Here's My Top Stock to Buy in April

Recent volatility in the stock market, particularly in the tech sector, led to a pullback in some major tech companies. This may have prompted some investors to look for investment opportunities in enduring companies that are now better buys after their stock prices dropped. Down almost 8% since the middle of March, one stock for investors to consider in April is software-as-a-service (SaaS) company salesforce.com (NYSE: CRM).

As the world's leader in customer relationship management (CRM), Salesforce is not only seeing strong top-line growth, but its operating cash flow is rising rapidly as well. In addition, thanks to its broad-based growth drivers and ongoing expansion, there's plenty of reason to expect this robust growth to persist over the long haul.

Here's a look at why Salesforce is my top stock to buy in April.

Image source: Getty Images.

The raw numbers

Metric | Salesforce |

|---|---|

Fiscal 2018 revenue growth* | 25% |

Fiscal 2018 operating cash flow growth* | 27% |

Fiscal 2018 non-GAAP EPS growth* | 34% |

Price-to-sales ratio | 8.1 |

Data source: Salesforce fourth-quarter and full-year financial results and Reuters. Table by author. * YOY = year over year.

Salesforce's business has been firing on all cylinders recently. Fiscal 2018 revenue climbed 25% year over year, putting the SaaS company's annual revenue above $10 billion for the first time -- at $10.48 billion.

Meanwhile, its improving scale helped profitability increase even more rapidly, evidenced by 27% and 34% year-over-year growth in operating cash flow and non-GAAP earnings per share, respectively, in fiscal 2018.

Though Salesforce's stock has pulled back in recent weeks, investors will still have to pay a premium to buy in. Salesforce has a price-to-sales ratio of 8.1, compared to an average of 6.2 for its software application peers. But as a market leader with such a solid growth story, this premium is worth it.

Salesforce's competitive advantage

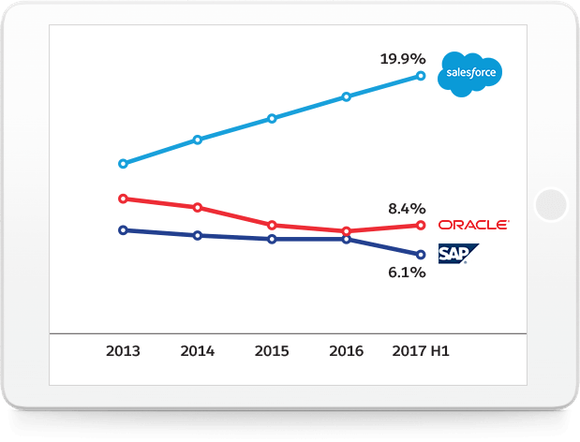

This growing market share lead over peers has morphed into a major competitive advantage for the company. Thanks to its network effect and high customer switching costs, any increase in market share widens Salesforce's economic moat. Its market share of global CRM application revenue has also been surging, climbing from about 10% in 2013 to about 20% in the first half of 2017 -- well above second- and third-place Oracle and SAP -- each of which has about 8% and 6% market share, respectively, according to October 2017 data from IDC.

Market share of global CRM applications revenue ranks Salesforce as the worldwide leader. Chart source: Salesforce.com. Data source: IDC.

Salesforce's sales cloud and service cloud businesses are also ranked No. 1 in worldwide market share among sales and service applications, respectively. In sales applications, Salesforce boasts 36% market share. In service applications, it commands about 38% market share.

Understanding the power of Salesforce's competitive advantages makes it easy to see why it's continued to gain market share over the years. Of Salesforce's 150,000-plus customers, one thing is true for all of them: The longer customers use Salesforce, and the more of its services they use, the more invested they are in Salesforce's platform. Furthermore, the more customers Salesforce has, the better the company can scale its platform and improve its offerings, providing better value to its clients. This is why Salesforce's network effect and high customer switching costs are so powerful, especially when Salesforce is already a market leader by a significant margin.

Looking ahead

Salesforce anticipates strong growth to continue in fiscal 2019. Management guided for fiscal 2019 revenue to rise to a range between $12.6 billion and $12.65 billion, representing 20% to 21% year-over-year growth. Considering that management's guidance typically proves to be extremely conservative, there's a good chance that actual revenue growth will be above these rates.

Management also expects profitability to continue to improve, with guidance for non-GAAP EPS to rise to a range between $2.02 and $2.04 in fiscal 2019, representing growth between about 50% and 51%. Salesforce also forecast 20% to 21% growth in operating cash flow.

Salesforce's momentum is demonstrated in its broad-based growth. Of its subscription and support revenue, which accounts for more than 90% of total revenue, there are four subsegments -- sales cloud, service cloud, salesforce platform and other, and marketing and commerce cloud -- and all are seeing strong, double-digit revenue growth.

Subscription and Support Revenue by Cloud Service Offering | Fiscal 2018 | Fiscal 2017 | Growth (YOY) |

|---|---|---|---|

Sales cloud | $3.6 billion | $3.1 billion | 16% |

Service cloud | $2.9 billion | $2.3 billion | 24% |

Salesforce platform and other | $1.9 billion | $1.4 billion | 34% |

Marketing and commerce cloud | $1.4 billion | $0.9 billion | 45% |

Data source: Salesforce fourth-quarter and full-year financial results. Table by author.

In addition, Salesforce is seeing similarly strong, broad-based growth across all of its geographic segments, with revenue in the Americas, Europe, and Asia-Pacific up 19%, 31%, and 26% year over year, respectively, in constant currency.

Finally, consider the company's ballooning backlog. Combining Salesforce's deferred and unbilled deferred revenue, there's already visibility into a backlog of over $20 billion. Even more, both of these backlog metrics are growing rapidly. Deferred revenue was up 28% year over year in Q4 while unbilled deferred revenue increased 48% during the same period.

Watch out for decelerating growth

Of course, there's no risk-free growth story. One bear case for Salesforce is that the company's growth is decelerating. Though Salesforce's 25% year-over-year revenue growth in fiscal 2018 was notable, this was down from 26% growth the year before. In addition, management's guidance for 20% to 21% revenue growth suggests there's more deceleration to come. If growth decelerates too quickly, Salesforce's premium valuation could be difficult to justify.

Image source: Getty Images.

But with Salesforce's leadership position in CRM showing no signs of eroding, any deceleration in revenue growth will likely be moderate. Furthermore, if the company can successfully add on offerings, such as the new "integration cloud" that Salesforce is building with its MuleSoft acquisition, there could be plenty of room left for Salesforce to keep deepening its relationships with existing customers and boosting its value proposition to continue attracting new customers. Finally, Salesforce's broad-based growth across its service and geographic segments also implies any slowdowns won't happen suddenly.

Salesforce stock may not be a screaming bargain after its slight pullback in recent weeks. But I'd argue that the company's strong momentum and market leadership can help drive outperformance in the stock price over the long haul.

More From The Motley Fool

Daniel Sparks has no position in any of the stocks mentioned. The Motley Fool owns shares of Oracle and has the following options: short June 2018 $52 calls on Oracle and long January 2020 $30 calls on Oracle. The Motley Fool recommends MuleSoft and Salesforce.com. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance