Apple bulls are high on services, but there are important unanswered questions

It may finally be time for the services businesses at Apple to bear fruit.

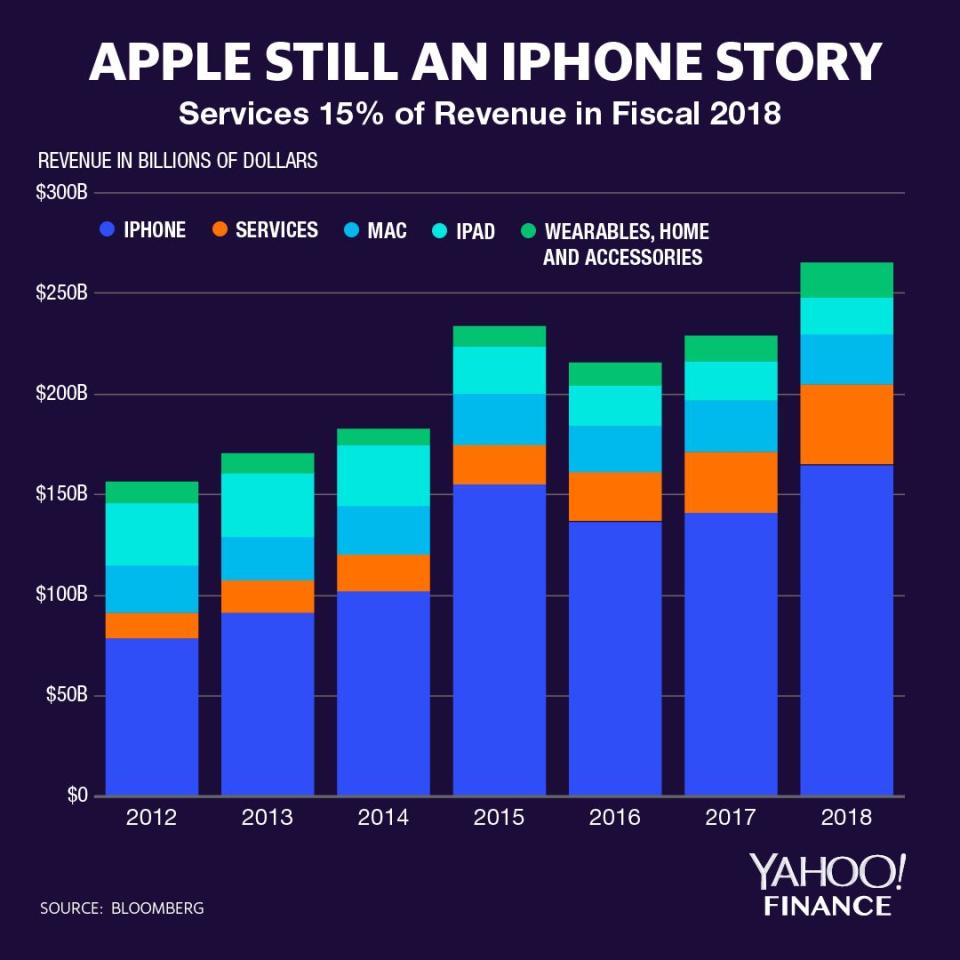

Apple (AAPL) — and Apple investors — have been touting the opportunity represented by the services business for years. But it’s only recently that Apple has announced beefed-up offerings, including Apple News Plus, Apple TV Plus, and Apple Arcade.

Ahead of its fiscal second-quarter earnings report after the closing bell Tuesday, Apple shareholder Jason Ware of Albion Financial Group says the services business is now perhaps even more crucial than the iPhone unit growth rate.

“Right now it’s something on the order of teens in terms of percentage of revenue. That’s getting closer to 25, 30 over the next couple of years. I think it’s the trajectory most investors expect. It’s certainly something we expect,” said Ware in an interview with Yahoo Finance’s streaming show “On the Move” on Monday. “As that continues to happen, with the more profitable margins in that business, that could ultimately impact the valuation on Apple.”

The services business alone could be worth between $400 billion and $450 billion, wrote Dan Ives of Wedbush in a note previewing Apple’s quarterly numbers. “The Street is slowly in the process of re-rating the name on this premise despite a maturing iPhone cycle,” said Ives, who has an “outperform” recommendation on the stock.

Apple could report second-quarter services revenue of $11.4 billion, according to the average of five estimates gathered by Yahoo Finance. For context, total revenue is estimated to be $59.6 billion, according to Bloomberg.

Unanswered questions

There are still outstanding questions on the newly-introduced services, and some analysts are asking for more details.

“Apple has thus far announced very little in terms of pricing strategy (outside of News+ at $9.99), nor the amount of spend related to these new services,” wrote Aaron Rakers of Wells Fargo, who has a “market perform” rating on the stock. “This has thus far left us with more questions than answers regarding the economics of these new services and what they mean for Apple’s bottom line after considering what we think are costly initial content investments.”

Chris Caso of Raymond James is a skeptic.

Caso, who has a “market perform” rating on Apple, says future growth will come from 5G, but that the services expectations are overblown. He argues that far from every iPhone user will sign up for the services offered, and points to the number of subscribers to Apple Music (which he pegs at 50 million), vs. Spotify, which just reported 100 million paying subscribers.

Apple shares have risen 31% this year.

—

Julie is an anchor for Yahoo Finance. Follow her on Twitter @juleshyman.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance