanding its diverse portfolio of wireless transport solutions and services.

Aviat is well-positioned to benefit from robust market dynamics, cost-reduction efforts, favorable customer mix, and higher investments in innovative software solutions. A solid liquidity position and balance sheet despite the COVID-19 uncertainties are likely to aid the company in executing key long-term strategic objectives.

Backed by a resilient business model, Aviat Networks benefits from strong demand for best-in-class broadband connectivity in rural areas and mission-critical networks. Also, higher revenues from private network business in North America, significant bottom-line improvement, and margin expansion fueled by an upsurge in software sales bolsters the company’s profitability.

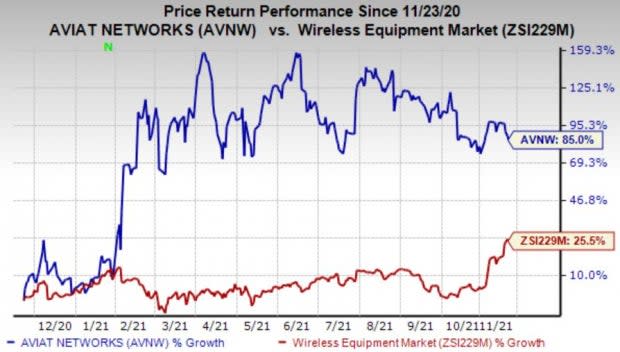

The Austin, TX-based company currently has a Zacks Rank #3 (Hold). Its shares have gained 85% compared with the industry’s growth of 25.5% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Clearfield, Inc. CLFD is a better-ranked stock in the industry, sporting a Zacks Rank #1. The consensus estimate for current-year earnings has been revised 8.8% upward over the past 30 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.8%, on average. The stock has rallied 186.7% in the past year.

Qualcomm Incorporated QCOM is another solid pick for investors, carrying a Zacks Rank #2 (Buy). The consensus estimate for current-year earnings has been revised 14.1% upward over the past 30 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 11.2%, on average. It has gained 28.6% in the past year. QCOM has a long-term earnings growth expectation of 15.3%.

Sierra Wireless, Inc. SWIR also carries a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has narrowed from a loss of $1.22 per share to a loss of 97 cents over the past 30 days.

Sierra Wireless delivered a trailing four-quarter earnings surprise of 34.2%, on average. It has returned 62% in the past year. SWIR has a long-term earnings growth expectation of 12.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Sierra Wireless, Inc. (SWIR) : Free Stock Analysis Report

Aviat Networks, Inc. (AVNW) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance