Aurinia's Lupus Candidate Succeeds in Pivotal Study, Stock Up

Aurinia Pharmaceuticals Inc. AUPH announced that its pipeline candidate, voclosporin, met the primary endpoint in a pivotal phase III AURORA study evaluating it in patients with lupus nephritis ("LN"), an inflammation of the kidney caused by systemic lupus erythematosus. Data showed that the candidate achieved statistically significant improvements in clinically meaningful endpoints with a comparable safety profile to the current standard of care.

Based on the encouraging data from the study, the company is planning to file a new drug application to the FDA in the first half of 2020. It anticipates to commercially launch the candidate in early 2021.

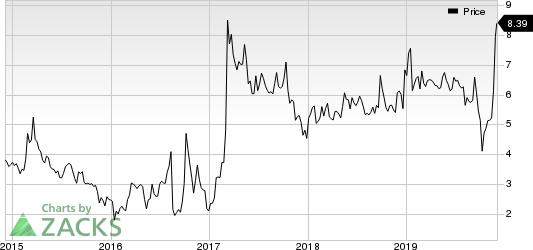

Shares of Aurinia surged almost 120% in after-hours trading on Dec 4, following the data readout. The company’s shares have gained 23% so far this year compared with the industry’s increase of 10.6%.

The AURORA study evaluated immunosuppressant candidate, voclosporin, for increase in speed of and overall renal response rates in patients with LN when added to background therapy of mycophenolate mofetil, another immunosuppressant, and low-dose corticosteroids. Data showed that patients receiving voclosporin achieved 40.8% renal response rate compared to 22.5% for the standard of care following a treatment period of 52 weeks. The candidate also achieved improvement of statistical significance in all pre-specified hierarchical secondary endpoints. The candidate was also well tolerated in patients.

The company believes the data from the pivotal study demonstrates that voclosporin can be a potential game changer for LN patients. It also believes that the candidate is the first novel treatment that has demonstrated therapeutic efficacy and no excess adverse events compared to standard of care.

Meanwhile, the company is evaluating the candidate in AURORA 2 extension study in patients who have completed the AURORA study for a duration of 104 weeks to assess the long-term benefit/risk of voclosporin in LN patients. The company mentioned in its press release that data from the study should be valuable in a post-marketing setting and for future interactions with various regulatory authorities.

Apart from the LN indication, Aurinia is also developing voclosporin across multiple inflammatory and autoimmune conditions.

We note that there are several big pharma companies that are also developing treatments for lupus. Biogen’s BIIB lupus candidate, BIIB059, met the primary endpoint in a phase II study earlier this month. A phase II study is evaluating Roche’s RHHBY Gazyva as a treatment for LN patients. In August, AstraZeneca AZN announced that anifrolumab met the primary endpoint of the phase III study evaluating it in lupus patients. We expect voclosporin to face competition from these drugs, upon their potential approval.

Aurinia Pharmaceuticals Inc Price

Aurinia Pharmaceuticals Inc price | Aurinia Pharmaceuticals Inc Quote

Zacks Rank

Aurinia currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Aurinia Pharmaceuticals Inc (AUPH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance