Auto Roundup: Updates From F and GM Make it to the Top Stories

Last week, the European Automobile Manufacturers Association (“ACEA”) released data for passenger car registrations for December and full-year 2021. In a telling sign that the chip shortage has hobbled the auto industry, European car sales hit a new low last year. Registrations of new passenger cars in the European Union (EU) plunged 22.8% in December to 795,295 units, representing the sixth straight month of decline. For the full year, sales slid 2.4% to 9.7 million units, marking the worst performance since statistics began in 1990, per data from ACEA. Quoting ACEA, “This fall was the result of the semiconductor shortage that negatively impacted car production throughout the year, but especially during the second half of 2021.”

The global chip deficit continues to cause disruptions. Evidently, Japan’s #1 automaker Toyota TM cut production targets for the next month and downwardly revised fiscal 2022 output goals amid supply-chain snarls.

Engine giant Cummins, Inc. CMI completed the acquisition of a 50% stake in Momentum Fuel Technologies from Rush Enterprises, Inc. RUSHA.

Meanwhile, there were numerous updates from U.S. auto giant Ford F. On a discouraging note, Ford suspended operations at the Flat Rock Assembly plant for the week amid supply-chain snarls. It also issued a recall for 200,000 vehicles over defective brake lights. The affected vehicles include certain 2014 and 2015 Ford Fusion and Lincoln MKZ midsize models as well as some 2015 Ford Mustang convertibles. In a couple of positive developments, Ford collaborated with an online payment processor, Stripe, to boost digital commerce. F also bolstered its car security with a new joint venture (JV) named Canopy.

Close peer General Motors GM also strengthened its foothold in the e-commerce space with its decision to set up an online parts marketplace. Further, in what might be a breather to GM, the auto giant will get a big tax break in Orion Township to expand its assembly plant therein to build more electric vehicles.

Major News of the Week Gone By

1. Ford signed a five-year deal with Stripe to bolster its e-commerce strategy. Per the agreement, Stripe will look after the transactions for consumer vehicle orders and reservations as well as bundled financing options for Ford’s commercial customers. Ford expects to start rolling out Stripe’s technology in the second half of 2022, starting with North America. Later, it intends to launch it in Europe.

Ford also teamed up with security company ADT Inc. to form a JV, Canopy, which will offer vehicle security systems as an aftermarket product. The initial outlay is expected to conclude in the second quarter of 2022. The companies anticipate investing $100 million during the next three years. Canopy plans to integrate camera security systems in Ford vehicles starting next year, but it will not be a Ford exclusive. Canopy will eventually expand this breakthrough technology to vehicles from other manufacturers.

In a separate development, Ford also provided updates on special items for 2021 results. Ford expects to report a fourth-quarter gain of $8.2 billion on its equity investment in Rivian. The company will also reclassify approximately $900-million first-quarter 2021 non-cash gain on the Rivian investment as a special item. The auto biggie anticipates recording $1.7 billion in costs associated with Ford repurchasing and redeeming more than $7.6 billion in high-cost debt in fourth-quarter 2021.

2. General Motors is set to launch its online parts marketplace, making its catalog — consisting of 45,000 repair and maintenance parts — more convenient for brand owners of Chevrolet, GMC, Buick and Cadillac. The new catalog includes oil filters, engine and cabin air filters, windshield wiper blades, brake pads, accessory belts, batteries and cooling hoses, among other parts. Customers can opt for home delivery or pick up their orders at one of the 800+ participating dealers. Parts purchased through the online platform are eligible for Chevrolet, Cadillac, Buick, and GMC rewards programs and can earn customers points that can be used to pay for parts, accessories or Certified Service at participating dealers.

In a unanimous vote, the Orion Township Board of Trustees approved General Motor’s request for tax abatement on its proposed $1.3-billion investment to expand the Orion Assembly Plant. In its tax abatement application, GM noted that it plans to start the plant expansion in July 2022 and finish construction by December 2025. The company has appealed for tax abatement for 12 years, plus the three years for construction. GM presently builds the Chevrolet Bolt EV and the Bolt at the Orion plant, wherein about 1,200 people are employed. The expansion is expected to create or retain 2,000 jobs.

General Motors also launched new commercial applications of the Hydrotec fuel cell technology. Hydrotec projects, which are currently in development, from heavy-duty trucks to aerospace and locomotives, are being planned for use beyond vehicles for power generation. It is planning multiple Hydrotec-based power generators powered by GM’s Generation 2 Hydrotec fuel cell power cubes. For details read: General Motors Expands Fuel Cell Projects Beyond Vehicles.

3. Cummins announced the completion of the acquisition of a 50% stake in Momentum Fuel Technologies from Rush Enterprises. The joint venture between Cummins and Rush Enterprises focuses on producing near-zero-emissions natural gas powertrains for the commercial vehicle market in North America.

The newly formed entity will combine the prowess of Momentum’s compressed natural gas (CNG) fuel delivery systems and Cummins’ powertrain expertise, which will result in engines with net greenhouse gas emissions at or below zero. The partnership will also offer aftermarket support through Rush Truck Centers dealerships and Cummins distributors, servicing both the engine and the fuel delivery system. It also bodes well for customers as they will have access to extensive CNG vehicle parts and service network. The alliance would enable CMI to offer the highest quality, clean and efficient natural gas products, including the 15-liter natural gas engine announced last October.

4. Toyota would be slashing the output target for the month of February by around 20%. The company acknowledges that is struggling to meet the surging demand owing to semiconductor shortfall. Next month, TM is suspending operations in Japan for several days across 11 lines in eight plants.

Toyota has adjusted its February production plan by around 150,000 units to 700,000 units globally. Taking into account the latest revision of output targets, TM now expects fiscal 2022 (ending March 2022) output to be lower than the previous forecast of 9 million units.

Toyota currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

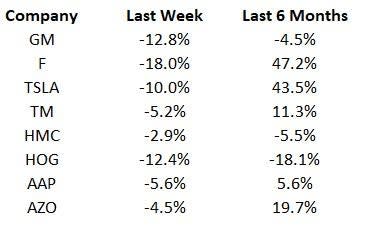

Price Performance

The following table shows the price movement of some of the major auto players over the past week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on December and full-year 2021 commercial vehicle registrations to be released by the ACEA this week. Also, fourth-quarter 2021 earnings for the auto sector are slated to kick off this week. Meanwhile, stay tuned for updates on how automakers will tackle the semiconductor shortage and make changes in business operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Rush Enterprises, Inc. (RUSHA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance