AstraZeneca's (AZN) Drug Combo Meets Ovarian Cancer Study Goal

AstraZeneca AZN generated positive results from an interim analysis of the phase III DUO-O study, which evaluated a combination of its blockbuster cancer drugs Lynparza (olaparib) and Imfinzi (durvalumab) in certain patients with advanced ovarian cancer.

The DUO-O study is evaluating the safety and efficacy of the combination of Imfinzi, Lynparza, chemotherapy and bevacizumab (“Lynparza plus Imfinzi arm”) against chemotherapy plus bevacizumab (“control arm”) in newly-diagnosed patients with advanced high-grade epithelial ovarian cancer without tumor BRCA mutations.

The interim analysis of data from the DUO-O study showed that the Lynparza plus Imfinzi arm achieved a statistically significant and clinically meaningful improvement in the primary endpoint of progression-free survival (“PFS”) over the control arm. The safety profile of the combinations was also consistent with the profile of individual medications.

Since the data from the study is still immature, AstraZeneca is currently unable to assess key secondary endpoints (like overall survival) of the study. The company expects to provide an update on the same after further data analysis.

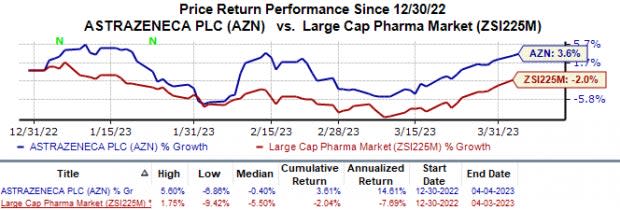

In the year so far, shares of AstraZeneca have gained 3.6% against the industry’s 2.0% fall.

Image Source: Zacks Investment Research

Management also announced that an additional arm of the study evaluating the combination of Imfinzi, chemotherapy and bevacizumab did not achieve statistical significance for PFS in the interim analysis against the control arm.

Imfinzi is already approved for multiple cancer indications. While the drug is already approved for two NSCLC indications, it is also approved in extensive-stage small cell lung cancer (ES-SCLC), biliary tract cancer (BTC) and hepatocellular carcinoma (uHCC) indications.

AstraZeneca markets Lynparza in partnership with Merck MRK. AstraZeneca/Merck’s Lynparza is approved for four cancer types, namely ovarian, breast, prostate and pancreatic. In 2022, Lynparza generated product sales of $2.6 billion for AstraZeneca and alliance revenues of $1.1 billion for Merck.

The profit-sharing deal between AstraZeneca and Merck was inked in 2017. In addition to Lynparza, the deal included Koselugo.

AstraZeneca is focused on strengthening its oncology business. In 2022, AZN generated $14.6 billion worth of total revenues from its Oncology business, reflecting a 19% year-over-year rise in the constant exchange rate, driven by a solid performance of newer medicines, such as Tagrisso, Lynparza, Imfinzi and Calquence. Management is working to further strengthen this portfolio through label expansions and advancing oncology pipeline candidates. AstraZeneca aims to develop a treatment for every form of cancer.

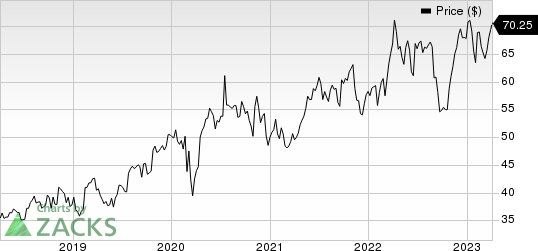

AstraZeneca PLC Price

AstraZeneca PLC price | AstraZeneca PLC Quote

Zacks Rank & Stocks to Consider

AstraZeneca currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the overall healthcare sector Certara CERT and CRISPR Therapeutics CRSP. While Certara sports a Zacks Rank #1 (Strong Buy), CRISPR Therapeutics carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Certara’s 2023 earnings per share have increased from 46 cents to $1.24. During the same period, the earnings estimates per share for 2024 have risen from 54 cents to $1.85. Shares of Certara are up 43.8% in the year-to-date period.

Earnings of Certara missed estimates in two of the last four quarters, beating the mark on one occasion while meeting the mark on another. On average, the company’s earnings witnessed a negative surprise of 3.25%. In the last reported quarter, Certara’searnings beat estimates by 14.29%.

In the past 60 days, estimates for CRISPR Therapeutics’ 2023 loss per share have narrowed from $8.21 to $7.35. Shares of CRISPR Therapeutics have risen 7.5% in the year-to-date period.

Earnings of CRISPR Therapeutics beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing an earnings surprise of 3.19%, on average. In the last reported quarter, CRISPR Therapeutics’ earnings beat estimates by 39.22%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Certara, Inc. (CERT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance