Auto Roundup: TM and HMC's Q4 Earnings Beat, CVNA's $2.2B Buyout & More

Last week, major Japanese auto giants posted fiscal fourth-quarter 2022 results. Both Toyota TM and Honda HMC managed to deliver earnings beat but their bottom lines fell year over year. Both the companies forecast fiscal 2023 revenues to increase year over year but operating profit to decrease from fiscal 2022 levels. The used car e-retailer Carvana CVNA grabbed headlines with two key updates. The company announced the acquisition of ADESA’s U.S. physical auction business for $2.2 billion. Meanwhile, it also trimmed its workforce by 12% in cost-cut actions. Then, there was Mercedes Benz Group DDAIF, which issued a recall of around 300,000 SUVs over a brake issue. The engine maker Cummins CMI also made headlines with its collaboration with Daimler Trucks North America for the supply of fourth-generation fuel cell powertrain in the latter’s trucks.

Last Week’s Top Stories

1. Toyota posted fiscal fourth-quarter fiscal 2022 earnings of $3.34 per share, which surpassed the Zacks Consensus Estimate of $2.40 on higher-than-expected revenues. The bottom line, however, declined from the year-ago earnings of $5.18 a share amid chip woes and supply chain disruptions aggravated by the Russia-Ukraine war. Consolidated revenues came in at $69,824 million, beating the consensus mark of $68,197 million but contracting 3.8% year over year.TM had cash and cash equivalents of ¥6.1 trillion ($50.36 billion) as of Mar 31, 2022. Long-term debt amounted to ¥15.3 trillion ($126.1 billion).

For fiscal 2023, Toyota projects consolidated vehicle sales of 8.85 million, indicating an increase from 8.23 million units sold in fiscal 2022. Fiscal 2023 sales are expected to total ¥33 trillion, implying an increase from ¥31.4 trillion recorded in fiscal 2022. Operating income is projected at ¥2.4 trillion, indicating a decline of 19.8% year over year. Pretax profit is estimated at ¥3.1 trillion, down from ¥4 trillion generated in fiscal 2022. R&D expenses are envisioned at ¥1,130 billion, suggesting a nominal rise from ¥1,124 billion spent in fiscal 2022. Capex is forecast at ¥1.4 trillion, signaling an uptick from ¥1.34 trillion spent in fiscal 2022.

2. Honda reported earnings of 63 per share for fourth-quarter fiscal 2022, surpassing the Zacks Consensus Estimate of 57 cents. The bottom line, however, fell from the year-ago profit of $1.17 per share. Quarterly revenues totaled $33,358 million, topping the Zacks Consensus Estimate of $33,180 million. The top line also edged up 7% year on year. Consolidated cash and cash equivalents were ¥3.7 trillion ($30.26 billion) as of Mar 31, 2022. Long-term debt was ¥4.98 trillion ($41 billion). The company’s total annual dividend per share for fiscal 2022 was ¥120, which includes an interim dividend of ¥55 and a year-end dividend of ¥65.

For fiscal 2023, Honda forecasts sales of ¥16.3 trillion, implying an 11.7% uptick year over year. Honda projects sales volumes from Motorcycle and Automobile segments at 18.5 million units and 4.2 million units in fiscal 2023, up around 9% and 5%, respectively. Operating profit is now forecast at ¥810 billion, indicating a year-over-year decline of 7%. Pretax profit is envisioned to be ¥1,035 billion, signaling a drop of 3.3% from fiscal 2022. HMC’s R&D expenses for fiscal 2023 are likely to be ¥840 billion, suggesting a rise from ¥804 billion spent in fiscal 2022. Capex is envisioned at ¥500 billion, indicating a jump from ¥278.4 recorded in fiscal 2022.

3. Carvana acquired ADESA’s U.S. physical auction business from KAR Global. The deal, valued at $2.2 billion, consists of 56 ADESA U.S. locations, covering nearly 6.5 million square feet of buildings on more than 4,000 acres. Citi and J.P. Morgan Securities LLC acted as financial advisors while Kirkland & Ellis LLP served as legal counsel for the company. The buyout will bolster Carvana’s growth opportunities. The deal seeks to improve the experiences of the ADESA U.S. physical auction customers and target unit economic improvements.

In a separate development, Carvana was forced to lay off 12% of its workers to cut costs amid uncertainty battering the car market lately, fueled by the ongoing parts shortage and the Russia-Ukraine war. Carvana is struggling financially and is focusing on cost-containment efforts. The used car e-retailer incurred a loss of $2.89 per share for first-quarter 2022, wider than the Zacks Consensus Estimate of a loss of $1.72 and the year-ago loss of 46 cents. Long-term debt amounted to $3,286 million as of Mar 31, 2022, up from $3,208 million recorded on Dec 31, 2021.

4. Mercedes-Benz issued a major recall of nearly 300,000 SUVs over a potential brake problem. The recall has impacted certain vehicles of GL-, ML- and R-class SUVs from the 2006 through 2012 model years. Mercedes and the National Highway Traffic Safety Administration have advised owners to park the vehicles until the free recall repair has been performed, as the problem can lead to a loss of braking power. The company has already begun notifying owners.

Mercedes has warned of early signs of failure that include a soft brake pedal or audible signs of air like hissing in the braking system. The vehicles are to be inspected by an authorized dealership. Vehicles that do not show signs of advanced corrosion may continue to be driven without further action. Vehicles with signs of advanced corrosion will undergo an additional test to ensure the functionality of the brake booster. Vehicles that pass the test may be driven for up to two years but should eventually return for an additional repair.

5. Cummins announced that it is partnering with Daimler Truck North America, the largest heavy-duty truck producer in North America, to upfit and validate Freightliner Cascadia trucks with an indigenous hydrogen fuel cell powertrain of Cummins. Freightliner will use Cummins’ fourth-generation fuel cell powertrain, which offers premium features like improved power density, efficiency and durability.

Subject to the successful validation, the companies plan to launch initial units in 2024 for selected customers.Both companies have a futuristic vision to make carbon-neutral commercial transportation economically feasible for customers. The collaboration between CMI and Daimler Truck will support the joint goals of the companies, aiming to reduce emissions across product offerings and operations and accelerate the shift to a carbon-free economy.

Cummins currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

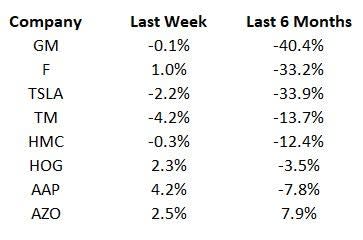

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on April 2022 passenger vehicle registrations to be released by the ACEA soon. Meanwhile, stay tuned for any update on how automakers will tackle the semiconductor shortage— compounded by the Russia-Ukraine war and COVID-19 restrictions in China— and make changes in business operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Daimler AG (DDAIF) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance