AvalonBay (AVB) Q1 FFO and Revenues Miss Estimates, Up Y/Y

AvalonBay Communities, Inc.’s AVB first-quarter 2020 core funds from operations (FFO) per share of $2.39 increased 3.9% year over year. However, the figure narrowly missed the Zacks Consensus Estimate of $2.40.

This year-over-year increase reflects growth in average rental rates and economic occupancy.

Total revenues of $601.7 million were up 6.3% year over year. However, the revenue figure missed the Zacks Consensus Estimate of $601.9 million.

The company has also apprised about the April residential revenue collections for established communities, through Apr 30, 2020, in light of the coronavirus pandemic.The collected residential revenues (denoting the part of billed residential revenue that has been collected and satisfied ) were 93.9%, while deferred and uncollected residential revenues came in at 6.1%.

Moreover, the company noted that retail revenues for established communities denoted 1.4% of the total revenues for established communities for full-year 2019. For the month of April, collected retail revenues and deferred and uncollected retail revenues was 44% and 56%, respectively.

Quarter in Detail

In the reported quarter, revenues from established communities improved 3% year over year to $547.9 million. Results reflect a 2.7% increase in average rental rates and 0.4% growth in economic occupancy.

Operating expenses for established communities rose 3.2% on a year-over-year basis. Consequently, NOI from established communities climbed 3% year on year to $391.6 million.

Portfolio Activity

During the first quarter, AvalonBay sold wholly-owned operating community — Avalon Shelton — in Shelton, CT, for $64.7 million, leading to a gain in accordance with GAAP of $24.4 million and economic gain of $14.9 million. It also sold 36 of the 172 residential condominiums at The Park Loggia, in New York, NY, for $105.6 million. In addition, following the quarter end and through May 6, the company sold five residential condominiums for $23.3 million.

Further, during the March-end quarter, AvalonBay completed the development of three apartment communities — Avalon Teaneck, in Teaneck, NJ; Avalon North Creek, in Bothell, WA; and Avalon Norwood, located in Norwood, MA — comprising a total of 762 apartment homes, for a total capital cost of $217 million.

During the January-March period, the company did not commence the construction of any new development communities. As of Mar 31, 2020, AvalonBay had 19 development communities under construction (expected to contain 6,198 apartment homes and 64,000 square feet of retail space). The estimated total capital cost at completion for these development communities is $2.32 billion at share.

Notably, at the end of the first quarter, AvalonBay had an estimated remaining total capital cost of $873 million for investment over the next several years. These includes the 19 development communities under construction as well as recently accomplished development communities.

As of Mar 31, 2020, the projected total capital cost of development rights decreased to $4.1 billion from the prior-quarter end’s $4.2 billion.

Balance Sheet Position

As of Mar 31, 2020, AvalonBay had $750-million outstanding under its $1.75-billion unsecured credit facility. Together with amounts drawn on the unsecured credit facility, the company had $868.4 million in unrestricted cash and cash in escrow as of the same date. In addition, its annualized net debt-to-core EBITDAre for the January-March quarter was 4.6 times and unencumbered NOI was 93%.

Furthermore, as of Apr 30, 2020, the company had $215-million outstanding under its unsecured credit facility following the use of unrestricted cash for net repayments of $535 million in April.

AvalonBay currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

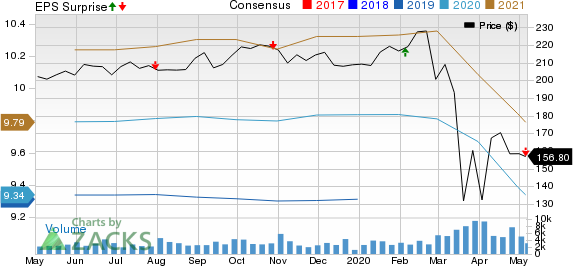

AvalonBay Communities Inc Price, Consensus and EPS Surprise

AvalonBay Communities Inc price-consensus-eps-surprise-chart | AvalonBay Communities Inc Quote

We, now, look forward to the earnings releases of other REITs like Outfront Media Inc. OUT, Kimco Realty Corp. KIM and Ventas, Inc. VTR, which are slated to report quarterly numbers on May 8.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

AvalonBay Communities Inc (AVB) : Free Stock Analysis Report

Ventas Inc (VTR) : Free Stock Analysis Report

OUTFRONT Media Inc (OUT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance