Automatic Data Processing (ADP) Hits New 52-Week High: Here's Why

Shares of Automatic Data Processing, Inc. ADP have scaled a 52-week high of $241.18 in the trading session on Nov 22, before closing a tad lower at $236.82.

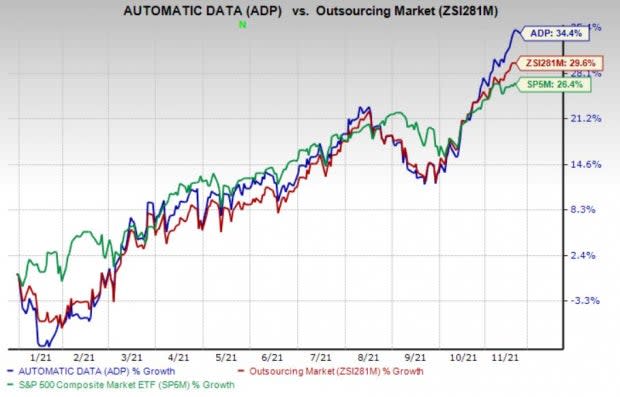

The company’s shares have charted a solid trajectory, appreciating 34.4% year to date compared with 29.6% growth of the industry it belongs to and a 26.4% increase of the Zacks S&P 500 composite.

Image Source: Zacks Investment Research

Let’s find out what’s supporting the uptick.

Dividend Hike

Automatic Data Processing’s board of directors has announced a dividend hike of 11.8%, thereby raising its quarterly cash dividend from 91 cents per share to $1.04. This reflects Automatic Data Processing’s 47th consecutive year of increased cash dividend. The raised dividend will be paid out on Jan 1, 2022 to shareholders of record on Dec 10, 2021.

Raised Fiscal 2022 Outlook

ADP raised its fiscal 2022 outlook. The company now expects revenues to register 7-8% growth compared with the prior growth rate of 6-7%. Adjusted EPS is now expected to register 11-13% growth compared with the prior growth rate of 9-11%.

The company now expects Employer Services revenues to grow at a rate of 5-6% compared with the prior growth rate of 4% to 6% and PEO Services revenues at a rate of 11-13% compared with the prior growth rate of 9% to 11%.

Consecutive Earnings & Revenue Beat

ADP reported better-than-expected earnings and revenue performance in the last three quarters.

Acquisitions Bode Well

Strategic acquisitions like Celergo, WorkMarket, Global Cash Card and The Marcus Buckingham Company have strengthened ADP’s customer base and are helping it expand operations in international markets. The company continues to pursue acquisitions that strategically fit its overall business mix and are easy to integrate over the long term.

Three-Tier Business Strategy

ADP’s three-tier business strategy helps it maintain and grow its strong position as a human capital management (“HCM”) technology and services provider. The company is focused on delivering a complete suite of cloud-based HCM and HR Outsourcing (“HRO”) solutions. It is expanding its international HCM and HRO businesses with established local, in-country software solutions and cloud-based multi-country solutions.

Zacks Rank and Stocks to Consider

ADP currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some similar-ranked stocks in the broader Zacks Business Services sector are Avis Budget CAR, Gartner IT and Charles River CRAI.

Avis Budget has an expected earnings growth rate of around 398.1% for the current year. The company has a trailing four-quarter earnings surprise of 76.7%, on average.

Avis Budget’s shares have surged 667.5% so far this year. The company has a long-term earnings growth of 27.5%.

Gartner has an expected earnings growth rate of around 78.3% for the current fiscal year. The company has a trailing four-quarter earnings surprise of 59%, on average.

Gartner’s shares have surged 108.8% so far this year. The company has a long-term earnings growth of 12%.

Charles River has an expected earnings growth rate of around 61.2% for the current fiscal year. The company has a trailing four-quarter earnings surprise of 50.9%, on average.

Charles River’s shares have surged 104.9% so far this year. The company has a long-term earnings growth of 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance