Asia Stocks Gain on Upbeat U.S. Jobs Data: 5 Top Picks

Most of the Asian markets notched up early gains on Mar 12 buoyed by robust U.S. job data for February. Record high job additions along with moderate increase in wages eased worries about inflation. Strong economic indicators have strengthened the Federal Reserve’s case for higher interest rates and gave fresh impetus to the bull market in global equities.

Most of the Asian countries are trying hard to achieve growth in 2018, investing more in businesses, adding capacity and raising R&D expenditures. Global investors are likely to invest more encouraged by the higher earnings at the companies in this region. This underscores the lucrativeness of the Asian stock market.

Job Additions Rise, Wage Growth Dips

Data released on Friday showed that the U.S. economy added 313,000 jobs in February 2018, exceeding the consensus estimate of 208,000. However, wage growth rose only 2.6% on an annualized basis compared with 2.9% in the prior month. This assuaged investor fears over rising inflation while at the same time reminding them that the economy remains remarkably strong.

Moreover, the total labor force increased by 806,000 and now stands slightly below 162 million. This is the highest since September 2003. The labor force participation rate and the employment-to-population ratio rose to 63% and 60.4%, respectively. Both figures were at its highest since September 2017.

Asian Markets Cheer the News

Asian stocks were among the biggest beneficiaries of U.S. jobs data. In Tokyo, the Nikkei 225 was up 1.4%. The broader Topix rose 1.3%, with gains seen across the index's 33 sectors. In Seoul, the benchmark Kospi index advanced 1.1%. Hong Kong's Hang Seng Index advanced 1.5%.

Mainland China markets also traded higher. The Shanghai composite inched up by 0.5% and the Shenzhen composite added 0.8%. The MSCI Asia Pacific Index of stocks advanced, and has now gained 4.4% in the last three months.

Asian markets are likely to maintain momentum in 2018 albeit at a slower pace. JPMorgan Asset Management expects Asian stocks to return 12-15% in 2018 excluding dividend.

Asian Economies to Witness Strong Growth in 2018

According to a report by World Bank in January 2018, the global economy is set to expand by 3.1% in 2018. The fastest-growing regions in the world are East Asia and the Asia-Pacific along with China.

IMF stated that Emerging and developing Asia will grow at around 6.5% over 2018–19. The region continues to account for over half of world growth. Growth is expected to moderate gradually in China. However, it will pick up in India, and remain stable in the ASEAN-5 region. The growth forecast for Japan has been revised up for 2018 and 2019 from 0.5% to 1.2%, reflecting upward revisions to external demand.

Meanwhile, China’s economy is expected to overtake the Eurozone in terms of size in 2018. According to data compiled by Bloomberg, China’s GDP is forecast to reach about $13.2 trillion in 2018, beating the $12.8 trillion combined total of the 19 countries that use the euro.

Out Top Picks

Economic growth is expected to rise in several Asian markets, fueled by an easy monetary policy adopted by the central banks. At present, Asian markets are well positioned to attract global investors’ attention by offering high yields with strong macroeconomic fundamentals.

Adding Asian stocks to your portfolios makes great sense at this point. However, picking winning stocks can be a difficult task.

This is where our VGM score comes in. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three scores. Such a score allows you to eliminate the negative aspects of stocks and select winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

At this stage, we have narrowed down our search to the following stocks, each of which has a Zacks Rank #1 (Strong Buy) and a good VGM score. You can see the complete list of today’s Zacks #1 Rank stocks here.

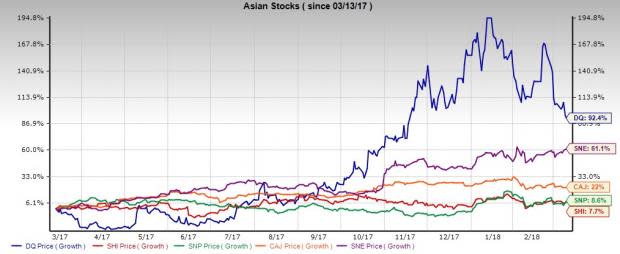

Canon Inc. CAJ is an industry leader in professional and consumer imaging equipment and information systems. The company expects earnings growth of 4.2% for current year. The Zacks Consensus Estimate for the current year has improved by 22.4% over the last 60 days. The stock has a VGM score of A.

Sony Corp. SNE develops and manufactures consumer and industrial electronic equipment. The company expects earnings growth of 656.9% for current year. The Zacks Consensus Estimate for the current year has improved by 34.5% over the last 60 days. The stock has a VGM score of A.

SINOPEC Shangai Petrochemical Company Ltd. SHI is a leading Chinese petrochemical company. It expects earnings growth of 10.6% for current year. The Zacks Consensus Estimate for the current year has improved by 86.6% over the last 60 days. The stock has a VGM score of A.

China Petroleum and Chemical Corp. SNP is a joint-stock company focusing on its core business of petroleum and petrochemicals with integrated upstream, mid-stream and downstream operations and a complete marketing network. The company expects earnings growth of 6.7% for current year. The Zacks Consensus Estimate for the current year has improved by 24.2% over the last 60 days. The stock has a VGM score of B.

DAQO New Energy Corp. DQ is engaged in the manufacture and sale of high-quality polysilicon to photovoltaic product manufacturers. The company expects earnings growth of 6.9% for current year. The Zacks Consensus Estimate for the current year has improved by 16.7% over the last 60 days. The stock has a VGM score of A.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

China Petroleum & Chemical Corporation (SNP) : Free Stock Analysis Report

Sony Corp Ord (SNE) : Free Stock Analysis Report

SINOPEC Shangai Petrochemical Company, Ltd. (SHI) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Canon, Inc. (CAJ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance