Apple regains its grip in China (AAPL)

BI Intelligence

This story was delivered to BI Intelligence Apps and Platforms Briefing subscribers. To learn more and subscribe, please click here.

Apple is showing signs of a comeback in China following six consecutive quarters of year-over-year (YoY) declines in iPhone shipments, according to estimates by Canalys.

Device shipments grew an estimated 40% YoY in Q3 2017 to reach 11 million units, up from 8 million in the year prior.

This growth is likely the result of pent-up demand for iPhones, along with price cuts on earlier iPhone models.

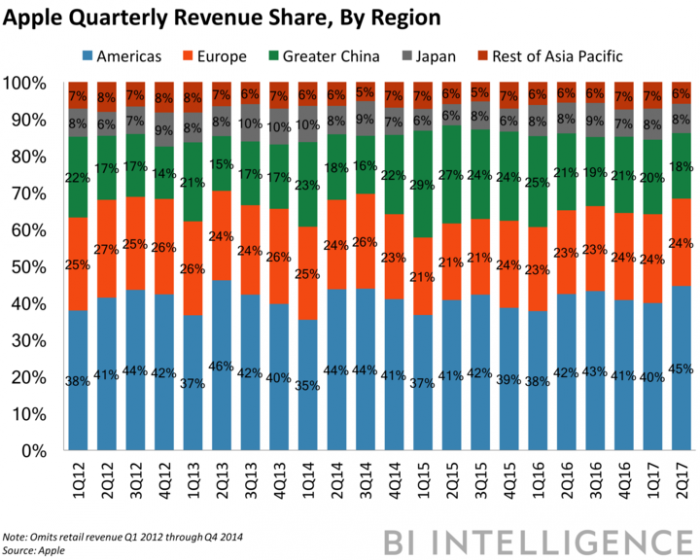

The estimates are a boon for Apple since success in China is crucial to the company’s overall business.

This shift could boost Apple's App Store revenue. Growth in shipments could lead to increased software revenue, as more Chinese smartphone users navigate the App Store. China is the largest market for iOS App Store revenue globally, according to App Annie.

The ecosystem effect could increase sales of Apple’s ancillary products. The ecosystem effect — when consumers prefer to use devices and services from one purveyor — means adoption of Apple’s iPhones could spur uptake of all of Apple’s connected devices in China, such as the Apple Watch.

However, Apple’s gains in China are likely only temporary.

China’s smartphone market is creeping toward saturation. Over the past six months, overall smartphone shipments in China have been decelerating. In Q3 2017, unit shipments fell 5% YoY to 119 million units, following a 2% YoY decline in smartphone shipments in Q2 2017. This suggests that the pool of new smartphone users is shrinking. And increases in smartphone shipments among four of the top five smartphone vendors in China likely stem from top vendors stealing sales from smaller smartphone makers, and from users upgrading their devices.

Domestic phone makers take the lion’s share of smartphone shipments. Huawei, Oppo, Vivo, and Xiaomi collectively accounted for 69% of all smartphone shipments in China in Q2, according to data from Market Monitor. Local vendors drive growth by selling high-functioning devices at drastically reduced price points that Apple can't compete with.

Looking ahead, Apple will probably double down on new growth opportunities outside of developed markets. If Apple becomes a less popular option in China, its overall growth will lag behind local competitors'. The company will therefore need to move into other markets like India. We expect to hear more about Apple’s international efforts and strategy when the company reports its quarterly earnings later this week.

To receive stories like this one directly to your inbox every morning, sign up for the Apps & Platforms Briefing newsletter. Click here to learn more about how you can gain risk-free access today.

See Also:

Yahoo Finance

Yahoo Finance