Auto Stock Q3 Earnings Roster for Oct 25: LEA, ALV, GT & SMP

The third-quarter earnings season seems to have started on an optimistic note for the Auto-Tires-Trucks sector. A host of industry players are expected to report quarterly results by the end of this week.

Picture Thus Far and Expectations

Per the Earnings Trends report dated Oct 23, 37.5% of the S&P auto components have already reported quarterly results, with their total earnings up 4.9% from the same period last year on 7.9% higher revenues. Notably, 100% of the firms surpassed the Zacks Consensus Estimate for earnings, while 66.7% topped revenue estimates.

A look back at the Q2 earnings season reflects that the auto sector’s earnings recorded a decline of 0.7% year over year, while revenues inched up 0.1%. In the third quarter, revenues and sales are expected to scale down 2% and 20.8% year over year, respectively.

Let’s take a look at the factors that are likely to have affected auto stocks in the to-be-reported quarter.

Challenges Galore in Auto Sector in Third Quarter

Automakers around the globe have been struggling with declining car sales amid economic slowdown concerns. This trend is likely to have continued in the third quarter. Auto sales in China, the world’s largest car market, continued to plunge during the quarter amid recession worries and trade war tensions that have been denting confidence of consumers and holding back manufacturers. Increasing popularity of ride-sharing platforms are also likely to have weighed on car sales. Stricter emission woes, and shift toward electric and autonomous vehicles are likely to have changed the sector’s dynamics. Widespread usage of technology and rapid digitalization resulted in fundamental restructuring of the automotive market. This is likely to have increased manufacturing vehicles’ costs, which were passed on to consumers and dented demand. Meanwhile, technological complications call for high-priced aftersales services, which may have created new opportunities for auto equipment manufacturers to capitalize on.

Key Releases on Oct 25

Given the bleak year-over-year backdrop, let’s take a glance at how three auto players are placed ahead of their third-quarter results, slated to release on Oct 25.

Lear Corporation LEA: Lear — one of the leading Tier 1 suppliers to the global automotive industry — is slated to report quarterly results before the opening bell.

Our proprietary model clearly indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The firm came up with weaker-than-expected earnings in the last reported quarter amid lower-than-anticipated revenues from the Seating segment. As far as earnings surprises are concerned, the firm displays a mixed record. It surpassed the Zacks Consensus Estimate in two of the last four quarters, with an average positive surprise of 1.02%.

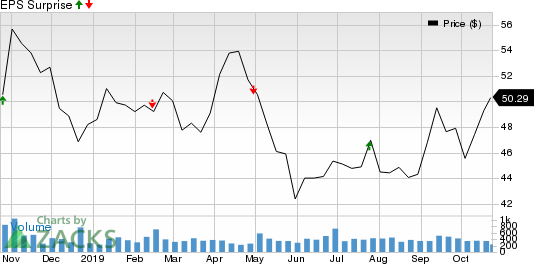

Lear Corporation Price and EPS Surprise

Lear Corporation price-eps-surprise | Lear Corporation Quote

Lear carries a Zacks Rank #3 and has an Earnings ESP of 0.00%, which makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

The current Zacks Consensus Estimate for the quarter to be reported is earnings of $3.20 per share on revenues of $4.75 billion. Lear’s acquisition of Xevo early this year, which integrated the latter’s e-commerce vehicle platform technology with Lear’s electronic expertise, is likely to have positively reflected in the quarter to be reported. However, lower production volumes in key markets, especially China and Europe, are likely to have impacted Lear’s top line. Notably, the Zacks Consensus Estimate for the firm’s Seating segment revenues is pegged at $3,633, indicating a 1.3% year-over year decline. Further, the consensus estimate for sales from the E-systems segment stands at $1,171 million, suggesting a decrease from $1,208.6 million reported in the year-ago period.

Autoliv, Inc. ALV: Autoliv, a Swedish auto-industry supplier, is also set to unveil quarterly numbers before the market opens. While the firm came up with better-than-expected results in the last reported quarter, it missed earnings estimates in three out of the last four quarters.

Autoliv, Inc. Price and EPS Surprise

Autoliv, Inc. price-eps-surprise | Autoliv, Inc. Quote

Things are not looking up for Autoliv this time around as the firm currently carries a Zacks Rank #3 and an Earnings ESP of 0.00%.

The current Zacks Consensus Estimate for the quarter to be reported is earnings of $1.38 per share on revenues of $2.10 billion. The company’s product segments — Airbags and Seatbelts — are sending mixed signals for the to-be-reported quarter. Weaker vehicle sales in Europe and China are likely to have impacted revenues from Seatbelt products. Notably, the Zacks Consensus Estimate for third-quarter 2019 Seatbelt revenues is pegged at $660 million, implying 2.4% year-over-year fall. However, estimates for Airbag revenues stand at $1,397 million, suggesting an uptick from $1,357 million recorded in the year-ago quarter. The firm’s product launches and strong performance of frontal and side airbags, especially in North America, are likely to have buoyed its earnings in the to-be-reported quarter.

The Goodyear Tire & Rubber Company GT: Goodyear Tire, one of the largest tire manufacturing companies in the world, is slated to post quarterly results before the opening bell. The firm came up with weaker-than-expected results in the last reported quarter due to lower sales volumes across all its major markets including North America, Europe and Asia Pacific regions. As far as earnings surprises are concerned, the firm displays a dismal record of missing the Zacks Consensus Estimate in three of the last four quarters.

The Goodyear Tire & Rubber Company Price and Consensus

The Goodyear Tire & Rubber Company price-consensus-chart | The Goodyear Tire & Rubber Company Quote

Our proven model does not conclusively predict an earnings beat for Goodyear Tire this time around, as it currently carries a Zacks Rank #3 and Earnings ESP of -11.56%.

The Zacks Consensus Estimate for the quarter to be reported is earnings of 50 cents per share on revenues of $3.78 billion. The firm’s strategic asset, TireHub, which is the national tire distributor of the United States, is likely to have boosted performance of Goodyear Tire in the quarter to be reported. The company’s restructuring efforts, launch of products, and innovative mobility connectivity via Roll retail pilot and Mobile Tire Shop Network are expected to have positively reflected in third-quarter results. Goodyear Tire’s strategy of slashing costs by reducing its manufacturing footprint in Alabama is also likely to have aided margins. However, challenging macroeconomic environment in major markets served by the company is likely to have dented the top line. Concerns regarding U.S.-China trade tussle and economic slowdown, as well as sagging auto sales in the United States are likely to have weighed on the company’s third-quarter 2019 earnings.

Standard Motor Products, Inc. SMP: Standard Motor came up with better-than expected results in the last reported quarter on the back of strong performance from Engine Management and Temperature Control segments. As far as earnings surprises are concerned, the firm displays a mixed record. It surpassed the Zacks Consensus Estimate in two of the last four quarters.

Standard Motor Products, Inc. Price and EPS Surprise

Standard Motor Products, Inc. price-eps-surprise | Standard Motor Products, Inc. Quote

Our proven model does not conclusively predict an earnings beat for Standard Motor this time around, as it currently carries a Zacks Rank #2 and Earnings ESP of 0.00%.

The current Zacks Consensus Estimate for the quarter to be reported is earnings of 92 cents per share on revenues of $304.7 million. Increasing orders from both Temperature Control and Engine Management segments are likely to have boosted Standard Motor’s overall sales in the quarter to be reported. For the Temperature Control unit, pre-season orders are likely to have been solid. This is expected to have driven its top line. Further, Engine Management — except the wire and cable business — is likely to have gained from strong orders on the back of the buyout of Pollak business early this year. Nonetheless, high labor costs and industry headwinds are likely to have weighed on the firm’s bottom line.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Standard Motor Products, Inc. (SMP) : Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance