Arista (ANET) Poised to Benefit From Healthy Growth Dynamics

On Jul 10, we issued an updated research report on Arista Networks, Inc. ANET, one of the leading cloud networking solutions providers in the United States.

Arista is benefiting from the expanding cloud networking market primarily driven by strong demand for scalable infrastructure, which has become a necessity to support new applications and services. Apart from delivering high capacity and availability, cloud networking promises predictable performance along with programmability that enable integration with third-party applications for network, management, automation, orchestration and network services. According to a research firm, Gartner, the company’s product portfolio with different form factors facilitates the implementation of high-performance, highly scalable and appropriate solutions for every environment.

We believe that Arista is well poised to benefit from strong demand for its data center switches. Per Transparency Market Research, the data center networking market is likely to witness a CAGR of 15.5% between 2017 and 2025. At this pace, the market’s valuation is forecasted to reach $228.40 billion by the end of 2025 from $63.05 billion in 2016. Moreover, continued spending on IT infrastructure products (server, enterprise storage, and Ethernet switches) for deployment in cloud environments is a positive. The company’s switches and routers support the high-end cloud networking market that requires fast throughput at low cost. Arista is targeting a large and growing market, which was worth more than $10 billion in 2017. The robust product portfolio is aiding the company win customers on a regular basis, consequently boosting top-line growth. Notably, revenues have recorded a CAGR of 35.5% in the 2013-2017 period to reach $1.6 billion.

Arista’s strategy of leveraging merchant silicon (“off the shelf”) from multiple suppliers has expanded product portfolio and increased its ability to offer products at cheaper prices. This has also helped it to focus on developing software like EOS and CloudVision. In addition, EOS’ fully programmable and highly modular architecture has been the key differentiator. We believe that new products like containerized EOS (cEOS) and DANZ Hybrid Cloud containerization will further expand its market share in 2018 and beyond.

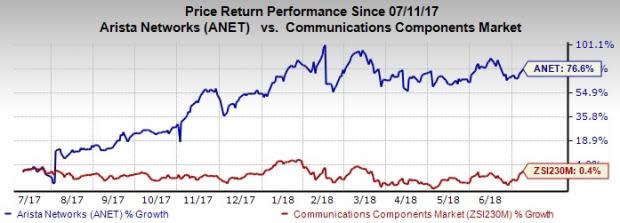

With a diligent execution of operational plans, Arista has gained 76.6% in the past year on an average compared with a rise of 0.4% for the industry.

However, continued lawsuits have been a distraction for Arista. It has been forced to bring much of manufacturing in the United States, which along with redesigning of products have lead to loss of time as well as hurt its profitability.

Nevertheless, we remain impressed with the inherent growth potential of this Zacks Rank #2 (Buy) stock. Some other top-ranked stocks in the industry are Corning Incorporated GLW and SeaChange International, Inc. SEAC, both carrying a Zacks Rank #2 and Plantronics, Inc. PLT sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Corning has a long-term earnings growth expectation of 5%. It surpassed estimates in each of the trailing four quarters with an average positive earnings surprise of 4.4%.

SeaChange International has a long-term earnings growth expectation of 10%. It topped estimates thrice in the trailing four quarters with an average positive earnings surprise of 282.8%.

Plantronics topped estimates thrice in the trailing four quarters with an average positive earnings surprise of 18.7%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Plantronics, Inc. (PLT) : Free Stock Analysis Report

SeaChange International, Inc. (SEAC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Corning Incorporated (GLW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance