Auto Sector Q4 Earnings Roster for Feb 2: F, HOG & More

The fourth-quarter 2022 earnings season for the Auto-Tires-Trucks sector kicked off last week. So far this earnings season, three S&P sector components— namely Tesla, PACCAR and General Motors— have come up with quarterly numbers. Despite the industry odds, all three companies not only managed to pull off a comprehensive beat but also witnessed year-over-year growth in the top and bottom lines.

Ford F, Harley-Davidson HOG, Asbury Automotive ABG and Lear Corporation LEA are some of the auto stocks lined up to report tomorrow. Before glancing through the key projections for these stocks, let's take a look at the general factors that are likely to shape the companies’ upcoming results.

Factors Setting the Tone for Auto Stocks’ Q4 Results

The fourth-quarter of 2022 was a mixed bag for the auto space, with some automakers witnessing a year-over-year increase in the number of vehicles sold while others saw a decline. In general, what aided the industry was the gradual abatement of chip woes and a slight improvement in supply chain systems. As such, inventory levels were on the rise. Inventory levels in December came in more than one million units for the third consecutive month, per J.D. Power and LMC Automotive. Per TrueCar, the total new light-vehicle inventory, including fleet and commercial vehicles, totaled 1.8 million in December 2022, up from 1.1 million recorded in December 2021.

Despite economic uncertainty, demand for vehicles largely managed to show resilience during the last three months of 2022. The rising deliveries of new energy vehicles (including all-electric, hybrids and fuel-cell) are expected to have fueled revenues. However, for the less-affluent and subprime consumers, the rising cost of financing is expected to have played spoilsport. Per estimates of J.D. Power and LMC Automotive, average interest rates for new vehicle loans were up around 250 basis points from the year-ago levels. High interest rates eat away vehicle buyers' willingness and ability to purchase. This may have limited revenues to some extent.

As for the average price of vehicles, used car prices are on a decline, while new car prices during the quarter under discussion have remained high. High new vehicle prices are likely to have offset the commodity cost inflation partially. High costs of raw materials, manufacturing inefficiency, rising freight and fuel costs may have limited margins.

Per the latest Earnings Trend report dated Jan 25, the auto sector’s earnings for Q4 are expected to grow 43.6% on a year-over-year basis. As for revenues, they are estimated to rise 19.5% year over year.

Key Releases on Feb 2

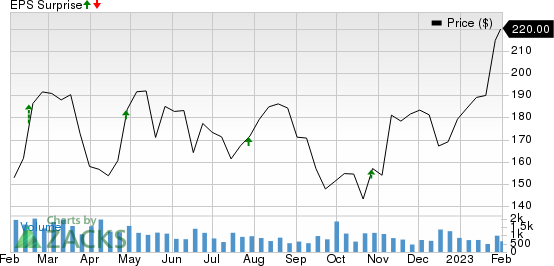

Ford: This legacy automaker missed earnings estimates in the last reported quarter on lower-than-expected profits in North America and a pretax loss in China. Over the trailing four quarters, Ford missed earnings estimates on three occasions and surpassed them once, with the average surprise being 3.2%. This is depicted in the graph below:

Ford Motor Company Price and EPS Surprise

Ford Motor Company price-eps-surprise | Ford Motor Company Quote

Our proprietary model clearly indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Our proven model doesn’t conclusively predict an earnings beat for Ford this time around. This is because it has an Earnings ESP of -3.01% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Zacks Consensus Estimate for the company’s fourth-quarter earnings is pegged at 60 cents per share. F is set to report quarterly results after the closing bell.

The consensus mark for fourth-quarter revenues from automotive sales is $39,402 million, implying an uptick from $35,300 million recorded in the corresponding quarter of 2021. The Zacks Consensus Estimate for adjusted EBIT from the segment is pegged at $3,631 million, implying growth from $1,638 million recorded in the fourth quarter of 2021. The consensus mark for revenues from Ford Credit is pegged at $2,235 million, implying a decrease from $2,373 million. The consensus mark for revenues from Ford Mobility is pegged at $42.9 million, implying a decline from $48 million. While stronger year-over-year results from the firm’s Automotive segment bode well, poor performances from Ford Credit and Mobility units are likely to have played spoilsports. Further, massive spending on modernization, including connectivity, IT and new product launches, is expected to have limited earnings to some extent.

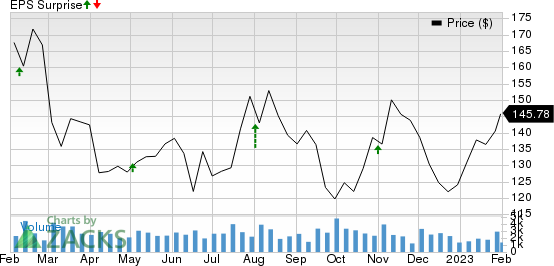

Harley-Davidson: This iconic motorcycle manufacturer posted an earnings beat in the last reported quarter on higher-than-anticipated revenues from the Motorcycles & Related Products and Financial Services segments. HOG surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, with the average being 43.24%. This is depicted in the graph below:

Harley-Davidson, Inc. Price and EPS Surprise

Harley-Davidson, Inc. price-eps-surprise | Harley-Davidson, Inc. Quote

Our model does not conclusively predict an earnings beat for Harley-Davidson this time around, as it carries a Zacks Rank #2 and an Earnings ESP of 0.00%. The Zacks Consensus Estimate for fourth-quarter earnings is pegged at 3 cents a share. HOG will unveil results before market open.

Harley-Davidson is likely to have benefitted from the Hardwire strategic plan, which aims at growth through refreshed product offerings. The Zacks Consensus Estimate for HOG’s revenues from the Motorcycles and Related Products segment — which constitutes the bulk of the firm’s overall revenues — is pegged at $868 million for the December-end quarter, suggesting an increase from the $816 million reported in the year-ago quarter. The consensus mark for operating loss from the segment is pegged at $69 million, narrower than a loss of $102 million recorded in the corresponding quarter of 2021. On the flip side, the Zacks Consensus Estimate for operating income from Financial Services is pegged at $182 million, depicting a drop from $200 million generated in the comparable year-ago period. The consensus mark for operating profit from the segment is $74 million, implying a decline from $95 million recorded in the fourth quarter of 2021.

Asbury: This automotive retailer came up with better-than-expected earnings in the last reported quarter, thanks to higher-than-expected gross profit from the Parts & Services and Finance & Insurance units. ABG surpassed the Zacks Consensus Estimate in the trailing four quarters, with the average being 11.2%. This is depicted in the graph below:

Asbury Automotive Group, Inc. Price and EPS Surprise

Asbury Automotive Group, Inc. price-eps-surprise | Asbury Automotive Group, Inc. Quote

Things are not looking up for Asbury this time around, as it carries a Zacks Rank #4 (Sell) and an Earnings ESP of -2.59%. The Zacks Consensus Estimate for fourth-quarter earnings and revenues is pegged at $8.23 a share and $3.82 billion, respectively. ABG will report results before the opening bell.

The Zacks Consensus Estimate for ABG’s revenues from Used Vehicle segment is pegged at $1,249 million, suggesting a decline from $1,331 million in the last reported quarter. The consensus mark for gross profit from the segment is $68 million, down from $84 million. Declining used vehicle prices and high cost of sales are likely to have played spoilsport. The consensus estimate for gross profit from New Vehicle segment is pegged at $197 million, down from $201 million generated in the prior quarter. The consensus mark for gross profit from the Finance/Insurance unit is pegged at $182 million, down from $187 million generated in the third quarter of 2022. On a bright note, the Zacks Consensus Estimate for Parts/Services segment stands at $301 million, implying a slight improvement from $298 million recorded in the three months ended September 2022. Asbury is bearing the brunt of escalating SG&A expenses amid expansion plans and digitization ramp, which may have clipped operating margins in the to-be-reported quarter.

Lear: This automotive equipment provider delivered an earnings beat in the last reported quarter on higher-than-expected sales and earnings across both its business segments. LEA surpassed the Zacks Consensus Estimate in the trailing four quarters, with the average being 18%. This is depicted in the graph below:

Lear Corporation Price and EPS Surprise

Lear Corporation price-eps-surprise | Lear Corporation Quote

Investors expect LEA to maintain its beat run and our model also predicts the same. This is because the company has an Earnings ESP of +0.04% and a Zacks Rank #3. The Zacks Consensus Estimate for fourth-quarter earnings and revenues is pegged at $2.51 per share and $5.24 billion, respectively. LEA will post results before the opening bell.

The buyouts of M&N Plastics and Kongsberg Automotive have strengthened Lear’s E-Systems and Seating business, respectively. Rising consumer demand for vehicle content — requiring signal, data and power management — and increasing electrification efforts by the company augur well. The Zacks Consensus Estimate for fourth-quarter revenues from the E-Systems unit is pegged at $1,337 million, up from $1,239 million generated in the year-ago quarter. The consensus mark for operating profit from the segment is $61 million, implying growth from $37.7 million in the fourth quarter of 2021. The Zacks Consensus Estimate for revenues from the Seating unit is $3,918 million, up from $3,641 million in the year-ago period. The consensus mark for operating profit from the segment stands at $263 million, implying growth of 32% year over year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance