Will Arch Coal (ARCH) Deliver a Beat This Earnings Season?

Arch Coal Inc. ARCH is scheduled to report first-quarter 2018 results on Apr 26. In the fourth quarter of 2017, the company reported a positive earnings surprise of 77.59%.

Why Likely a Positive Surprise

A stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Per our model, Arch Coal is likely to beat earnings this quarter as it possesses these components.

Zacks ESP: The company’s Earnings ESP is +3.48%. This is because the Most Accurate estimate is at $4.26, while the Zacks Consensus Estimate is pegged at $4.12.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

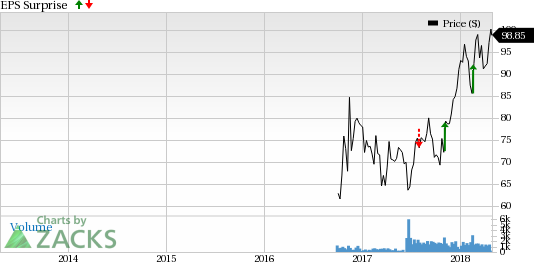

Arch Coal Inc. Price and EPS Surprise

Arch Coal Inc. Price and EPS Surprise | Arch Coal Inc. Quote

Zacks Rank: Arch Coal’s Zacks Rank #3, when combined with a positive Earnings ESP, increases the possibility of a beat.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Factors to Consider

The Zacks Consensus Estimate for first-quarter 2018 total revenues is pegged at $585 million, reflecting a sequential increase of 4.5%. Per the consensus estimate, earnings are projected at $4.15, reflecting a growth of 0.7%.

Earnings are likely to benefit from lesser number of shares outstanding as the company repurchased 4 million shares in 2017.

Arch Coal will gain from the shipment of nearly 200,000 tons of coking coal during the first half of 2018, which it failed to supply due to transportation bottleneck in the fourth quarter of 2017.

Cash margin in the Metallurgical segment are expected to improve, courtesy of improved pricing in the North American business and consistent strong demand from seaborne market.

Other Stocks to Consider

Here are a few other players from the industry that have the right combination of elements to post an earnings beat this quarter.

SunCoke Energy Partners SXCP has an Earnings ESP of +6.67%. It carries a Zacks Rank #3 and is expected to report first-quarter 2018 results on Apr 26.

Warrior Met Coal Inc HCC has an Earnings ESP of +5.26%. It sports a Zacks Rank #1 and is expected to report first-quarter 2018 results on May 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Peabody Energy Corporation BTU is expected to report first-quarter 2018 results on Apr 25. The company has an Earnings ESP of +4.55% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Peabody Energy Corporation (BTU) : Free Stock Analysis Report

SunCoke Energy Partners, L.P. (SXCP) : Free Stock Analysis Report

Arch Coal Inc. (ARCH) : Free Stock Analysis Report

Warrior Met Coal Inc. (HCC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance