Apollo Declares 110 Million Ounces Silver in Measured and Indicated Resource for Waterloo Property

Figure 1

Figure 2

90 million ounces silver classified as Measured

Calico silver resource also includes 51 million ounces classified as Inferred

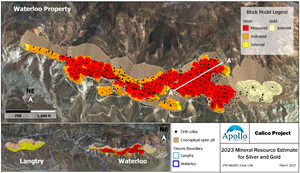

VANCOUVER, British Columbia, March 06, 2023 (GLOBE NEWSWIRE) -- Apollo Silver Corp. (“Apollo” or the “Company”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF0) is pleased to announce an updated National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) mineral resource estimate (“MRE”) with an effective date of February 8, 2023, for its flagship Calico Silver Project (“Calico” or the “Calico Project”) located in San Bernardino County, California (the “2023 MRE”). The findings of the 2023 MRE, particularly in terms of size and confidence level, positions Calico and its Waterloo Property (“Waterloo”) resource as one of the largest advanced stage silver projects in North America.

Highlights of the Calico Project 2023 MRE1:

110 million ounces (“Moz”) silver (“Ag”) classified as Measured and Indicated (“M&I”) declared at Waterloo with an average grade of 100 grams per tonne (“g/t”) silver:

81% (90 Moz) classified as Measured at 103 g/t silver.

95% of Inferred2 silver ounces have been converted to M&I2.

51 Moz silver classified as Inferred:

720,000 oz silver at Waterloo Property1

50 Moz silver at Langtry Property2

70,000 oz Inferred oxide gold (“Au”) ounces added to metal inventory at Waterloo.

Robust silver resource: conservative base-case estimate uses 50 g/t silver cutoff grade (“COG”).

Low strip ratio of 1.1:1 for Waterloo silver resource.

Significant growth opportunities remain.

“Today’s announcement is an important milestone that will underpin the future development of the Calico Silver Project,” commented Apollo’s President and CEO, Tom Peregoodoff. “This updated mineral resource estimate significantly de-risks the Calico Project and confirms Waterloo as one of the premier silver development opportunities in any Tier-1 jurisdiction. This solid outcome is the culmination of a tremendous amount of work by an excellent team that has consistently delivered against our stated objectives. The low strip ratio, combined with the recently announced positive initial metallurgical results, and nearby infrastructure provide an excellent foundation as we advance one of the largest undeveloped silver resources in the USA. Calico is uniquely positioned to benefit from the USA’s commitment to reducing its carbon footprint and the increased demand for a secure supply of ethically sourced silver to support that objective. We believe that Apollo provides a compelling investment opportunity for investors looking for exposure to responsibly sourced silver development opportunities.”

“I am very pleased with the outcome of our 2023 MRE,” Apollo Vice President Exploration and Resource Development, Cathy Fitzgerald, commented. “The team went above and beyond for our 2022 exploration and drilling programs to deliver results on time, on budget and safely, with results culminating in the delivery of a very positive 2023 MRE. The exceptional conversion rate of material from Inferred to Measured and Indicated reflects the robustness of Waterloo’s geologic model and the continuous and predictable nature of silver mineralization at Waterloo. With the size of the resource now confidently defined, our plans in 2023 to advance the Calico Project include geotechnical drilling, preliminary engineering work, and additional metallurgical studies. In addition, there remain a number of growth opportunities at Calico and we are confident that further work will not only continue to increase the silver and gold inventory, but add barite to a future MRE at Waterloo.”

Apollo will host a webcast to discuss the 2023 MRE at 9:00am PT on Wednesday, March 15, 2023. To register, please click here: http://bit.ly/3KUP1Gf

A technical report is being prepared for the 2023 MRE in accordance with NI 43-101 and will be available on SEDAR and the Company’s website within 45 days of the date of this release.

1The Calico Project 2023 MRE has been prepared by Derek Loveday, P. Geo., of Stantec Consulting Services Ltd. (“Stantec”), who is an independent “qualified person” as such term is defined in NI 43-101 (a “Qualified Person”), in co-operation with Mariea Kartick, P.Geo. (an independent Qualified Person for drilling data quality control and quality assurance). The 2023 MRE was produced in conformance with the Canadian Institute of Mining Metallurgy and Petroleum (“CIM”) “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with NI 43-101. The 2023 MRE has an effective date of February 8, 2023. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve.

2No drilling was completed on the Langtry Property since the disclosure of the Company’s 2022 mineral resource estimate on February 9, 2022 (the “2022 MRE”) and as such, the Inferred mineral resource disclosed at that time for the Langtry Property remains unchanged and current. The 2022 MRE was prepared by Derek Loveday, P. Geo. of Stantec, an independent Qualified Person.

Significant growth opportunities remain

Silver: As previously reported (see news release dated December 1, 2022), 2022 drilling was successful in defining additional silver mineralization situated beneath the base of the 2022 MRE (see news release dated February 9, 2022). These intersections have been incorporated into the 2023 MRE. There remain further opportunities to expand the silver mineralization below the base of the 2023 MRE in the northern half of the Waterloo deposit.

Gold: Drilling and surface mapping in 2022 has successfully defined a significant gold bearing horizon within the Barstow sedimentary rocks that extends over 1,000 metre (“m”) strike length at Waterloo. Also, two key discoveries of the 2022 work programs were that the underlying Pickhandle volcanic sequence hosts thicker gold mineralization than previously understood, and a number of high-grade structures (up to 211 g/t gold from grab samples) were identified (see news release dated February 14, 2023). The expansion of the gold mineralized horizon has culminated in the addition of inferred gold resources at Waterloo in the 2023 MRE. Gold mineralization remains open along strike and at depth and future work will focus on both expanding this and better defining high-grade structures.

Barite: A portion of the 2022 Metallurgical Test Program comprised understanding the quality of barite at Waterloo. A barite concentrate was produced and sent for testing to determine if its quality met the standards for use in oil and gas drilling, as specified by the American Petroleum Institute. Final results of the 2022 Metallurgical Test Program, including barite testing results, will be released once they are received. Pending these, further work will involve better understanding the distribution and concentration of barite throughout the Waterloo deposit with the goal of adding it to a future MRE update.

Calico Project 2023 Mineral Resource Estimate

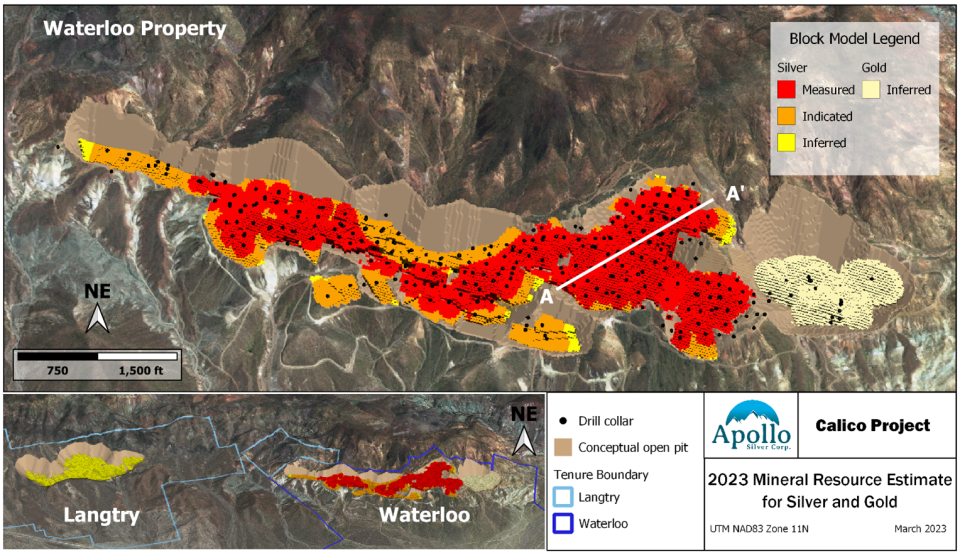

The 2023 MRE focused on upgrading and expanding the Waterloo resource estimate from that declared in 2022 (see news release dated February 9, 2022). The most significant change in the 2023 MRE is the significant conversion of the silver mineralization defined in the Waterloo deposit to the Measured and Indicated resource classification categories. The Waterloo resource now contains 110 Moz silver in 34.2 Mt at an average grade of 100 g/t silver in M&I, and 0.72 Moz silver in 0.29 Mt at an average grade of 77 g/t silver in the Inferred category. The Langtry MRE remains unchanged from that defined in the 2022 MRE2, therefore the following information relates only to the 2023 MRE and updates for the Waterloo Property.

In addition to its robust silver resource, the Waterloo resource now contains 70,000 oz oxide gold contained in 4.5 Mt at an average grade of 0.50 g/t gold in the Inferred category. Oxide gold mineralization has been drilled over 1,000 m strike length and remains open in multiple directions. Previously reported preliminary cyanide solubility tests show gold recoveries ranging from 75% to 95% (see news release dated February 14, 2023). Please refer to Table 1 for a summary of the 2023 MRE silver and gold results.

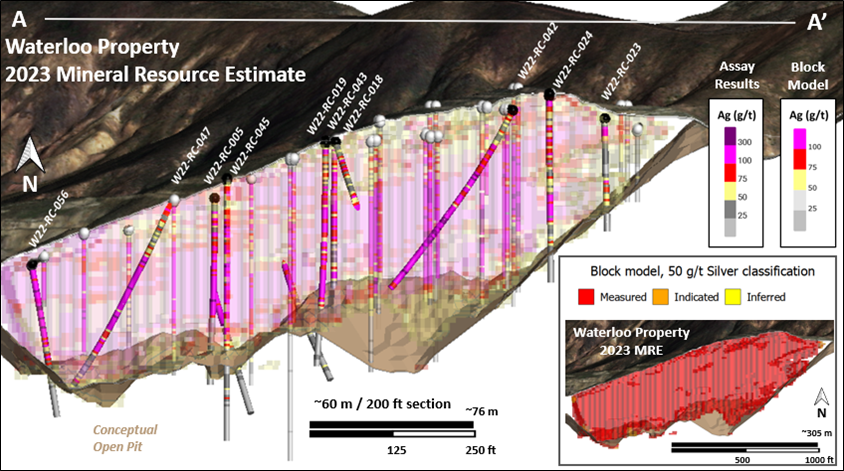

Mineralization at Waterloo is shallow and shows high continuity along the 1.8 km long strike length of the deposit. The 2023 MRE is calculated to a maximum depth of ~183 m (600 ft) (increased from 125 m (410 ft). Using conservative open pit optimization to determine reasonable prospects for economic extraction, the calculated waste to mineralization ratio for the silver resource is 1.1:1 and 2.1:1 for the gold resource.

Table 1: Calico Project 2023 mineral resource estimate. Base case at 50 g/t silver and 0.30 g/t gold cut-off grades, effective February 8, 2023.

Deposit | Metal | Class | Imperial Units | Metric Units | Strip | Contained | ||||

Volume | Tons | Grade | Volume | Tonnes | Grade | Moz | ||||

Waterloo1 | Silver | Measured | 14.7 | 30.2 | 2.99 | 11.2 | 27.4 | 103 | 1.1 | 90 |

Indicated | 3.7 | 7.5 | 2.67 | 2.8 | 6.8 | 91 | 20 | |||

Measured | 18.3 | 37.7 | 2.93 | 14.0 | 34.2 | 100 | 1.1 | 110 | ||

Inferred | 0.2 | 0.3 | 2.25 | 0.1 | 0.3 | 77 | 1.1 | 0.72 | ||

Gold | Inferred | 2.4 | 5.0 | 0.01 | 1.8 | 4.5 | 0.5 | 2.1 | 0.07 | |

Langtry2 | Silver | Inferred | 10.3 | 21.3 | 2.35 | 7.9 | 19.3 | 81 | 6.0 | 50 |

Ounces reported as troy ounces.

Base-case resource estimate reported in Table 1 using 50 g/t silver and 0.30 g/t gold cut-off grades.

CIM definitions are followed for classification of the mineral resource.

For the Waterloo Property, cut-off grade was calculated using the following variables: surface mining operating costs (US$2.75/st), processing costs (US$20.00/st), general and administrative costs (US$3/st), silver price (US$23.50/oz), gold price (US$1,800/oz), and metal recoveries (silver 65%, gold 80%). Resources reported in Table 1 are constrained to within a conceptual economic pit shell targeting mineralized blocks with a minimum of 50 ppm (50 g/t) silver and 0.3 ppm (0.30 g/t) gold. Specific gravity for the mineralized zone is fixed at 2.44 t/m3 (13.13 ft3/st). Silver grade was capped at 450 g/t and gold was capped at 2 g/t for the Waterloo estimate only.

Totals may not represent the sum of the parts due to rounding.

1The 2023 MRE has been prepared by Derek Loveday, P. Geo., of Stantec Consulting Services Ltd., an independent Qualified Person, in co-operation with Mariea Kartick, P.Geo. (independent Qualified Person for drilling data QA/QC). The 2023 MRE was produced in conformance with NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve.

2No drilling was completed on the Langtry Property since the declaration of the 2022 MRE and as such, the Inferred mineral resource announced February 9, 2022 for the Langtry Property remains unchanged and current. The 2022 MRE was prepared by Derek Loveday, P. Geo. of Stantec, an independent Qualified Person. Cut-off grade for the Langtry 2022 MRE was calculated using surface mining operating costs of US$2.50/st, processing costs of US$29.00/st, silver price of US$23.00/oz and silver recovery of 80%. The Langtry resource is constrained to within a conceptual economic pit shell targeting mineralized blocks with a minimum of 50 ppm (50 g/t) silver.

Figure 1: Calico Project, Waterloo Property 2023 mineral resource block model.

Figure 2: Cross section through Waterloo Property 2023 mineral resource block model.

Data Input

The 2023 MRE considered drilling information up to and including the most recently completed program in 2022, as well as geological information from Apollo’s 2021 and 2022 exploration activities. Drilling data supporting the 2023 MRE includes information from historic drilling data from 258 holes (18,679 m/61,283 ft), and 2022 drilling data from 85 holes (9,729 m/31,919 ft) for a total of 343 holes (28,407 m/93,199 ft). Nominal drill hole spacing is 30 x 46 m (100 x 150 ft) within the Measured portion of the 2023 MRE. Of the drill data set used, 332 holes are rotary or reverse circulation holes, and 11 holes are diamond drill holes. Verification of drilling exploration data used for the 2023 MRE was performed by Mariea Kartick, P.Geo. (Stantec), an independent Qualified Person.

The 2023 MRE reflects the addition of drilling completed by the Company at Waterloo to the drilling database and other geological information acquired in 2022 as reported above. No drilling was completed on the Langtry Property since the declaration of the 2022 MRE and as such, the Inferred mineral resource announced February 9, 2022, for the Langtry Property remains unchanged and current. The following information therefore relates only to the 2023 MRE and updates for the Waterloo Property.

Cut-Off Grade and Reasonable Prospects for Eventual Economic Extraction

The base-case COG (50 g/t silver and 0.30 g/t gold) was determined using the following assumptions:

Silver price of US$23.50 per troy ounce and gold price of US$1,800 per troy ounce;

Processing costs of US$20 per short ton;

General and administrative costs of US$3 per short ton;

Mining costs of US$2.75 per short ton; and

Silver recovery of 65% and gold recovery of 80%.

Metal recoveries are based on preliminary results from the 2022 Metallurgical Test Program (see news releases dated February 14, 2023, and February 23, 2023) and published recoveries for comparative operations. Silver price was calculated by averaging the price from the last 24 months up to December 31, 2022, based on data from the World Bank. Changes in metal prices, optimized processing parameters and/or improved metal recoveries will all impact COGs and any resultant MRE.

Reasonable prospects for eventual economic extraction of silver were assessed by calculating block revenues for silver grade blocks at 50 g/t silver or greater, less surface mining costs, and generating an optimized Hexagon Mineplan® Pseudoflow economic pit shell at constant slope of 45 degrees and constrained to within the property claim boundaries. Reasonable prospects for eventual economic extraction of gold were assessed by calculating revenues for gold grade blocks at 0.30 g/t gold or greater, less surface mining costs, and generating an optimized Hexagon Mineplan® Pseudoflow economic pit shell at constant slope of 45 degrees and constrained to within the property claim boundaries. The economic pit shells for silver and gold are spatially separate from one another.

Sensitivity Analysis

A sensitivity analysis was undertaken to examine the impacts of varying the COG for silver and gold above and below that of the COG for the 2023 MRE for Waterloo. The available tonnes and average grade for each COG from within the 2023 MRE economic pit shell for silver is shown in Table 2. The strip ratio (t:t) shown in Table 2 are cumulative with decreasing levels of assurance.

Table 2: Sensitivity analysis of the grade and tonnage relationships at varying pit-constrained cut-off grades for silver for the Waterloo Property. Effective February 8, 2023.

Classification | Silver | Tonnes | Average Ag | Strip Ratio | Contained |

Measured | ≥ 25 | 37.0 | 86 | 0.7 | 102 |

≥ 50 | 27.4 | 103 | 1.3 | 90 | |

≥75 | 17.3 | 126 | 2.6 | 70 | |

≥ 100 | 10.9 | 150 | 4.6 | 53 | |

Indicated | ≥ 25 | 10.7 | 72 | 0.5 | 25 |

≥ 50 | 6.8 | 91 | 1.1 | 20 | |

≥75 | 3.8 | 114 | 2.4 | 14 | |

≥ 100 | 2.0 | 140 | 4.6 | 9 | |

Inferred | ≥ 25 | 0.5 | 62 | 0.5 | 1 |

≥ 50 | 0.3 | 77 | 1.1 | 0.7 | |

≥75 | 0.1 | 95 | 2.4 | 0.4 | |

≥ 100 | 0.03 | 110 | 4.6 | 0.1 |

RESOURCE ESTIMATION METHODOLOGY

The 2023 MRE was prepared in accordance with the requirements of NI 43-101 and applicable guidelines disseminated by CIM. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The quantity and grade of reported Inferred resources are uncertain in nature as there has been insufficient exploration to define these Inferred Resources as Indicated or Measured.

The 2023 MRE resource block model was oriented along regional strike of mineralization controlling range front fault (Calico fault) and bedding, at approximately 045 degrees. Silver grades were estimated using ordinary kriging into a standard 20 ft x 20 ft x 10 ft block model using 5 ft drill hole composites and a bulk density of 2.44 t/m3 (13.13 ft3/st). The block models are constrained to the west by the Calico range front fault and to the east by the contact between the mineralized Barstow formation sedimentary rocks and the Pickhandle formation rhyolitic rocks. Both structures are mineralization controlling features. A grade capping evaluation was performed, and silver grades were capped at 450 g/t silver; gold grades were capped at 2 g/t gold.

The MRE was internally audited and peer reviewed by Stantec prior to being released to the Company and being declared final. Further, the Company completed an internal review of the 2023 MRE data supplied by Stantec. A full description of the data and the data verification process will be detailed in the technical report associated with the 2023 MRE, which will be prepared in accordance with NI 43-101 Standards of Disclosure for Mineral Projects and filed within 45 days of this news release on the Company’s website and on SEDAR at www.sedar.com.

SAMPLING AND QUALITY ASSURANCE/QUALITY CONTROL

Drilling in 2022 was undertaken by Cooper Drilling LLC, of Monte Vista, Colorado. Representative chip samples were also collected for logging purposes (lithology, alteration, mineralization), detailed photography and analysis by portable X-Ray Fluorescence. RC samples were catalogued and securely stored in a warehouse facility in Barstow, California until they were ready for secure shipment to ALS Global-Geochemistry in Reno, Nevada (“ALS Reno”) for sample preparation and gold analysis. ALS Reno has selectively shipped samples to other ALS laboratories for preparation, such as Carson City of Nevada, ALS Chihuahua of Mexico or ALS Chemex de Mexico, S.A. de C.V., branch Queretaro, Mexico. After preparation, splits of prepared pulps were securely shipped to ALS Vancouver, British Columbia for multi-element analysis. Samples from the three PQ diamond drill core drilled in 2012 by Pan American Silver Corporation, were prepared by McClelland Laboratories Inc., in Sparks, Nevada. In 2022, the -1.5 inch reject material was separated into 2 m intervals, each of which was coarsely crushed to ~38 mm before being thoroughly blended and split in half. One half was further crushed to -1.7 mm and a 250 g split was taken using a rotary-type splitter. The 250 g splits were pulverized to better than 90% passing 106 microns. McClelland maintains its own comprehensive guidelines to ensure best practices in sample preparation. The pulp pulverized by McClelland were sent by secure transport to ALS Global-Geochemistry in Reno, Nevada.

Drilling samples were prepared at ALS Reno (Prep-31 package) with each sample crushed to better than 70% passing a 2 mm (Tyler 9 mesh, U.S. Std. No.10) screen. A split of up to 250 g is taken and pulverized to better than 85% passing a 75-micron (Tyler 200 mesh, U.S. Std. No. 200) screen. All samples were analyzed for 48 elements via ICP-MS following a four-acid digestion with reportable ranges for silver of 0.01 to 100 ppm (method ME-MS61). Over-range samples analyzed for silver were re-submitted for analysis using a four-acid digestion and ICP-AES finish with a silver range of 1-1,500 ppm (method Ag-OG62). When results were over 400 ppm silver, they were re-submitted for analysis by fire assay with a gravimetric finish using a 30 g nominal sample weight with reportable silver range of 5-10,000 ppm (method Ag-GRA21). Over-range samples analyzed for copper, lead and zinc were re-submitted for analysis using a four-acid digestion and ICP-AES finish with range of 0.001-50% for copper, 0.001-20% for lead, and 0.001-30% for zinc. Gold was analyzed by fire assay with atomic absorption finish (method Au-AA26) with a reportable range of 0.01-100 ppm Au. Metallurgical pulp samples were analyzed for analysis of 48 elements via ICP-MS following a four-acid digestion with reportable ranges for silver of 0.01 to 100 ppm (method ME-MS61). Over-range samples were re-submitted for analysis using a four-acid digestion and ICP-AES finish with a silver range of 1 to 1,500 ppm (method Ag-OG62) and by fire assay with a gravimetric finish using a 30 g nominal sample weight with reportable silver range of 5 to 10,000 ppm (method Ag-GRA21). Major elements were analyzed using fused-disc X-Ray Fluorescence (method ME-XRF26). Gold was analyzed by fire assay with atomic absorption finish (method Au-AA26) with a reportable range of 0.01 to 100 ppm Au. All analyses were completed at ALS Vancouver except for gold by fire assay, which was completed at ALS Reno.

For cyanide solubility testing, pulps representing individual drill samples from within gold intercepts (at a 0.100 g/t Au cutoff grade) for which fire assay gold results were previously reported were analyzed. Pulps were submitted to ALS Reno and analyzed using method Au-AA13 (reported range of 0.03 to 50 ppm) which measures Au by cyanide leach with follow up gold analysis via AAS. For bottle roll testing, all heads and tails assays were performed by McClelland, an ISO 17025 certified facility, via AAS 4-acid digestion with reportable ranges for silver of 1 to 200 ppm.

The Company maintains its own comprehensive quality assurance and quality control (“QA/QC”) program to ensure best practices in sample preparation and analysis for samples. The QA/QC program includes the insertion and analysis of certified reference materials, commercial pulp blanks, preparation blanks, and field duplicates to the laboratories. Apollo’s QA/QC program includes ongoing auditing of all laboratory results from the laboratories. The Company’s Qualified Person is of the opinion that the sample preparation, analytical, and security procedures followed are sufficient and reliable. The Company is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data reported herein.

ABOUT THE PROJECT

Location

The Calico Project is located in San Bernardino County, California and comprises the adjacent Waterloo and Langtry properties which total 2,950 acres. The Calico Project is 15 km (9 miles) from the city of Barstow, 5 km (3 miles) from commercial electric power and has an extensive private gravel road network spanning the property.

Geology and Mineralization

The Calico Project is situated in the southern Calico Mountains of the Mojave Desert, in the south-western region of the Basin and Range tectonic province. This 15 km (9 mile) long northwest- southeast trending mountain range is dominantly composed of Tertiary (Miocene) volcanics, volcaniclastics, sedimentary rocks and dacitic intrusions. Mineralization at Calico comprises high-level low-sulfidation silver-dominant epithermal vein-type, stockwork-type and disseminated-style associated with northwest-trending faults and fracture zones and mid-Tertiary (~19-17 Ma) volcanic activity. Calico represents a district-scale mineral system endowment with approximately 6,000 m (19,685 ft) in mineralized strike length controlled by the Company. Silver and gold mineralization are oxidized and hosted within the sedimentary Barstow Formation and the upper volcaniclastic units of the Pickhandle formation along the contact between these units. The 2023 MRE for the Calico Project comprises 110 Moz silver in 34.2 Mt at an average grade of 100 g/t silver (Measured and Indicated categories); 0.72 Moz silver in 0.3 Mt at an average grade of 77 g/t silver (Inferred category); and 70,000 oz gold in 4.5 Mt at an average grade of 0.5 g/t gold.

QUALIFIED PERSONS

The scientific and technical data contained in this news release was reviewed, and approved by Derek Loveday, P. Geo., and Mariea Kartick, P.Geo., both of Stantec. Both are Qualified Persons independent of the Company. Mr. Loveday is a registered Professional Geoscientist in Alberta, Canada and is responsible for the mineral resource estimation and Ms. Kartick is a registered Professional Geoscientist in Ontario, Canada and is responsible for drilling data QA/QC.

This news release has also been reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director of Mineral Resources. Ms. Lépine is a registered Professional Geoscientist in British Columbia, Canada and is not independent of the Company.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Tom Peregoodoff

Chief Executive Officer

About Apollo Silver Corp.

Apollo Silver Corp. has assembled an experienced and technically strong leadership team who have joined to advance world class precious metals projects in tier-one jurisdictions. The Company is focused on advancing its portfolio of two significant silver exploration and resource development projects, the Calico Silver Project, in San Bernardino County, California and Silver District Project in La Paz County, Arizona.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the potential of the Calico Project and its overall investment attractiveness; the potential for identification of gold and barite resources at Calico; the potential recovery rates; the potential to expand the resource estimate and upgrade its confidence level, including prospective silver and gold mineralization on strike and at depth; timing and execution of future planned drilling, exploration, preliminary engineering and additional metallurgical activities; timing of completion of the 2022 Metallurgical Test Program, including barite test results; and timing of commencement and completion of a preliminary economic assessment or a future MRE update. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; contests over title to properties; changes in project parameters as plans continue to be refined; and impact of the COVID-19 pandemic. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold and barite; the demand for silver, gold and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

CONTACT: For further information, please contact: Tom Peregoodoff Chief Executive Officer Telephone: +1 (604) 428-6128 tomp@apollosilver.com

Yahoo Finance

Yahoo Finance