The Antibe Therapeutics (CVE:ATE) Share Price Has Gained 126%, So Why Not Pay It Some Attention?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. To wit, the Antibe Therapeutics Inc. (CVE:ATE) share price has flown 126% in the last three years. How nice for those who held the stock! On top of that, the share price is up 22% in about a quarter.

See our latest analysis for Antibe Therapeutics

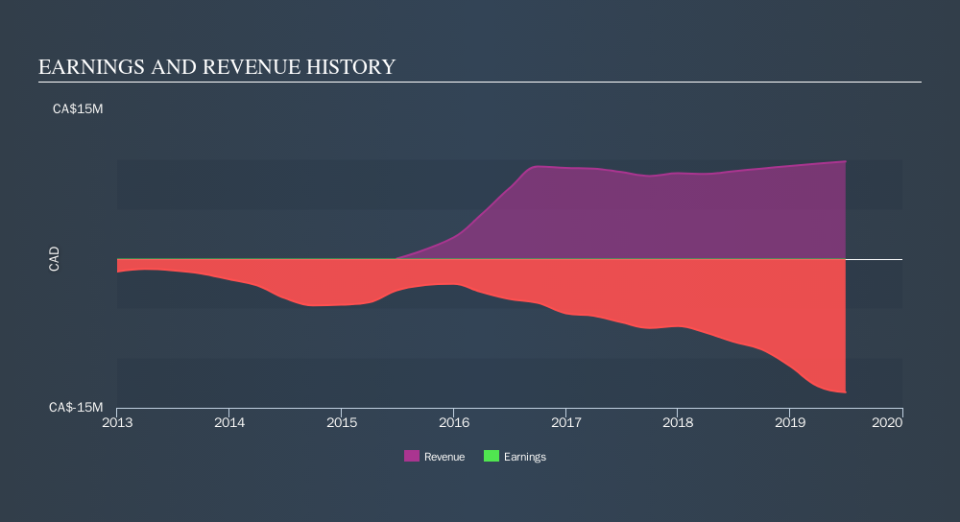

Antibe Therapeutics isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Antibe Therapeutics saw its revenue grow at 4.7% per year. That's not a very high growth rate considering it doesn't make profits. In contrast, the stock has popped 31% per year in that time - an impressive result. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. It seems likely that the market is pretty optimistic about Antibe Therapeutics, given it is losing money.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Antibe Therapeutics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Antibe Therapeutics shareholders have received a total shareholder return of 31% over one year. That certainly beats the loss of about 5.1% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. If you would like to research Antibe Therapeutics in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance