Here's Why You Should Buy HealthEquity (HQY) Stock Right Now

HealthEquity, Inc. HQY is currently one of the top-performing stocks in the Medical Services industry. Strong Health Savings Account (HSA) member growth and a solid guidance for fiscal 2019 currently favor the stock.

Shares Up

In the past year, shares of the Utah-based company have rallied 72.8% compared with the industry’s 40.1% rise. The current level is also higher than the S&P 500 index’s increase of 13.4%.

This Zacks Rank #2 (Buy) stock currently has a Growth Score of B. This reflects possibilities of outperformance over the long haul. Our research shows that stocks, with a Growth Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, are better picks than most.

Factors That Make It an Attractive Pick

HealthEquity Joins S&P MidCap 400

With a market cap of $5.46 billion, HealthEquity replaced WellCare Health Plans in the S&P MidCap 400 index. The company was earlier a member of the S&P SmallCap 600. A strong presence in the HSA industry and a solid revenue base are contributing factors.

Over the last four years, the company’s revenues have seen a CAGR of 37.7% to $230 million.

FY19 Guidance Solid

For fiscal 2019, HealthEquity projects revenues in the range of $279-$285 million, up from the previous guidance of $278-$284 million.

Adjusted income is projected in the range of $67-$71 million, up from the previous $55-$59 million. Adjusted net income per share is expected in the band of $1.05-$1.11.

HSA Custodian

HealthEquity clinched the top position in the HSA industry through its first-mover advantage, focus on innovation and differentiated capabilities.

In the last reported quarter, HealthEquity registered solid HSA member growth. The total number of HSAs for which HealthEquity served as a non-bank custodian (HSA Members) was 3.6 million, up 23% year over year.

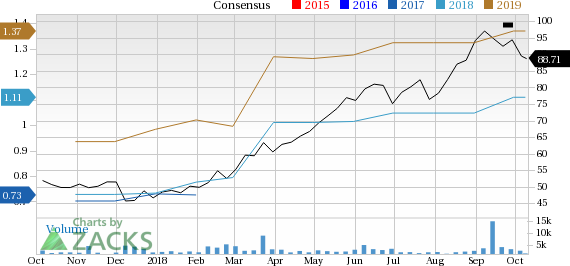

HealthEquity, Inc. Price and Consensus

HealthEquity, Inc. Price and Consensus | HealthEquity, Inc. Quote

Which Way Are Estimates Treading?

For the ongoing quarter, the Zacks Consensus Estimate for earnings is pegged at 25 cents, reflecting year-over-year growth of 47.1%. The same for revenues is pegged at $69.8 million, indicating an increase of 22.8% year over year.

For the full year, the Zacks Consensus Estimate for earnings is pegged at $1.11, reflecting growth of 105.6% from a year ago. The same for revenues stands at $284.1 million, showing an improvement of 23.8% from the previous year.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Intuitive Surgical ISRG, Masimo Corporation MASI and Inogen, Inc. INGN.

Intuitive Surgical has an expected long-term earnings growth of 14.7%. The stock has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Masimo’s long-term earnings growth rate is projected at 14.8%. The stock carries a Zacks Rank #2.

Inogen’s long-term earnings growth rate is projected at 24.5%. The stock carries a Zacks Rank #2.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masimo Corporation (MASI) : Free Stock Analysis Report

Inogen, Inc (INGN) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance