Is Apple Ready for Another Stock Split in 2018?

Apple (NASDAQ: AAPL) is the largest publicly traded company in the U.S. stock market, and the tech giant is well-known for its emphasis on superlatives. From product releases to stock buybacks, Apple aims to make the biggest splash it can, and that strategy has served the company well over its history.

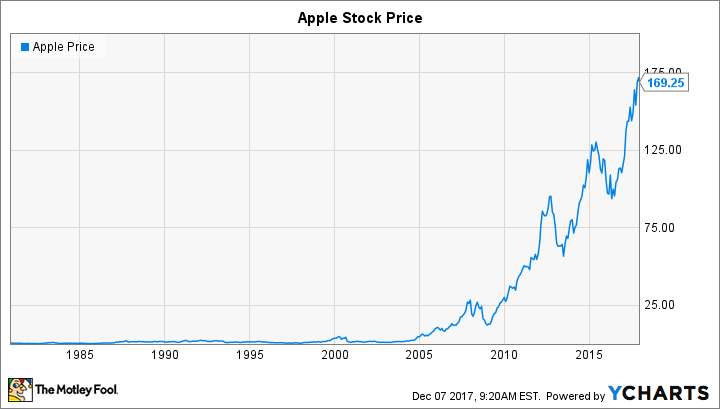

One area in which Apple made a big impression was with its most recent stock split in 2014. By making a bigger than usual move with its split decision, Apple dramatically reduced its share price, making it a much easier decision for the overseers of the Dow Jones Industrial Average (DJINDICES: ^DJI) to invite the iPhone pioneer to join its ranks. Since then, Apple stock has climbed significantly, and some wonder if another stock split would be appropriate even as the company's market capitalization approaches the $1 trillion mark. Below, we'll work through the thought process that Apple might use to consider a stock split in 2018.

When has Apple done stock splits before?

Here's when Apple has split its stock in the past:

Effective Date of Split | Split Ratio | 100 Shares in 1986 Would Now Be: |

|---|---|---|

June 16, 1987 | 2 for 1 | 200 shares |

June 21, 2000 | 2 for 1 | 400 shares |

Feb. 28, 2005 | 2 for 1 | 800 shares |

June 9, 2014 | 7 for 1 | 5,600 shares |

Data source: Apple investor relations.

When you look at what has seemed to prompt Apple to do stock splits in the past, a pattern seems to emerge initially. In 1987, the stock had climbed to about $80 per share before the tech company made its stock split, sending the share price into the $40s following the move. By 2000, Apple's shares had once again approached triple digits, prompting the next 2-for-1 move. Then, 2005's split came as Apple approached new record highs, again trading in the $80 to $85 per share range.

After 2005, Apple adopted a new approach. Even though the stock climbed into the triple digits by 2007, the company didn't use its previous playbook and instead allowed its shares to continue to appreciate. Despite dramatic volatility both before and during the financial crisis in 2008 and 2009, Apple quickly rebounded and soared to as much as $700 per share.

What made Apple finally split one last time

At the time, Apple's decision not to split didn't look as odd as it might have in the past. The trends for stock splits had changed dramatically, and many of Apple's most important peers had used similar strategies in choosing not to make stock splits. Changes in the way investors bought and sold shares made it less important for Apple and other companies to do stock splits in order to sustain trading liquidity.

Yet that didn't stop CEO Tim Cook from attributing Apple's 2014 stock split to the traditional rationale of making them available to a wider range of investors. That might have been the official explanation, but the fact that Apple became part of the Dow the following year suggests another reason: Because the Dow is a price-weighted average, the only way to make Apple a viable candidate for addition to the benchmark was to bring its stock price more in line with Dow component stocks. The 7-for-1 split reduced the stock price to the $100 per share range, making Dow inclusion a no-brainer.

Image source: Apple.

Is it time for Apple to do another split?

Now, Apple has seen its stock hit new highs above $175 per share. That has some investors wishing for another split, but there are a couple of reasons Apple is unlikely to be in any hurry to make such a move in 2018.

First, even though the company's share price has risen, Apple isn't in danger of standing out among its Dow peers. In fact, several Dow components currently have prices above $200 per share, giving Apple plenty of breathing room before causing a problem for the average.

Moreover, even if Apple were to see its stock become the most influential in the average, few would argue that such a thing was inappropriate. Apple has by far the most weight in market-capitalization-based indexes, so having an overweight in the Dow would be fitting, were it to happen.

The most important thing for Apple shareholders to realize is that it really doesn't matter whether the company splits its shares. With the stock up more than 50% in the past year, long-term investors are quite happy to count their investment gains regardless of what the nominal price of Apple shares happens to be at any point in time.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Dan Caplinger owns shares of Apple. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance