Here's Why You Should Add TEGNA (TGNA) to Your Portfolio

On Mar 6, TEGNA TGNA was upgraded by a notch to Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Catalysts Behind the Upsurge

TEGNA reported strong fourth-quarter 2017 results wherein both the top line and the bottom line outpaced the Zacks Consensus Estimate.The company reported adjusted earnings of 32 cents per share, surpassing the Zacks Consensus Estimate by a penny. Total revenues in the reported quarter were $490.3 million, down 10.3% on a year-over-year basis. The figure outperformed the Zacks Consensus Estimate of $488.9 million. Moreover, in the quarter under review, TEGNA reported a one-time deferred tax benefit of $221 million, from the new tax law passed.

The results were further aided by the buyout of Midwest Television's broadcasting stations, sale of CareerBuilder and spin-off of Cars.com. This marks TEGNA’s focus on acquiring lucrative businesses along with making additional investments to increase shareholders’ wealth.

Additionally, TEGNA offers a dynamic portfolio of media and digital businesses in the United States. Currently, it is the largest independent television station group of major network affiliates in the top 25 markets. Being more focused on content creation rather than TV broadcasting, the media division shields the company from the prevailing cord-cutting threats in the pay-TV industry. With the recent acquisition of broadcasting stations of Midwest Television, TEGNA now owns or operates 47 television stations and two radio stations in 39 markets. The buyout is expected to boost TEGNA’s free cash flow on an immediate basis and drive the bottom line by a few cents within a year.

Meanwhile, TEGNA has been riding high, following the completion of its two strategic business moves. Its plan to use $250 million of gross proceeds from the sale of its web portal CareerBuilder, to clear off existing debt, looks impressive. Spin-off of its auto-sales website, Cars.com into two publicly traded companies: TEGNA and Cars.com, should increase TEGNA's growth opportunities and market valuation.

We are also impressed with TEGNA’s board of directors’ decision to reward stockholders with a dividend of 7 cents per share, payable Apr 2, 2018 to stockholders of record as of the close of business on Mar 9, 2018. Notably, the company portrays an impressive record of dividend payouts.

As investors prefer an income-generating stock, a high dividend-yielding one is obviously much coveted. Needless to say, investors are always on the lookout for companies with a track record of consistent and incremental dividend payments.

Moreover, TEGNA’s multi-year distribution agreement with Sony Corporation (SNE), inked last week, is impressive as well.

Hiked First-Quarter 2018 Guidance

The above positives apart, TEGNA’s bright outlook for the first quarter of 2018 is a positive. The company expects total revenues (excluding the terminated digital business) to increase 10-12% year over year driven by Olympics, Super Bowl and subscription revenue growth. On a GAAP basis, total revenues are projected to increase in high single-digits from the prior-year quarter.

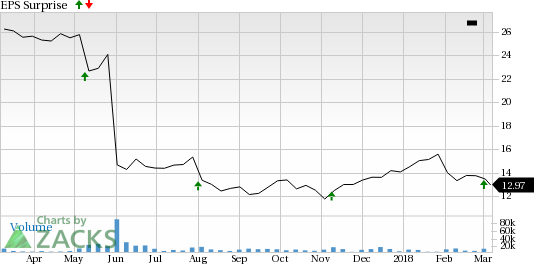

Positive Earnings Surprise

TEGNA has a positive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in three of the previous four quarters, with an average beat of 3.80%.

TEGNA Inc. Price and EPS Surprise

TEGNA Inc. Price and EPS Surprise | TEGNA Inc. Quote

Estimates Trending Up

The Earnings per share (EPS) estimate for TEGNA has climbed in the first two quarters of 2017 and also for full-year 2018.

The Zacks Consensus Estimate for the first and second quarter of 2018 is pegged at 34 cents and 41 cents per share, respectively, indicating year-over-year growth of 3.0% and 41.4%. For 2018, EPS is estimated at $1.71, reflecting a year-over-year soar of 58.3%.

The upward estimate revisions reflect optimism over prospects of this stock.

Other Key Picks

Other top-ranked stocks in the broader Consumer and Discretionary sector are Cable One CABO, Cinemark Holdings CNK and AMC Networks AMCX. While Cable One and Cinemark carry a Zacks Rank #2, AMC Networks sports a Zacks Rank #1 stock.

The bottom line of Cable One and Cinemark has surpassed the Zacks Consensus Estimate in two of the previous four quarters with an average beat of 2.7% and 20.1%, respectively. AMC Networks surpassed the consensus estimate in all of the trailing four quarters with an average beat of 24.3%.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley, Goldman Sachs and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMC Networks Inc. (AMCX) : Free Stock Analysis Report

Cable One, Inc. (CABO) : Free Stock Analysis Report

Cinemark Holdings Inc (CNK) : Free Stock Analysis Report

TEGNA Inc. (TGNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance