Here's Why You Should Hold on to Cerner (CERN) Stock for Now

Cerner Corporation CERN is expected to gain from its solid focus on big-data based services and a slew of developments. However, the company operates in an intensely competitive industry.

In the past six months, the Zacks Rank #3 (Hold) stock has rallied 14.3% compared with the industry's 15.6% rise. The current level is higher than the S&P 500 index's 11.5% increase.

What’s Deterring the Stock?

Cerner faces fierce competition from Healthcare IT (HCIT) bigwigs like athenahealth ATHN and Allscripts Healthcare Solutions MDRX, which might affect both pricing and margins.

Why Should You Retain Cerner?

Focus on Big-Data Based Electronic Health Records (EHR) Services

The use of EHRs has been gaining prominence. Cerner’s efforts to digitize its EHR systems deserve a mention here. Notably, the company’s HealtheIntent is a big data platform, which provides it with significant exposure to AI trends in the medical world. HealthIntent can fetch data from any EHR system, pharmacy benefits managers and insurance claims.

Cerner Rides on a Slew of Developments

The Missouri-based HCIT bigwig has lately seen a series of developments.

Recently, Signature Performance joined Cerner to help make seamless care available to the veterans in the United States.

Cerner, along with health technology company Carevive, lately announced the first deployment of their integrated cancer care management software. Notably, Carevive's patient care planning software has been integrated into Cerner Oncology to interact with the patient's EHR.

Cleveland Area Hospital recently selected Cerner’s EHR and revenue cycle solutions across its critical access hospital through the CommunityWorks deployment model.

Last month, the company’s coveted CommunityWorks was selected by Pershing Health System, a 25-bed Critical Access Hospital located in Brookfield, MO. (Read More: Cerner CommunityWorks Selected by Pershing Health System)

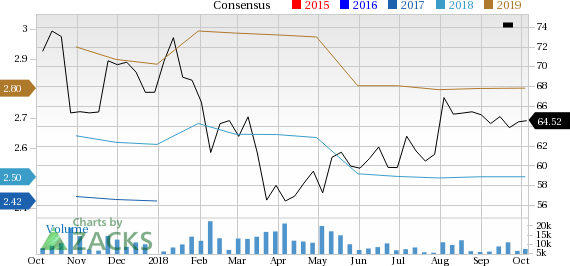

Cerner Corporation Price and Consensus

Cerner Corporation Price and Consensus | Cerner Corporation Quote

Which Way Are Estimates Treading?

For the ongoing quarter, the Zacks Consensus Estimate for earnings is pegged at 63 cents, reflecting a year-over-year increase of 3.3%. The same for revenues is pegged at $1.36 billion, showing an increase of 6.7% from the previous year.

For the full year, the Zacks Consensus Estimate for revenues is pinned at $5.41 billion, showing an increase of 5.2% from the prior year. The same for earnings stands at $2.51, indicating growth of 5.5% from the previous year.

Key Pick

A better-ranked stock in the broader medical space is Veeva Systems VEEV.

Veeva Systems’ long-term earnings growth rate is estimated at 19.3%. The stock carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

athenahealth, Inc. (ATHN) : Free Stock Analysis Report

Allscripts Healthcare Solutions, Inc. (MDRX) : Free Stock Analysis Report

Cerner Corporation (CERN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance